I have some ideas on how to help correct your payroll item, @mallison.

Yes, you're right. Changing the posting account of your payroll item from income to expense will affect all your previous transactions.

If you don't want this, you can create a new payroll item to replace the old one. This way, you can link your auto reimbursements to the correct expense item or account going forward.

On the other hand, if you want to keep the old payroll item, you can edit it. Before doing so, please make sure to consult with your accountant for the best advice to prevent messing up your transactions.

Here's how:

- Click Lists at the top, and then Payroll Item List.

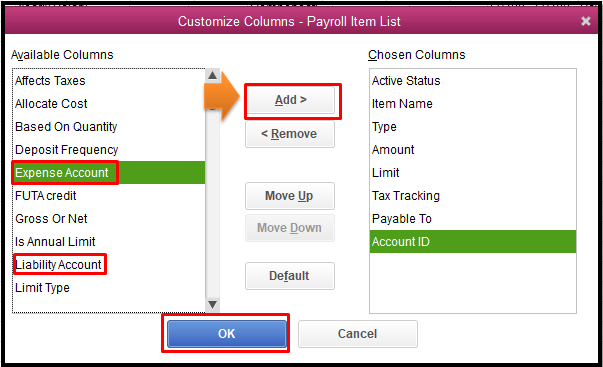

- Select Customize Columns.

- From the Available Columns list, choose Expense Account, and then click Add.

- Still from the Available Columns list, select Liability Account, and click Add.

- Choose OK, and then double-click the payroll item you want to change.

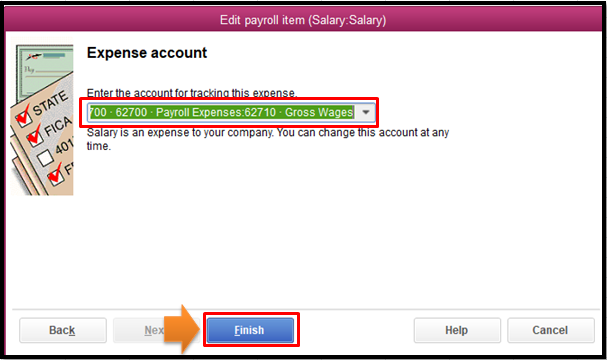

- In the Edit payroll item window, click Next until you reach the Expense Account or Liability Account drop-down list.

- Select the new expense or liability account, and click Next until you can reach the Finish button.

For more info about this, please check out this article: Change an expense or liability account associated with a payroll item.

In case your payroll items aren't calculating correctly in QuickBooks Desktop, you can use this handy resource for the steps on how to resolve them: Fix payroll items not calculating correctly.

I'm just a comment away in case you have additional questions about this. I'm always ready to help. Have a good one.