Turn on suggestions

Auto-suggest helps you quickly narrow down your search results by suggesting possible matches as you type.

Showing results for

Connect with and learn from others in the QuickBooks Community.

Join nowI have a client who has the bank sends one payment to several vendor contracts once a month. I split the transaction thinking that I am putting in the expenses for each vendor, however running 1099 report nothing shows up for these. I am at a loss as to how to separate the payments or re-do the transactions to set this up. They have automatic bank updates into QuickBooks how do I separate a bank transaction that went to several vendors? Or is it possible to fix it the way it is to be able to print 1099s?

Solved! Go to Solution.

You've come to the right place, @Kelise Enterprises.

To show these payments in the 1099 report, you'll have to specify the payee to the contractor's name. The best way to rectify this is to create a separate expense transaction for each contractor. Make sure that it would sum up the total payment. Then, match them to the bank transaction. I'd be glad to discuss this in detail.

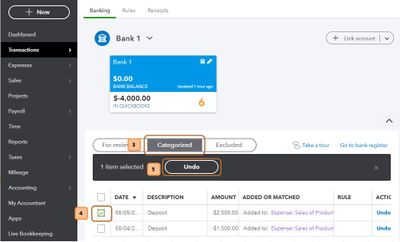

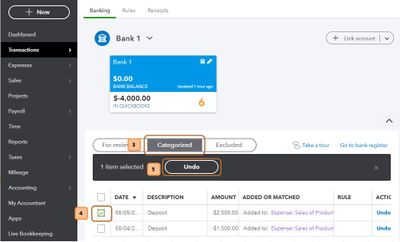

First, undo them from the Categorized tab. I'll guide you how.

Once you remove a transaction from the Categorized tab, it will return to the For Review list.

After that, create the expense transaction for each vendor.

Lastly, match these expenses from your bank feeds.

Check out our guide on categorizing and matching online bank transactions in QuickBooks Online for more info.

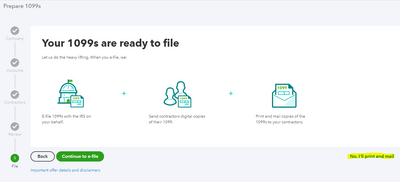

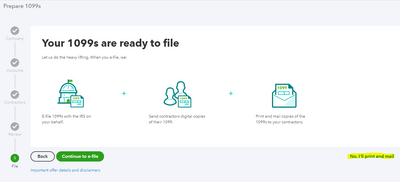

Once done, these transactions will show up in the 1099 report. Follow these steps to prepare and print 1099s:

Doing this will allow you to print your 1099 forms right away. Check out our guide on printing 1099s in QuickBooks Online for more information.

You can also read through the common questions and answers about 1099s.

Please let me know how it goes by leaving a comment below. I'm only a post away should you have any follow-up questions or concerns. Have a wonderful day!

You've come to the right place, @Kelise Enterprises.

To show these payments in the 1099 report, you'll have to specify the payee to the contractor's name. The best way to rectify this is to create a separate expense transaction for each contractor. Make sure that it would sum up the total payment. Then, match them to the bank transaction. I'd be glad to discuss this in detail.

First, undo them from the Categorized tab. I'll guide you how.

Once you remove a transaction from the Categorized tab, it will return to the For Review list.

After that, create the expense transaction for each vendor.

Lastly, match these expenses from your bank feeds.

Check out our guide on categorizing and matching online bank transactions in QuickBooks Online for more info.

Once done, these transactions will show up in the 1099 report. Follow these steps to prepare and print 1099s:

Doing this will allow you to print your 1099 forms right away. Check out our guide on printing 1099s in QuickBooks Online for more information.

You can also read through the common questions and answers about 1099s.

Please let me know how it goes by leaving a comment below. I'm only a post away should you have any follow-up questions or concerns. Have a wonderful day!

Thanks for the help. This was definitely helpful. Another question: What if part of the transaction was a Owner's Draw? How do I separate that with the vendors when matching?

Thanks for getting back to me, Kelise Enterprises.

If it's an owner's draw, you'll not enter it on a 1099 instead, it will be recorded on a W-2 forms.

As for matching it with your vendor's transactions, you can split them to the correct expense accounts. I've added these articles as your guide:

I'm just a post-away if ever you need help. Keep safe!

You have clicked a link to a site outside of the QuickBooks or ProFile Communities. By clicking "Continue", you will leave the community and be taken to that site instead.