- US QuickBooks Community

- :

- QuickBooks Q & A

- :

- Employees and payroll

- :

- I was asked to create an employees paycheck half way through the pay period and no Federal taxes were removed, only SS and Med. The employee has been here for years

- Mark Topic as New

- Mark Topic as Read

- Float this Topic for Current User

- Bookmark

- Subscribe

- Printer Friendly Page

- Mark as New

- Bookmark

- Subscribe

- Permalink

- Report Inappropriate Content

I was asked to create an employees paycheck half way through the pay period and no Federal taxes were removed, only SS and Med. The employee has been here for years

Is this an online error or is it because I created the check early? He claims 2 on his tax withholding

Solved! Go to Solution.

Labels:

Best answer March 06, 2023

Solved

Best Answers

- Mark as New

- Bookmark

- Subscribe

- Permalink

- Report Inappropriate Content

I was asked to create an employees paycheck half way through the pay period and no Federal taxes were removed, only SS and Med. The employee has been here for years

Thanks for laying out the details of your concern, @salamone. I can share information about the factors that affect the withholding calculations.

If you're employee has no federal withholding or if a paycheck shows $ 0.00, it can be because of the following:

- They do not meet the taxable wage base.

- In the employee setup, they were set to Do Not Withhold for federal and state income taxes.

Since your employee has been with you for years, let's review her or his profile. This way, we can ensure the correct taxes are enabled.

Here's how:

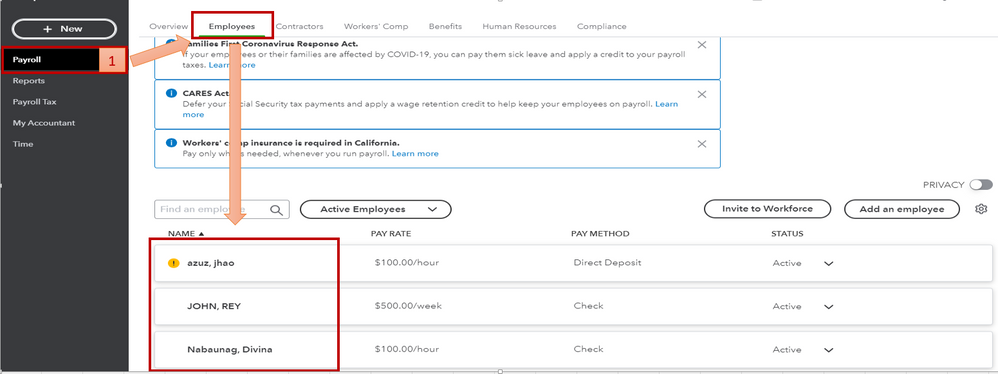

- Go to the Payroll menu, then select Employees.

- Click on the name of the employee.

- Choose the edit icon beside Pay.

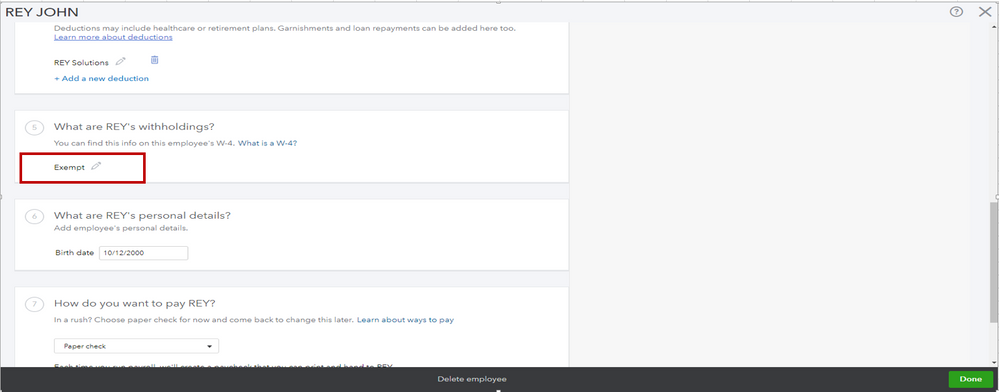

- Next to the withholding section, press the edit icon.

- Examine the Federal Filing Status/State Filing Status.

Feel free to check out this guide to learn more about the annual wage base limits in QuickBooks: Understand payroll tax wage bases and limits.

You can also refer to this article for more troubleshooting solutions when payroll taxes are not withheld: Troubleshoot no income tax withheld from a paycheck.

You are always welcome to visit the Community whenever you need assistance. We are always here to help. I hope you enjoy the rest of your day. Take care.

1 Comment 1

- Mark as New

- Bookmark

- Subscribe

- Permalink

- Report Inappropriate Content

I was asked to create an employees paycheck half way through the pay period and no Federal taxes were removed, only SS and Med. The employee has been here for years

Thanks for laying out the details of your concern, @salamone. I can share information about the factors that affect the withholding calculations.

If you're employee has no federal withholding or if a paycheck shows $ 0.00, it can be because of the following:

- They do not meet the taxable wage base.

- In the employee setup, they were set to Do Not Withhold for federal and state income taxes.

Since your employee has been with you for years, let's review her or his profile. This way, we can ensure the correct taxes are enabled.

Here's how:

- Go to the Payroll menu, then select Employees.

- Click on the name of the employee.

- Choose the edit icon beside Pay.

- Next to the withholding section, press the edit icon.

- Examine the Federal Filing Status/State Filing Status.

Feel free to check out this guide to learn more about the annual wage base limits in QuickBooks: Understand payroll tax wage bases and limits.

You can also refer to this article for more troubleshooting solutions when payroll taxes are not withheld: Troubleshoot no income tax withheld from a paycheck.

You are always welcome to visit the Community whenever you need assistance. We are always here to help. I hope you enjoy the rest of your day. Take care.

Need QuickBooks guidance?

Log in to access expert advice and community support instantly.

Featured

Make your QuickBooks Online invoices, estimates, and sales receipts work

fo...

This episode of Quick Help with QuickBooks will guide you through

QuickBook...

Want to master your banking and reconciliation process in QuickBooks

Online...