Turn on suggestions

Auto-suggest helps you quickly narrow down your search results by suggesting possible matches as you type.

Showing results for

Connect with and learn from others in the QuickBooks Community.

Join nowWelcome to the Community, chenwareinc.

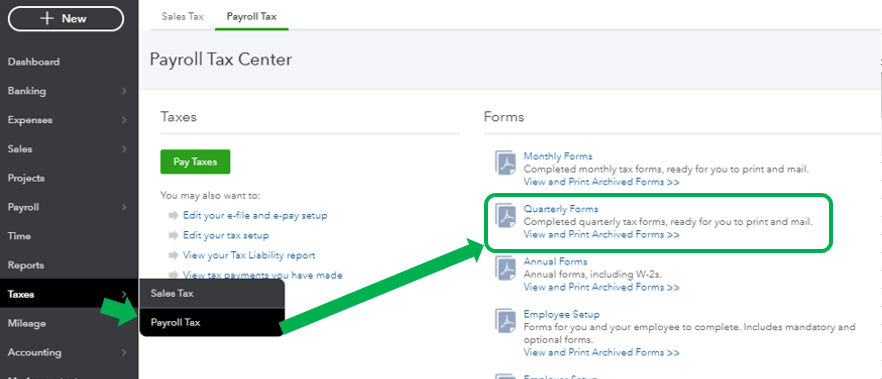

I can help get the original 941 and 944 forms in QuickBooks Online (QBO) so you'll be able to refile them.

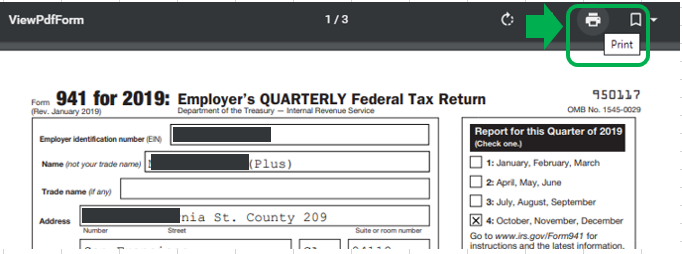

If you have cancelled your subscription, you will have a read-only access to your account for one year after the cancellation. This way, you can archive your 941 forms from last year 2019 so you'll be able to view/print and refile them manually outside QBO.

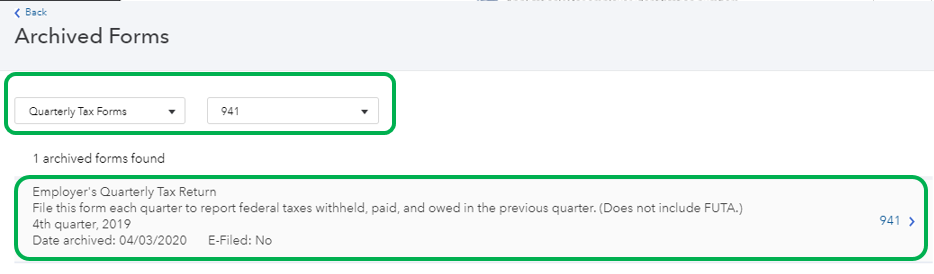

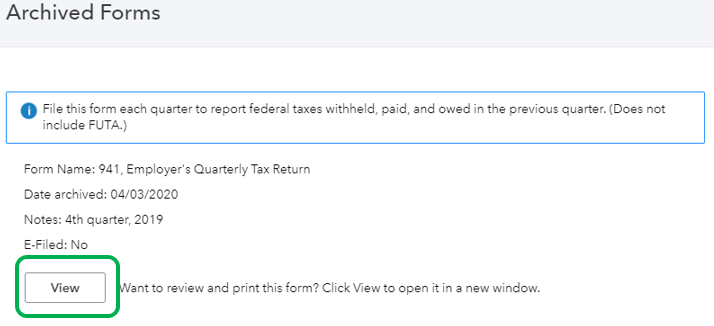

Here's how

For the 944 form, just repeat the process. In step 3, make sure to select 944 as your filter. Once done, you'll manually submit the form to the IRS.

I've got this article for more information about archiving tax forms in QBO: Archive Old Forms.

If you need more help with the process or had a hard time getting those archived forms, feel free to contact our QuickBooks Payroll Support. They can pull up your account and help you get the 2019's 941/944 forms you've previously filed.

If there's anything I can help you with, feel free to drop me a reply below. Hope you have a good one.

Thank you, but when I click on that link, there is nothing in my archived quarterly reports. Is it possible that QuickBooks calculates the payment and breakdown but does not generate / file the form? I have a screen shot of the breakdown of costs and would like to recreate that form, even if it means resubscribing for a short period.

Thank you, but when I click on that link, there is nothing in my archived quarterly reports. Is it possible that QuickBooks calculates the payment and breakdown but does not generate / file the form? I have a screen shot of the breakdown of costs and would like to recreate that form, even if it means resubscribing for a short period.

Hi there, chenwareinc.

Thank you for coming back and for following the steps provided by my colleague above. Since there are no archived forms shows in your end, it could be that you manually filed or haven't saved a copy of your form. That said, I suggest contacting our QuickBooks Support team. They have the tools to pull your account and can archive the form for you.

Here's how to contact them:

1. Open your QuickBooks Account.

2. At the top right, click the Help icon.

3. Click Contact Us.

4. Under What can we help you with?, enter your concern about 941/944 forms.

5. Click Let's Talk.

6. You'll be routed into the Choose a way to connect with us page.

7. Select Get a callback or Start a chat. Then, fill in the information.

You can browse this article to learn more about the different types of support we offer at Intuit and its availability: Support hours and types.

On the other hand, yes, it's possible that QuickBooks automatically calculates the payment and breakdown. That said, we will be the one to file your taxes, pay your taxes, and send it to the IRS. This only works if you're using QuickBooks Online Payroll Full Service ( QuickBooks Online Payroll Core, QuickBooks Online Payroll P....

Please also refer to this article on how you can pull up a report that shows the taxes you need to pay and the ones you’ve already paid: Payroll Tax Liability Report.

Fill me in if you need more help with managing your payroll forms or other QuickBooks-related concerns. Take care and have a good one.

You have clicked a link to a site outside of the QuickBooks or ProFile Communities. By clicking "Continue", you will leave the community and be taken to that site instead.