Hi there, @jkoflerlmhc.

You'll have to print a new paper form to amend a 1099 and resubmit it outside QuickBooks. Let me guide you how.

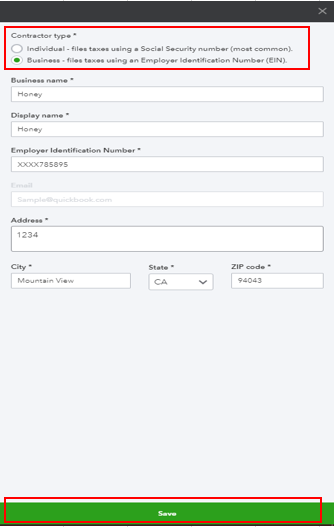

First off, you'll need to use your contractor's Employer Identification Number (EIN) if they're operating as a business. However, if they're running as an individual contractor, you'll have to use their Social Security Number (SSN).

To get started, let's first correct the Tax ID of your contractor in QuickBooks. Here's how:

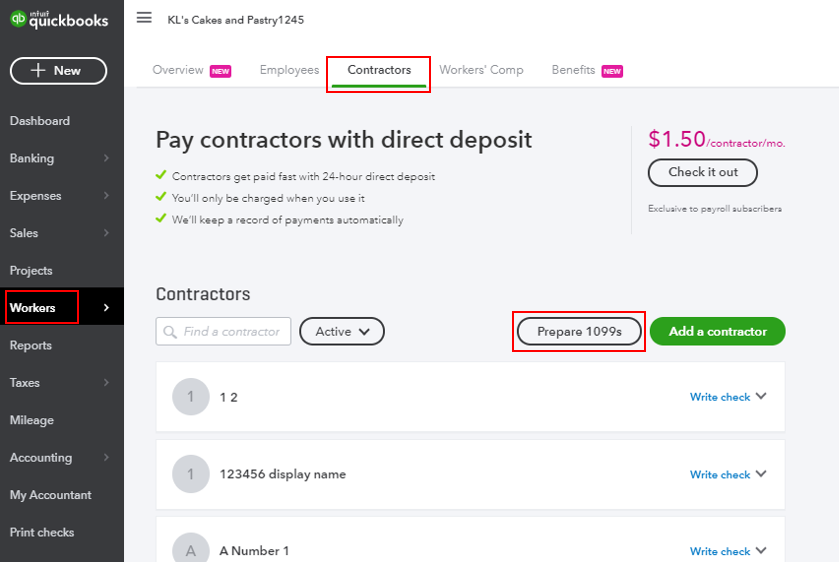

- In your QuickBooks Online, click Workers from the left menu, then select Contractors.

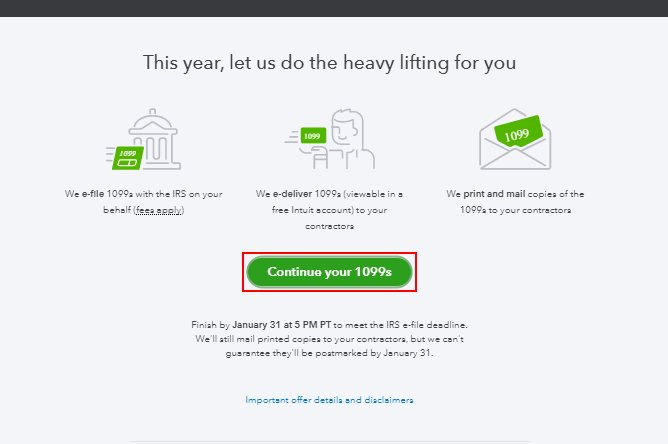

- Click the Prepare 1099s, then select Continue your 1099s.

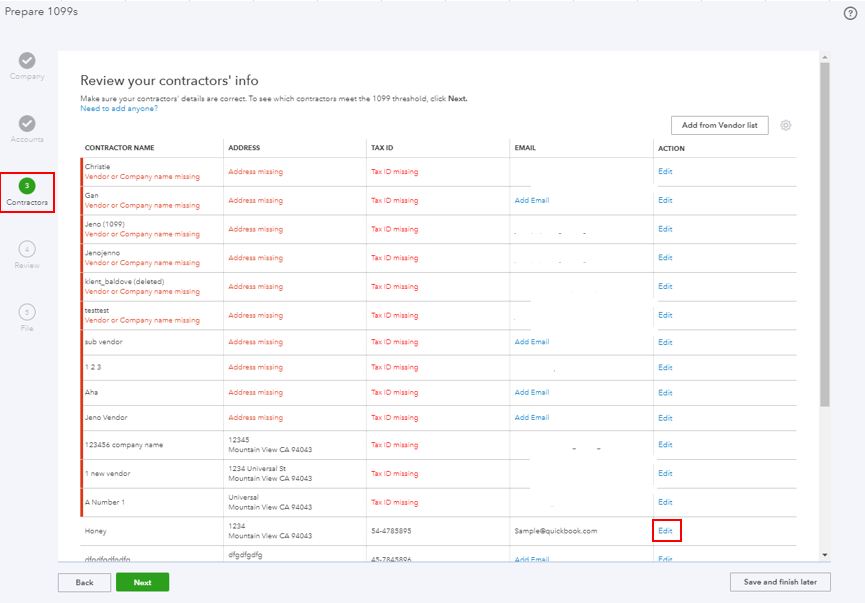

- Hit Next until you've reached the Review your contractor's info.

- Select the appropriate vendor from the list and click Edit under the Action column.

- Choose the Contractor type and enter the correct EIN or SSN.

- Click Save.

Once done, you can get paper 1099s forms from the IRS or order from us. And fill it out with the correct information, then select the Corrected checkbox and mail it to the IRS and your contractor.

For your reference, you can check out this article and go to the How do I make changes to a 1099 I already sent section for more guidance: Common questions about 1099s.

As always, feel free to visit our QuickBooks Community help website if you need tips and related articles in the future.

Please let me know if you need further clarification about this, or if there's anything else I can do for you. I'll be standing by for your response. Have a great day.