Hi there, @kwbartholf.

You don't have to update the PA state SUI tax rate. Instead, you can directly exempt your employees from it. Let's go to your employee's withholding and mark the PA SUI tax rate from there.

Here's how:

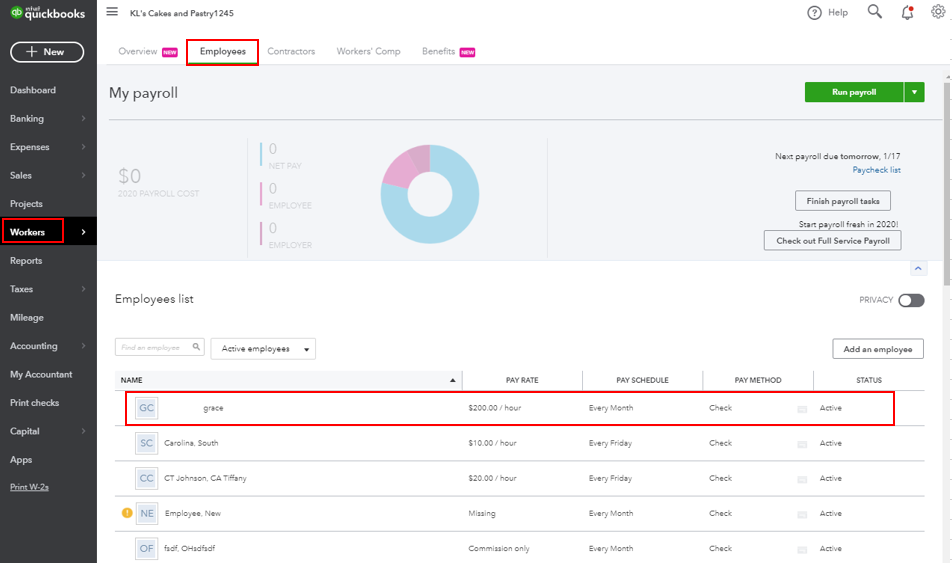

- In your QuickBooks Online, click Workers from the left panel.

- Go to the Employees tab, then select each employee who is exempted from PA SUI tax rate.

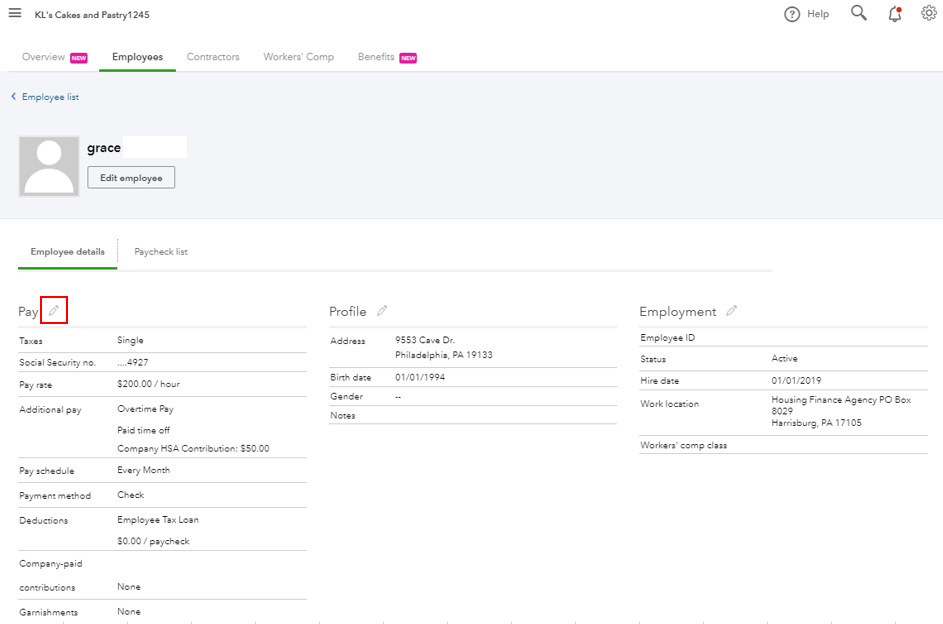

- In the employee's profile, click the pencil icon in the Pay section.

