Welcome to the Community, @harrodtransport.

Yes, you can! The steps to do this are pretty simple. This can be done by boing to the Taxes menu in QuickBooks Online (QBO). Here's how:

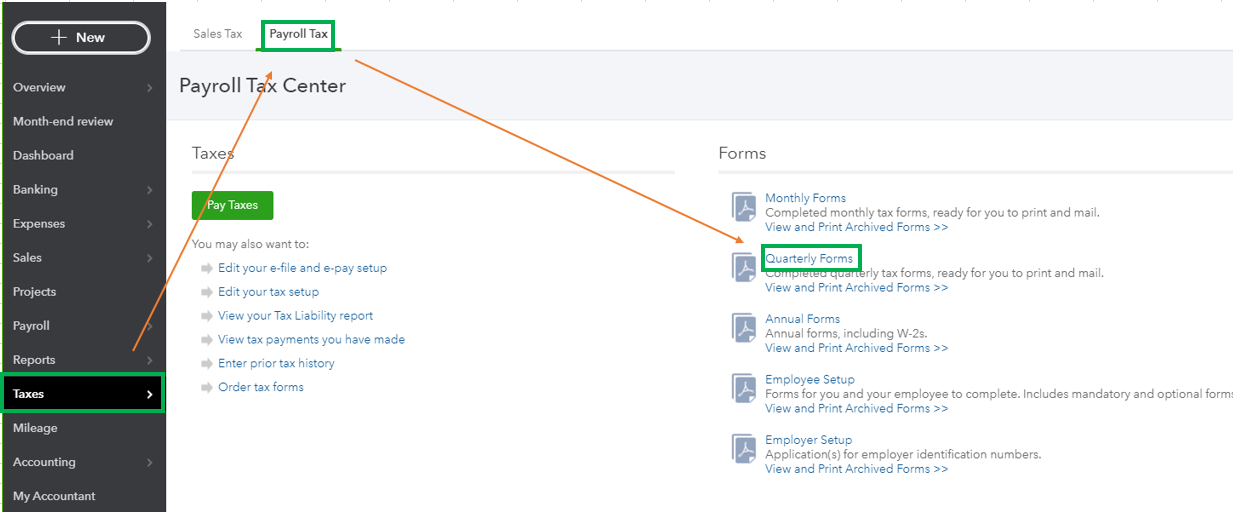

- In QBO, go to the Taxes menu at the left pane to get to the Payroll Tax page.

- In the Forms section, select Quarterly Forms.

- Click the RT-6 form link, then Payroll Tax.

- Choose the date range of the form.

- If you’ve setup e-services before, uncheck the File electronically box. If you haven’t enrolled for e-services, click the View button.

For more information about filing your Florida quarterly form, consider checking out these articles:

Reach out to me in the comment section if you have additional questions or concerns. I'll be happy to assist. Have a great rest of the day!