Turn on suggestions

Auto-suggest helps you quickly narrow down your search results by suggesting possible matches as you type.

Showing results for

Connect with and learn from others in the QuickBooks Community.

Join nowMy first question is why aren't you withholding federal and state taxes? An employee over 65 is still subject to taxes.

Hi there, @perfectionautobo.

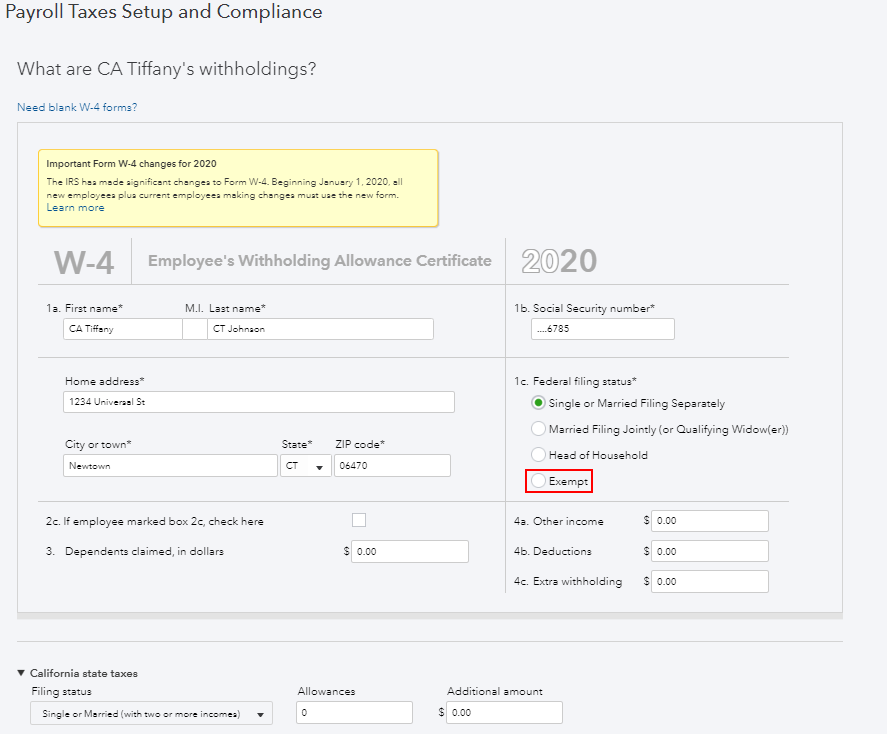

QuickBooks Online (QBO) calculates the federal withholding based on the information entered on your employee's W-4. Let's determine if your employee is subject to Federal withholding exemption.

Before we start, please know that employees over 65 are still subject to taxes, as stated by KathyS296.

Here are the factors considered in calculating your Federal and State Income Tax (FIT and SIT) amount:

I'm adding these articles for more details:

However, if your employee is subject to an exemption, you'll want to make sure that the Federal filing status from the W-4 information is Exempt. Here's how:

You can also read this article to learn more about payroll: Payroll 101.

Please know you can continue to reach me here with any additional questions. Thanks for coming to the Community, wishing you continued success.

You have clicked a link to a site outside of the QuickBooks or ProFile Communities. By clicking "Continue", you will leave the community and be taken to that site instead.