Turn on suggestions

Auto-suggest helps you quickly narrow down your search results by suggesting possible matches as you type.

Showing results for

Connect with and learn from others in the QuickBooks Community.

Join nowHello there, @123snb-bbq.

Yes, you can change your TIN. However, you'll have to make sure to consult your accountant or IRS on whether or not you need to submit separate W-2s for the new and the old TIN or EIN. Also, please make sure to check the IRS requirements before changing an existing TIN or EIN.

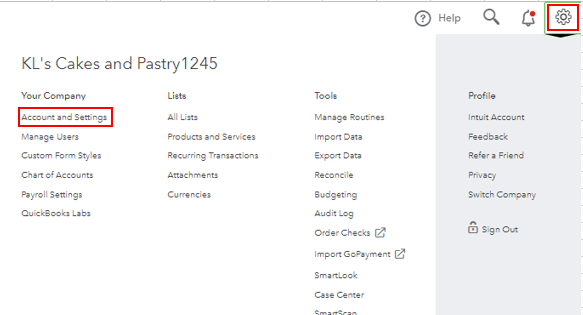

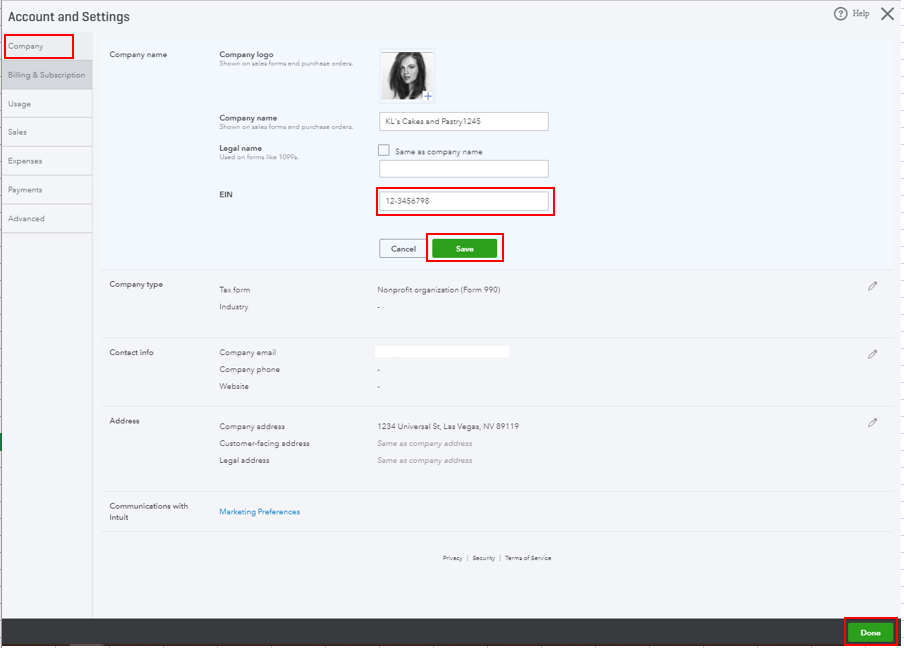

Here's how to change the TIN or EIN in QuickBooks Online (QBO):

You can read this article for more details: Change your business name, contact info, or EIN in QuickBooks Online.

As always, feel free to visit our QuickBooks Community help website for QBO if you need tips and related articles in the future.

Please touch base with me here for all of your QuickBooks needs, I'm always happy to help. Wishing you all the best.

How to change TIN in Desktop Premier Pro 2017? And yes I'm updating :)

Thanks for joining this thread, @jrf-llc.

I'd be glad to help with changing the Federal Employer Identification Number (EIN) in QuickBooks Desktop.

Before going into detail, workflows vary from business to business, so I recommend reaching out to an accountant to make sure this would work best for you.

Although, to change an existing EIN, check the IRS requirements. If you're eligible for a new EIN, then you'll need to submit Form SS-4 to the IRS.

After you've completed the steps above, update QuickBooks Desktop Payroll.

Here's how:

Once you've updated it on your payroll account, you'll also need to contact us so we can update your EIN in our records.

For more detailed instructions with changing your EIN, check out this link: Change your Federal Employer Identification Number (EIN) in QuickBooks Desktop.

If you have any more questions, I'm always here to help. Have a safe and productive rest of your day!

You have clicked a link to a site outside of the QuickBooks or ProFile Communities. By clicking "Continue", you will leave the community and be taken to that site instead.