Turn on suggestions

Auto-suggest helps you quickly narrow down your search results by suggesting possible matches as you type.

Showing results for

Connect with and learn from others in the QuickBooks Community.

Join nowSolved! Go to Solution.

I'm glad to lend a hand, GraceUMC1.

QuickBooks populates the amount of employee-reported tips in box 7.

You can run the Payroll Summary report for the entire calendar year. The number is equal to the amount of the item (any item that has a tax tracking type of Reported Tips). Double-click the amount to see what transactions contribute the total.

Here's how to get the report:

After that, I recommend contacting our QuickBooks Desktop Team. They'll make the necessary corrections and adjustments so you can file the W-2 form with no errors.

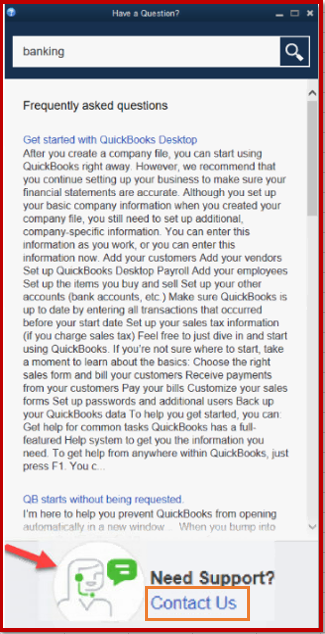

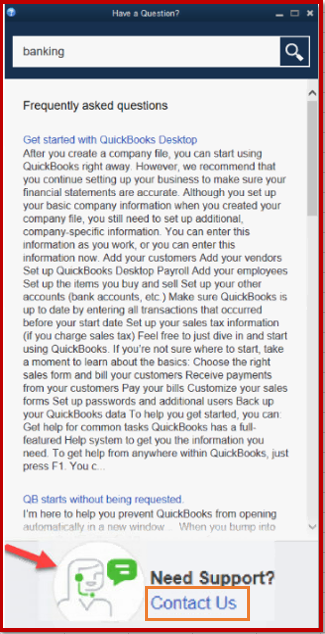

Here's how:

You can also check out the Support hours and types to contact them at a time convenient to you.

Don't hesitate to click the Reply button if you need additional information. I'm happy to help you out.

I'm glad to lend a hand, GraceUMC1.

QuickBooks populates the amount of employee-reported tips in box 7.

You can run the Payroll Summary report for the entire calendar year. The number is equal to the amount of the item (any item that has a tax tracking type of Reported Tips). Double-click the amount to see what transactions contribute the total.

Here's how to get the report:

After that, I recommend contacting our QuickBooks Desktop Team. They'll make the necessary corrections and adjustments so you can file the W-2 form with no errors.

Here's how:

You can also check out the Support hours and types to contact them at a time convenient to you.

Don't hesitate to click the Reply button if you need additional information. I'm happy to help you out.

You have clicked a link to a site outside of the QuickBooks or ProFile Communities. By clicking "Continue", you will leave the community and be taken to that site instead.