Hi there, @ANGIEAUDIE.

Good to see you here in the Community.

Things you should know about changing bank accounts.

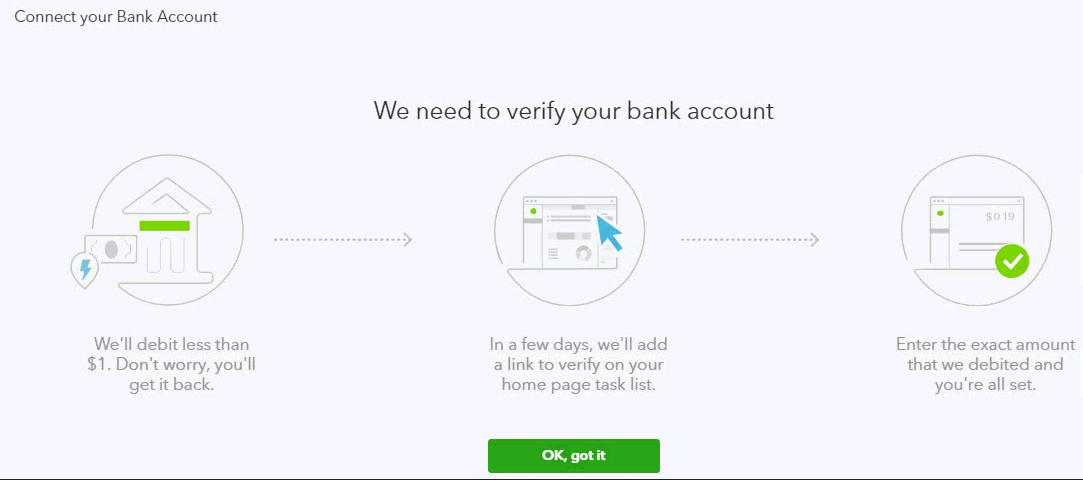

- A test transaction should appear in your bank statement in two-three business days.

- The amount should be a debit and a credit of less than a dollar.

- You can call your bank or check it on your online bank statement.

Here's how:

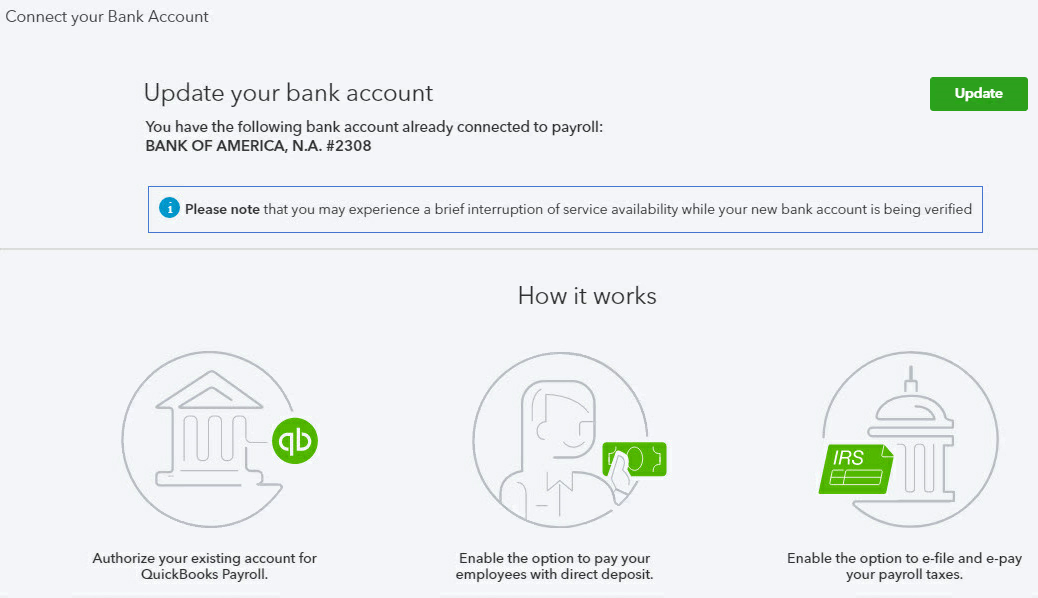

- Go to the Gear icon on the upper right and then select Payroll Settings.

- Below Bank Accounts, select Company.

- Click Update.

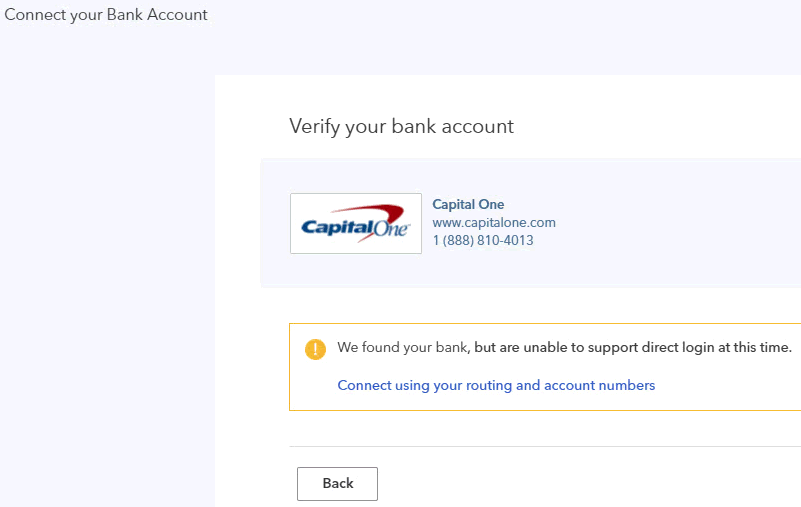

- Choose Connect using your routing and account numbers entering new bank account information.

- Then hit Submit.

- You will receive instruction on your email or call Payroll Support for assistance, then click OK, got it.

After the changes, to ensure your paychecks are processed in your new bank account. I suggest updating your bank account in the export preferences.

I'll provide you an article that will help you edit bank transactions including the best possible suggestion for accepting the transaction: Assign, categorize, edit, and add your downloaded banking transactions.

Here's how to add a payroll deduction for your employees. (Note: Once set up for one employee, you'll see this as an option for other employees):

- Select Workers, and then Employees.

- Select the employee's name and next select Edit ✎ next to Pay.

- In section 5, select + Add a new deduction or + Add deductions.

- From the Deductions/contributions ▼ dropdown menu, choose New deduction/contribution.

- Choose a Deduction type and Type from the small arrow ▼ icon.

- Enter Provider name(appears on paycheck).

- From the Amount per pay period ▼icon, choose $ amount or % of gross pay and enter the $ amount or percentage. Do the same for the Company-paid contribution as applicable.

- Select OK, then Done.

If you need assistance, here's how to contact Payroll Support:

- Click the (?)Help button on the upper right.

- Hit Contact Us.

- Enter "Payroll support for QuickBooks Online Payroll" and click Let's talk.

- Choose to Get a callback or Chat.

For FAQs about changing bank account information like accidentally entered an incorrect bank, here's the link: Change bank account information.

This link will give you the steps on connecting an account if the one you need for payroll isn't linked: How to use Online Banking, Connect Bank Accounts, and Review your Bank Feed in QuickBooks Online.

Should you ask more, don't hesitate to leave a message for assistance. I'm right here to help you. Enjoy your day!