I'll help you change your payroll setting so your previous payroll won't carry to your next payroll, hcsbi. Let's work side-by-side to ensure we can get past your payroll concerns and for you to begin processing payroll.

To do this, you may want to update your payroll preferences. This setting allows you to configure your payroll information, map your payroll transactions, and ensure you stay compliant with paychecks and pay stubs. By updating, previous payroll details won't automatically appear when processing your payroll.

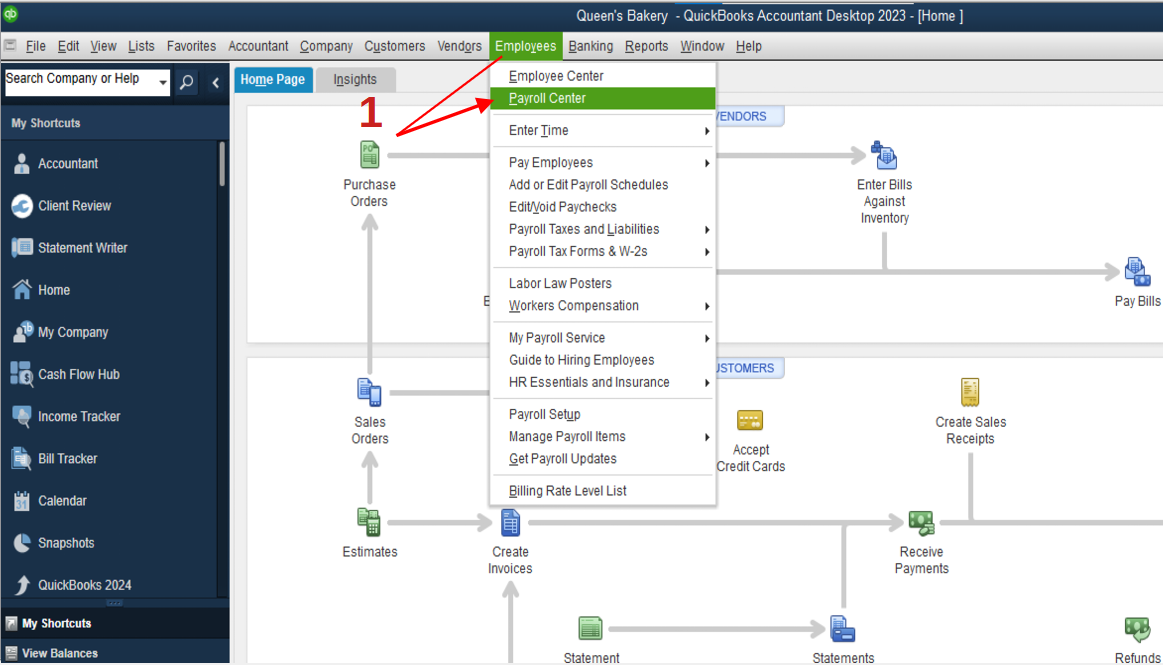

Let me guide you on how:

- Go to Employees and choose Payroll Center.

- Under the My Payroll Service field, select the Payroll tab.

- Locate the Preferences menu and click Company Preferences.

- Uncheck the Recall hour field on paychecks box.

- Once done, hit OK.

Also, if you want to get a closer look at your employee info, you can pull up payroll reports. This way, you can use the data for audits, preparation of government forms, and compensation requirements. You can choose to customize its content and appearance depending on your preferences.

I'm still all ears if you have additional questions about managing payroll in QuickBooks Desktop (QBDT). Please feel free to reach out with any specific inquiries, and I'll do my best to provide helpful guidance. I'm here to support you in ensuring your payroll processes are configured accurately and efficiently within the QBDT.