Turn on suggestions

Auto-suggest helps you quickly narrow down your search results by suggesting possible matches as you type.

Showing results for

Connect with and learn from others in the QuickBooks Community.

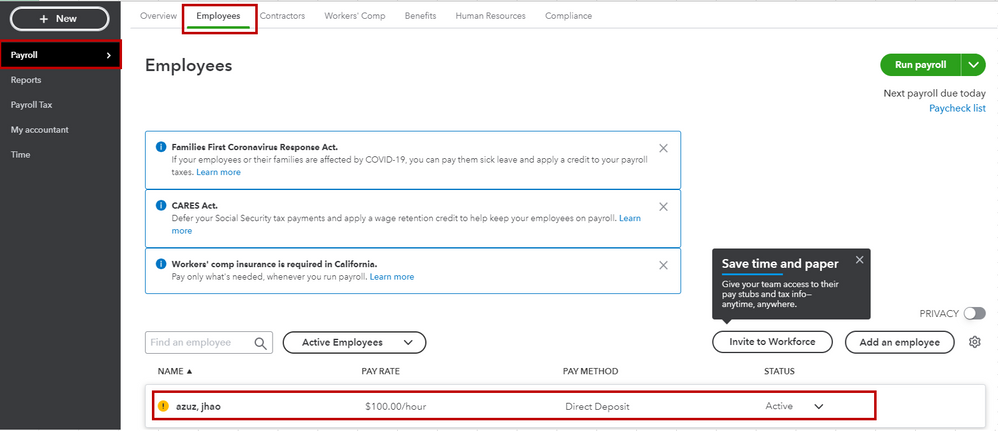

Join nowI can help you withhold local income tax from your employee, @lyttletrucking.

Payroll withholding taxes are the money you take out of an employee’s gross wages. As an employer, you’re required to withhold money from an employee’s paycheck and use it to pay their portion of payroll taxes on their behalf.

To get started setting up your local taxes, please follow the steps below:

If you're not sure what local taxes you and your employees are required to pay, I recommend contacting your tax agency or use the resources in this article: Set up local taxes in Online Payroll. It also includes steps on how to add your tax account number and how to pay and file them.

In addition, let me share this link for you to learn more about payroll withholding and how do you calculate it in QuickBooks: What you need to know about payroll withholding.

Keep in touch if you have other questions about managing payroll taxes in QuickBooks. I'll be around to lend a helping hand. Have a wonderful day.

Hi, @lyttletrucking.

Hope you’re doing great. I wanted to see how everything is going about the withholding income tax concern you had the other day. Was it resolved? Do you need any additional help or clarification? If you do, just let me know. I’d be happy to help you at any time.

Looking forward to your reply. Have a pleasant day ahead!

You have clicked a link to a site outside of the QuickBooks or ProFile Communities. By clicking "Continue", you will leave the community and be taken to that site instead.