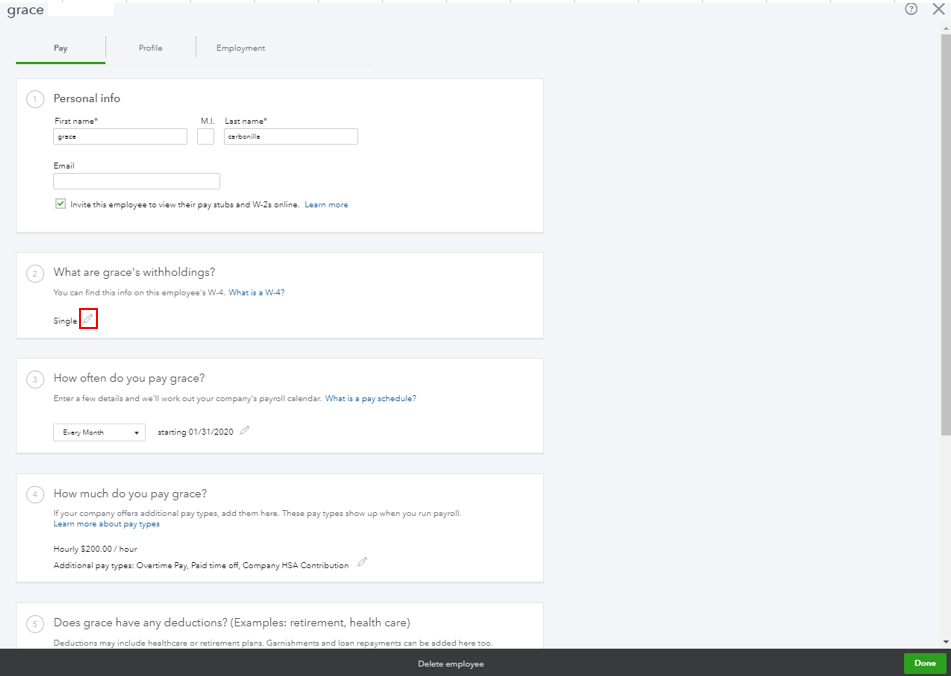

- Go to the employee's withholdings, then click the pencil icon to edit.

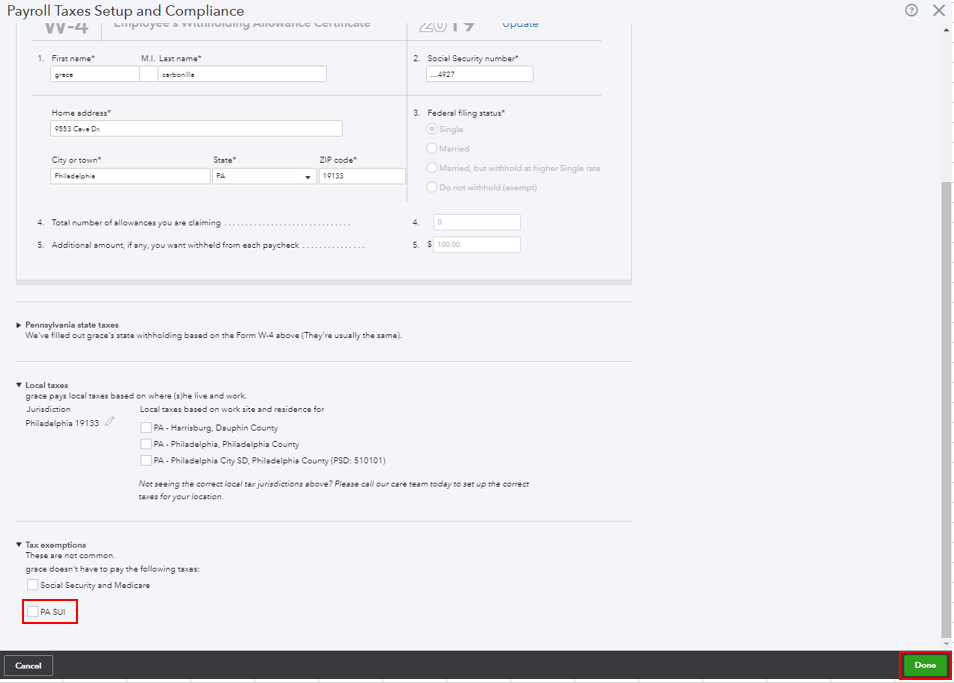

- Scroll down a bit, then click the arrow beside Tax exemptions.

- Put a checkmark in the PA SUI checkbox to exempt the employee from the tax.

- Click Done twice to save the changes.

Once done, please repeat the steps for the rest of your employees.

If you want to update your PA SUI tax rates, you can check out these article for more guidance:

Please touch base with me here for all of your QuickBooks needs, I'm always happy to help. Wishing you all the best.