Turn on suggestions

Auto-suggest helps you quickly narrow down your search results by suggesting possible matches as you type.

Showing results for

Connect with and learn from others in the QuickBooks Community.

Join nowSolved! Go to Solution.

Hi @kok_treasurer,

Welcome aboard to the Community. I'm here to share some clarification about the message you get when setting up an employee in QuickBooks.

Users who subscribed to the Full-service payroll subscription have automated taxes and forms. Currently, the option to make changes to the entire tax exemptions is available to Enhanced payroll users only.

To ensure taxes are calculated correctly, I suggest contacting our Payroll Support Team. They can securely access your account and make the necessary changes on your behalf.

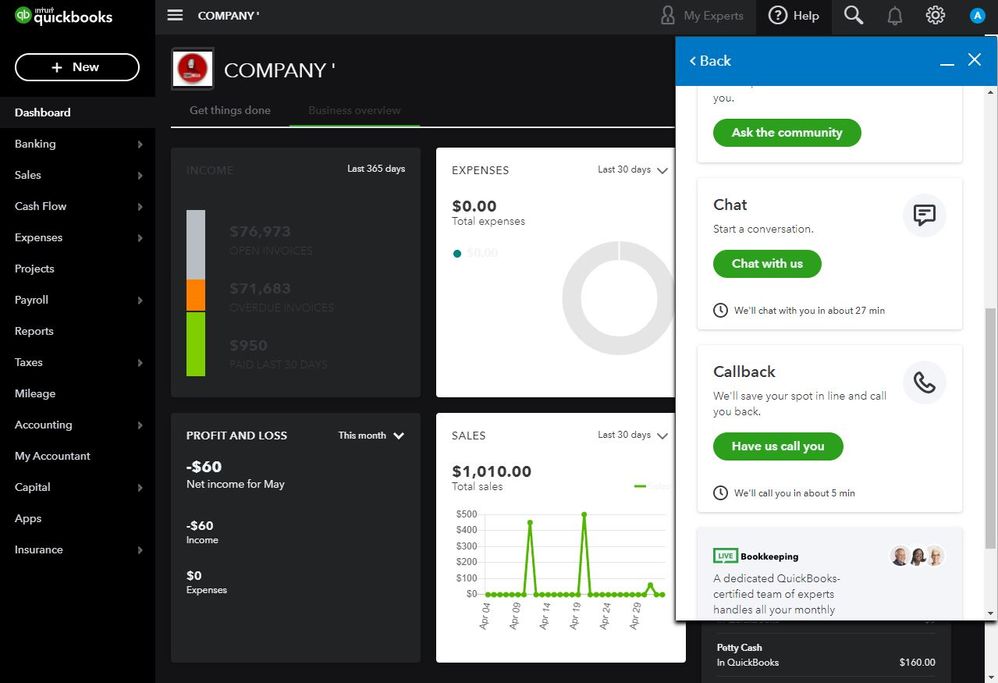

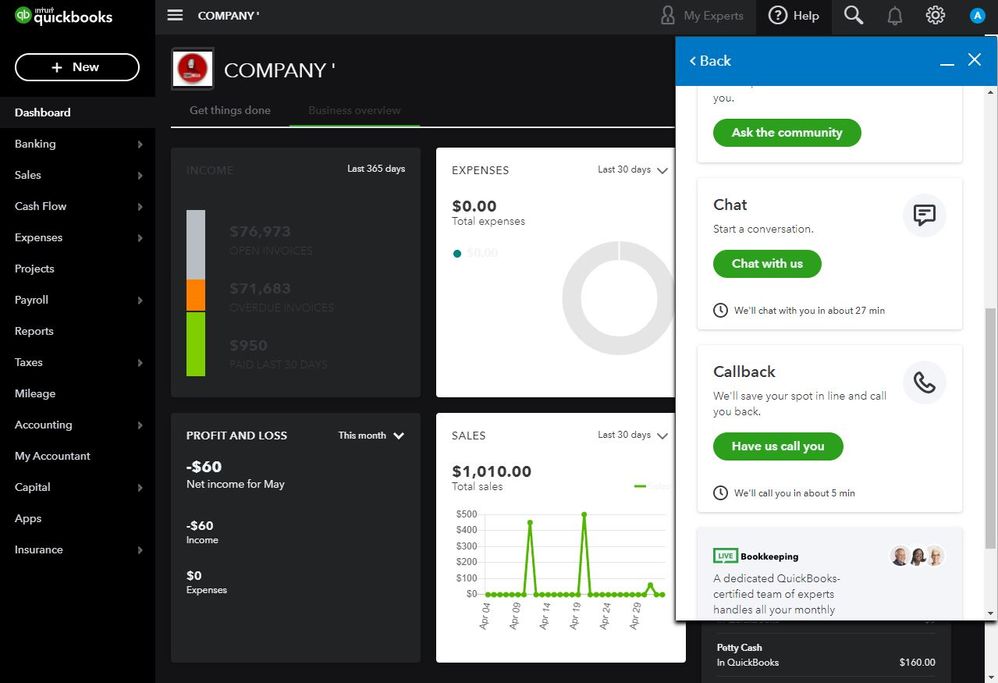

Here's how:

Our Customer Support Team is available from 6 AM - 6 PM PT (Monday - Friday) and 6 AM - 3 PM PT (Saturday).

For additional reference, you can use the following article to view details on tax forms, as well as the forms you can e-file through QuickBooks: California Payroll Tax Compliance.

Leave a comment below if you have other concerns setting up an employee. The Community and I will be around to help you.

Hi @kok_treasurer,

Welcome aboard to the Community. I'm here to share some clarification about the message you get when setting up an employee in QuickBooks.

Users who subscribed to the Full-service payroll subscription have automated taxes and forms. Currently, the option to make changes to the entire tax exemptions is available to Enhanced payroll users only.

To ensure taxes are calculated correctly, I suggest contacting our Payroll Support Team. They can securely access your account and make the necessary changes on your behalf.

Here's how:

Our Customer Support Team is available from 6 AM - 6 PM PT (Monday - Friday) and 6 AM - 3 PM PT (Saturday).

For additional reference, you can use the following article to view details on tax forms, as well as the forms you can e-file through QuickBooks: California Payroll Tax Compliance.

Leave a comment below if you have other concerns setting up an employee. The Community and I will be around to help you.

You have clicked a link to a site outside of the QuickBooks or ProFile Communities. By clicking "Continue", you will leave the community and be taken to that site instead.