Hi there, @lmoore2.

You'll want to edit the W-4 of your employee and remove the extra withholding to step 4 box C (Extra withholding).

Here's how.

- Navigate to the Payroll menu and select Employee.

- Select your employee name.

- In the Pay section, click the Pencil icon.

- Select the Pencil icon under the What are the Employee's Withholding? section.

- Click Got it if prompted.

- Delete the amount for the extra withholding.

- Click Done.

I'd also recommend reaching out to our Payroll Support team to have the tax information updated. They can take a closer look into your account using their tools and have the tax information updated.

Here's how:

Here's how:

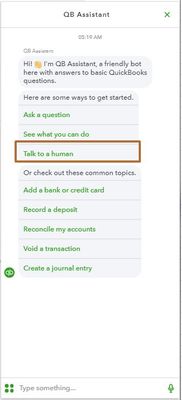

- Click the (?) Help icon in the upper right-hand corner of the Dashboard.

- Select Talk to a Human.

- Enter a short description of your concern and press Enter.

- Click I still need a human.

- Select Contact Us to connect with our live support.

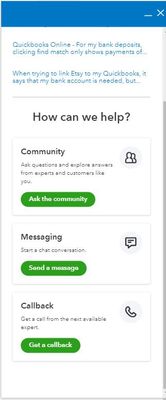

- Choose Send a message or Get a callback.

These instructions are also available from our guide on contacting QuickBooks Online Payroll support for your convenience.

Please check this article to see information about the new changes to the Federal W-4 and how to enter and print a W-4 for employees: What’s changing with the Federal W-4?.

Please know that you're always welcome to post if you have any other concerns. Wishing you and your business continued success.