Turn on suggestions

Auto-suggest helps you quickly narrow down your search results by suggesting possible matches as you type.

Showing results for

Connect with and learn from others in the QuickBooks Community.

Join nowHi: We use ADP to process our payroll. We have many outstanding checks over a year old. Can I just VOID them in the check register or do I have to do journal entries of some sort to cancel them? Thanks in advance!

I’ve got you covered, @CarrieMT.

Thanks for reaching out in the Community for assistance. I’m happy to share few information to get these payroll checks settled.

In QuickBooks Online, yes, you can create journal entries to cancel and clear them. Here are the steps to do it:

You can refer to this article for further details about recording journal entries in QuickBooks. It has video tutorials to ensure everything is entered accordingly.

I’d also recommend contacting your accountant for further assistance. They can help you with the process, especially when choosing the appropriate accounts.

Don't hold back to add a message below if you have additional concerns or questions about managing transactions. I'll always be here to help. Take care!

So how does the actual check come off the bank account reconciliation?

I'd be glad to help you with the reconciliation process in QuickBooks Online, CarrieMT.

For most outside payroll services or ADP, you would need to manually record those old payroll checks via a journal entry. Once recorded, you can match them to your payroll payments from the banking page.

You would need to set up a Clearing Account where you post your payroll payments and to ensure your transactions from the bank are reflected properly in QuickBooks Online to credit the liability accounts.

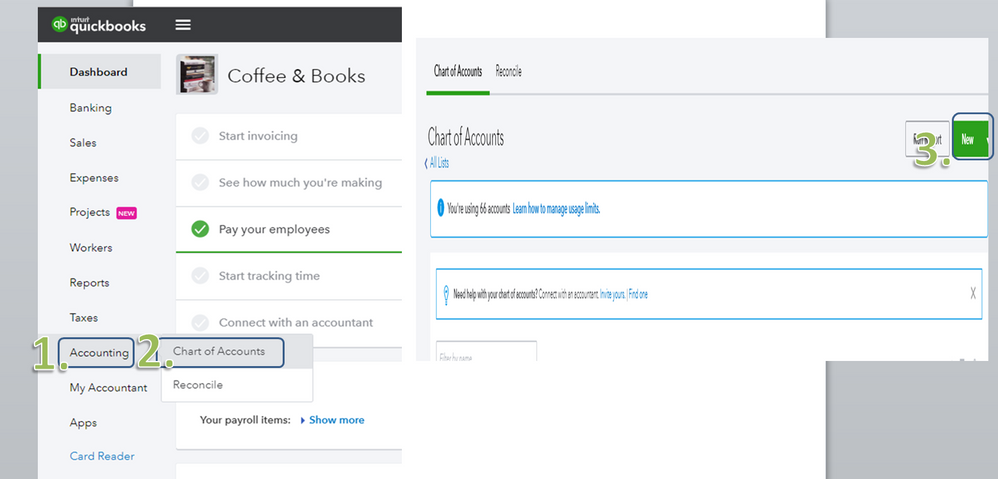

To set up a clearing account, here's how:

That should do it. You can now post your payroll payments in this account, match them to your journal entries and start reconciling. You can refer to this article to help you with the reconciliation process: Reconcile an account in QuickBooks Online. On the same link, you'll find write-ups about how to review your previous reconciliation as well as adjusting them in QuickBooks.

Let me know if you still need help with this or if you ran into a different situation by adding a reply below so I can look further into this. I want to make sure your transactions are accurate and you're able to reconcile them. Have a lovely week.

i think that solution is backwards...i would like to cancel payroll checks that are over a year old. Isn't that solution to manually record payroll checks?

It's nice to have you here, @CarrieMT,

I can help you correct your Paypal transactions in QuickBooks Online.

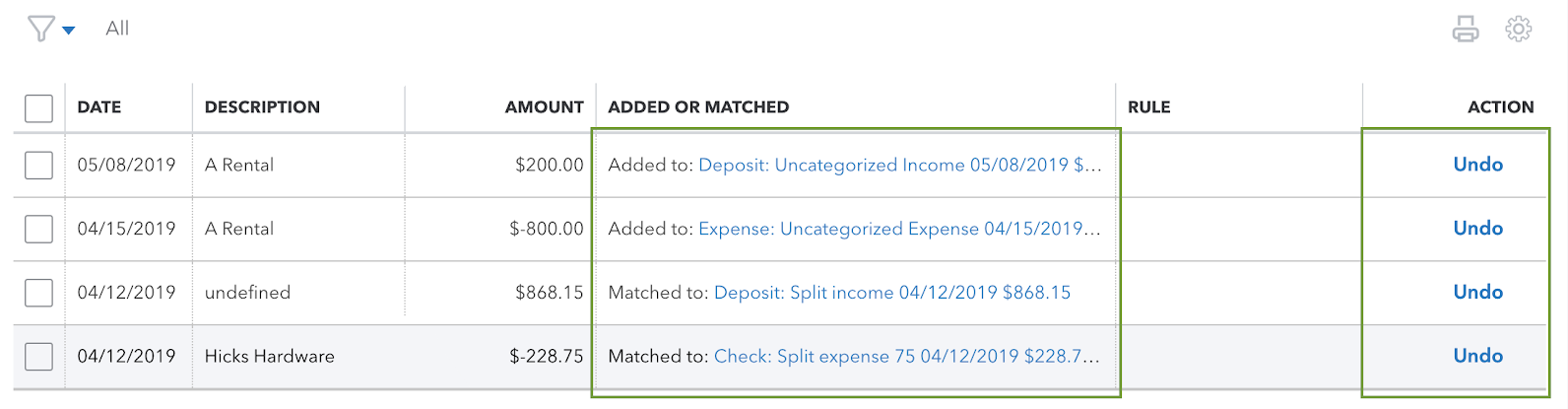

If these entries are imported as bank transactions and was added in the register, you can undo and exclude them. Here's how:

Did you match a downloaded transaction with the wrong one? Follow these steps:

To exclude the entries in the Banking page, follow the steps below:

Excluded transactions are then moved to the Excluded tab, and won’t be added to QuickBooks or be downloaded again. To permanently delete duplicate entries, put a check mark on them, then hit Delete.

If you imported them from ADP as real time transactions, you can manually delete them in the program. The following link will guide you how to remove entries in QBO: Void or delete transactions in QuickBooks Online

Another option is finding a third-party deleter app to remove the data inside QuickBooks. Click this link to our site: QuickBooks Online Applications

If you have further questions about the steps, please feel free to post them here or mention my name. I'll be here to help. Have a nice day!

so if i go in and void the stale dated/expired pay checks, i don't have to do journal entries? If i do journal entries, i just reverse the accounts the paycheck normally posts to?

Hello there, CarrieMT.

Yes, you may need not create journal entries if you void the paychecks. If you choose to create one, you'll just have to reverse the accounts. In doing so, I highly suggest reaching out to an accountant to help you in identifying the payroll accounts affected.

Feel free to use these links on how to manage payroll:

Keep me posted if there's anything else that you need help with. Take care!

You have clicked a link to a site outside of the QuickBooks or ProFile Communities. By clicking "Continue", you will leave the community and be taken to that site instead.