Hi there, @dlittleton1.

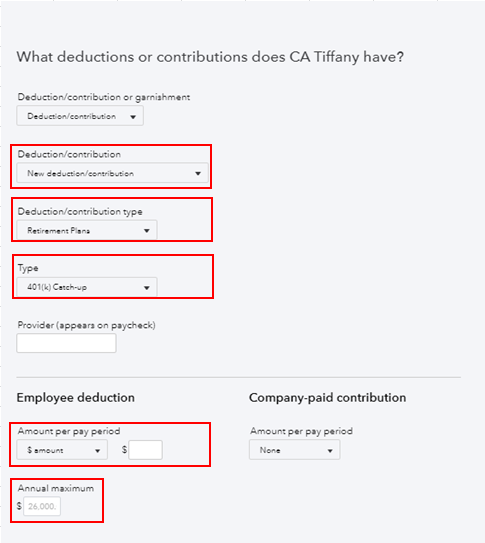

You can set up a new contribution called 401(k) Catch-up to increase the annual limit. Let me guide you through the steps.

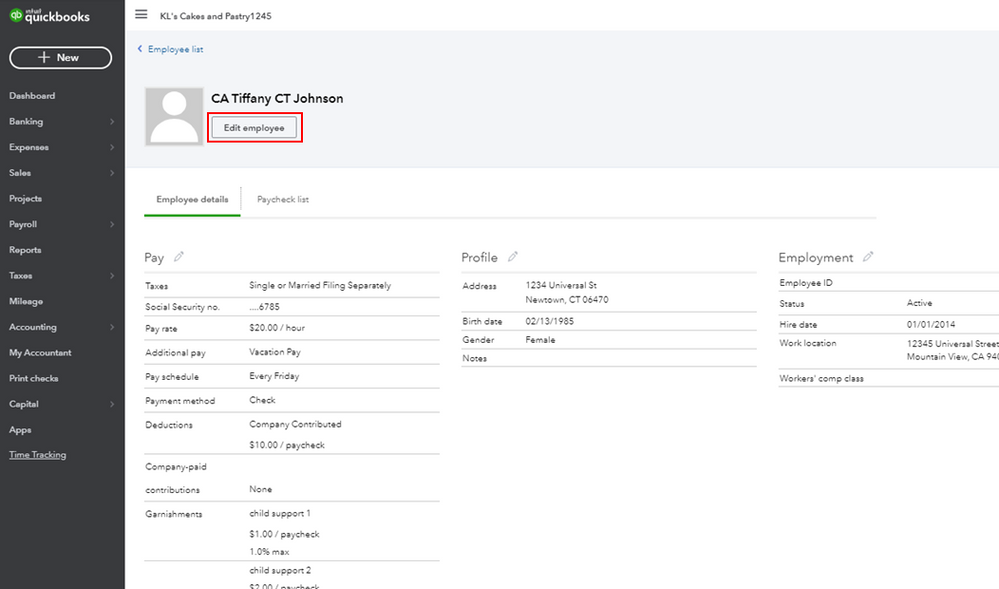

- In your QuickBooks Online, go to the Payroll tab and select Employees.

- Choose the appropriate employee you want to increase the limit.

- Then, click Edit employee.

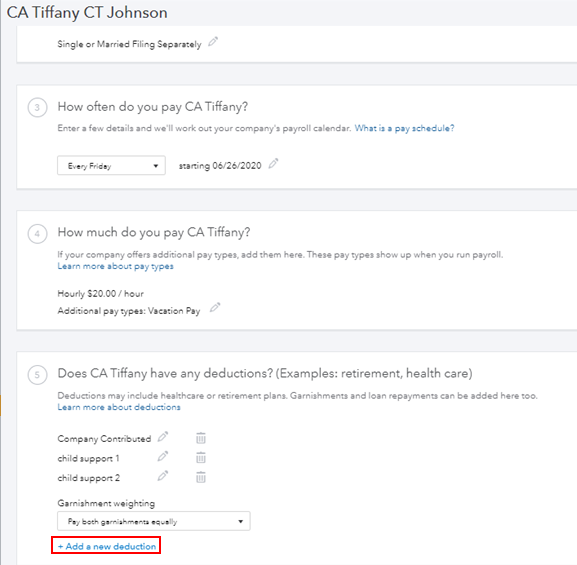

- On the deductions section, click +Add a new deduction.

- Choose Deduction/contribution > New deduction/contribution > Retirement Plans > 401(k) Catch-up.

- Enter the amount per pay period, then click OK to save.

You can check out these articles to learn how to handle deductions/contributions:

Keep in touch if you need any more assistance with this, or there's something else I can do for you. I've got your back. Have a good day and stay safe.