This isn't the kind of experience we want you to have in filing your 941 forms using QuickBooks Online (QBO) Payroll, @moodyautumn. With this, I'm here to guide you on the actions you need to take care of this issue.

Based on your description of this matter, it seems that you're using the QBO Full Service Payroll platform to file your forms and pay your taxes. Since they've filed your 941, you'll have to contact them to request an amended return to the IRS. You can reach them at the time of your convenience because they're available to serve you at any time and day.

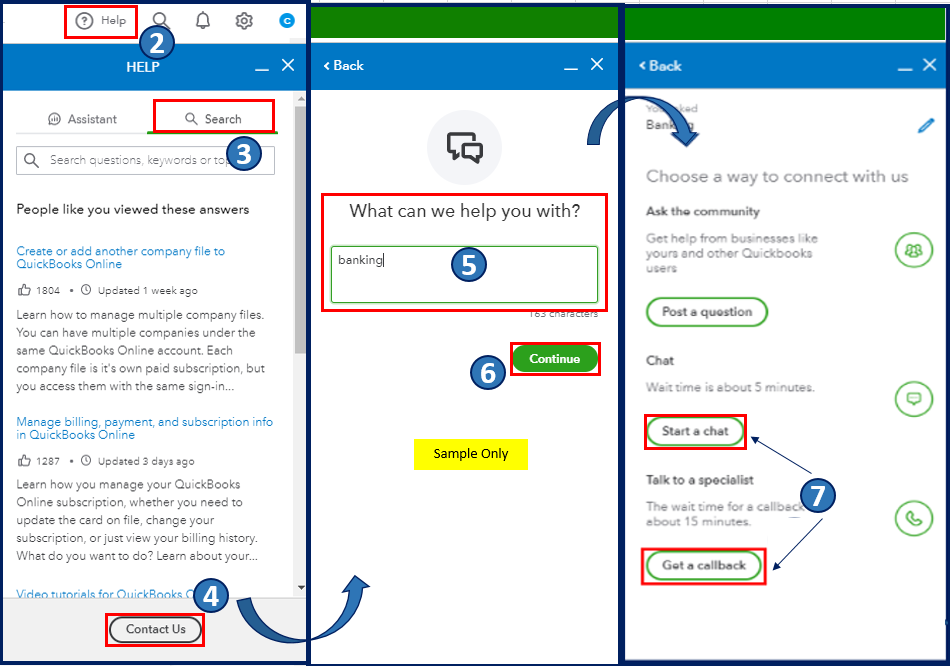

Here's how:

- Sign in to your QBO company.

- Go to the Help menu.

- Choose the Search tab.

- Click the Contact Us button.

- Enter your concern in the What can we help you with? field.

- Click Continue.

- Choose a way to connect either Start a Chat or Get a callback.

I've attached a screenshot below that shows the last six steps.

In the meantime, I'm adding these articles to know more about correcting errors made on your Form 941:

Please keep me posted on how it goes in the comments below. If You have other payroll concerns or inquiries about filing forms in QBO, I'm just around to help. Take care always.