Thanks for joining the Community, Confused Karen.

If you've already created your employee's retirement plan deduction, you'll need to assign it to their profile. This will get it to display correctly.

Here's how:

- In the left navigation bar, go to Workers, then Employees.

- Click your employee's name.

- Use the Pencil (✏️) icon in your Pay section.

- Scroll down on the deductions area and hit + Add deductions.

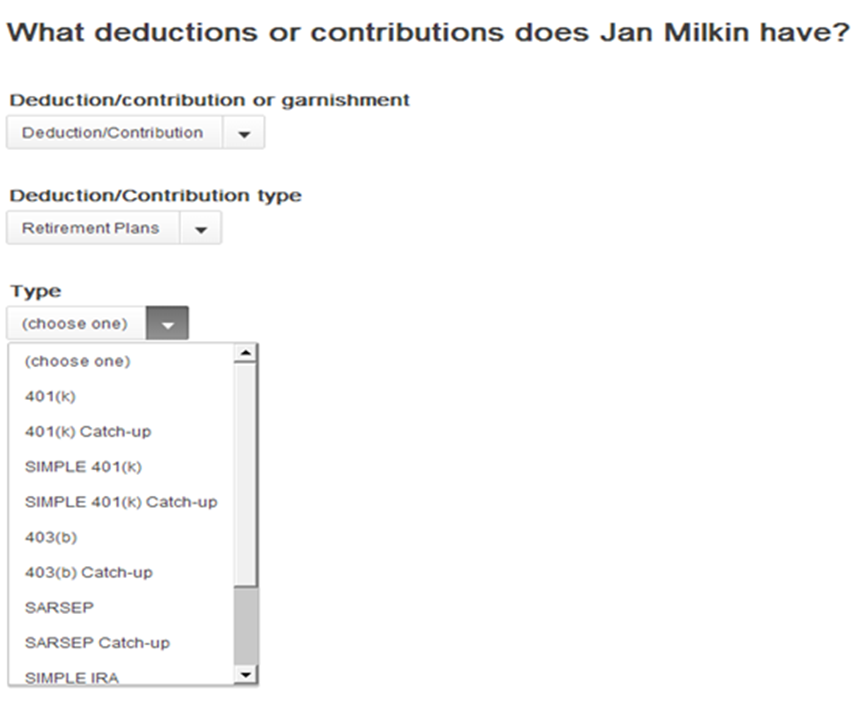

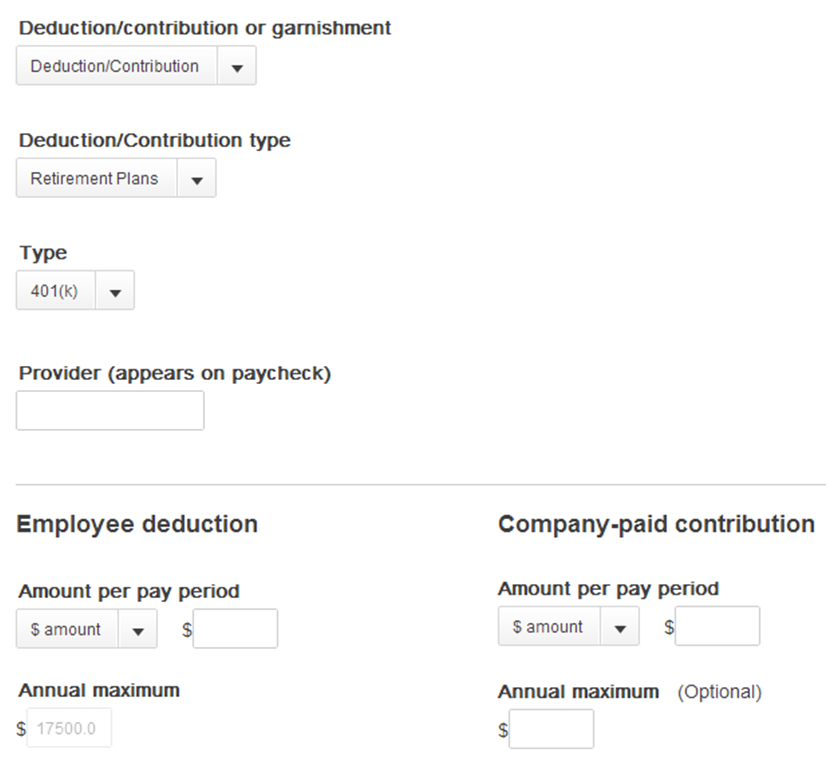

- Choose Retirement Plans under Deduction/Contribution type.

- Pick a Type.

- Enter your provider's name.

- Specify the amounts per pay period.

- Select Done.

In the event you haven't set up their pension as a SARSEP (Salary Reduction Simplified Employee Pension) yet, you can review our Retirement plan deductions/contributions article for detailed steps on how to create it. You'll additionally find a lot of useful information about working with retirement plans in that resource.

If there's any questions, I'm just a post away. Have a wonderful Wednesday!