Turn on suggestions

Auto-suggest helps you quickly narrow down your search results by suggesting possible matches as you type.

Showing results for

Connect with and learn from others in the QuickBooks Community.

Join nowHi there, @ERB1.

Thank you for reaching out to us here on the Community page. I can share with you some insights about preparing 1099s in QuickBooks Online.

Usually, payments to 1099 vendors made via credit card, debit card, or any third-party system such as PayPal are excluded from the 1099-Misc and 1099-Nec calculations. This is because the financial institutions will report these payments.

If the PayPal payments are added, please ensure to review the mapping of your accounts when preparing the form and exclude the PayPal expenses.

To learn more about what payments are excluded from the Federal 1099s, I recommend checking out this link: What payments are excluded from a 1099-NEC and 1099-MISC?.

For additional resources while preparing your 1099s in QuickBooks, you may also open this article: Create and file 1099s using QuickBooks Online.

If you have any other questions about your QuickBooks forms, please let me know by adding a comment below. I'm always here to help.

The credit card payments are being excluded but the Paypal payments are not being excluded. How can I get it to exclude the Paypal payments too?

Glad to have you back, @ERB1.

Excluding the PayPal payments from your 1099's can be done in just a few clicks.

You'll need to check the payments from PayPal and remove them from the mapping. You can create a 1099 Transaction Detail Report to identify the amounts paid and to which accounts.

Here's how:

This will allow you to map the accounts as you go through the 1099 process. You can also use the 1099 Contractor Balance Detail or 1099 Contractor Balance Summary reports if either of them add more information.

To give you more details about mapping and modifying your accounts for your 1099-MISC and 1099-NEC filing, please see this link: How to modify your chart of accounts for your 1099-MISC and 1099-NEC filing.

Lastly, to help you understand the categories of the payments for 1099's, feel free to scan through this article: Learn more about the boxes on Forms 1099-NEC and 1099-MISC.

Let me know how it goes by leaving a comment below. If you have other 1099 concerns in QBO, I'm just around to help. Take care always.

The payments by PayPal are on the same account as the payments by check and by credit card. The amounts paid by credit card are excluded but the amounts paid by PayPal are not excluded.

The Community has got your back, @ERB1.

You have to make sure that the account for PayPal is not included or excluded in the account mapping in 1099. Once done, refer to this step by step guide to prepare 1099 in QuickBooks: Create and file 1099s using QuickBooks Online.

For additional info, please see this link: Learn which payments should be excluded from the 1099-MISC and 1099-NEC form.

I also encourage you to visit our QBO Help page. From there, you can browse articles or get some ideas from other QuickBooks users and experts. This way, you'll get more insights that can help you with your accounting tasks.

Don't hesitate to post again here if you have further questions about preparing 1099 NEC in QuickBooks. I'll be around to help and provide answers to achieve your goal. Have a blissful new year and take care.

I'm having the same problem and your answer still doesn't resolve the problem.

Paypal payments are included in the same accounts as check payments. You cannot simply exclude the account. Mapping only maps the expense accounts.

Paypal is considered a credit card under Payment methods so any of those payments should not be pulled when preparing 1099s.

How do we resolve this?

I'm here to help exclude the PayPal payment when preparing 1099s, @serahrose.

To remove the PayPal payments from your 1099, you'll want to change the transaction category that isn't included in the mapped category of Box 7. However, before doing this, I'd suggest consulting your accountant or tax preparer if it's advisable to exclude those amounts. Here's how to change the category:

Just in case you want to learn more about the payment categories for the 1099-MISC and 1099-NEC, feel free to check out this article:

Should you need any assistance preparing your 1099s, I'm available here to help any time!

That does not answer the question.

Thanks for getting back to us here in the Community, @serahrose.

You're right. Payments made via third party system, such as PayPal, shouldn't be included in the 1099-MISC and 1099-NEC calculations. There's a need to further investigate what's causing this unusual behavior of the QuickBooks Online (QBO) system. With this, I'd recommend contacting our Customer Care team. They can securely pull up your account and guide you with a fix.

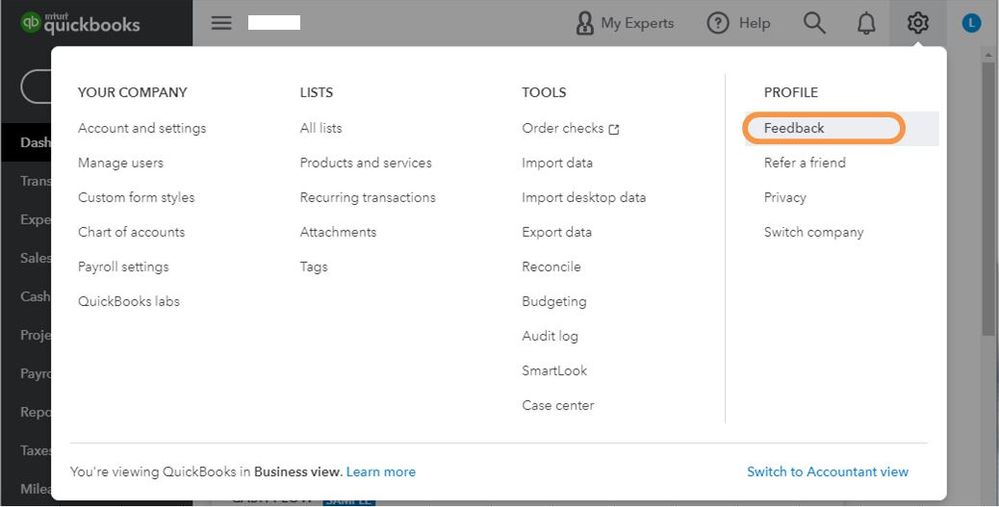

In case you want to talk to one of our representatives to relay this matter, you need to request a callback. You'll first have to check out our support hours to ensure we can assist you on time. Here's how:

I've attached a screenshot below for your reference.

I'm also adding this article to learn more about filing 1099 forms: 1099 FAQs. It includes answers to the most frequently asked questions about 1099-NEC, 1099-MISC, and 1099-K forms.

You're welcome to comment below if you have other 1099 concerns in QuickBooks or inquiries. I'm just around to help. Take care always.

Thank you for clarifying. I was in contact with customer support on Monday who spent a long time on the phone with engineering. Unfortunately, I have not heard back. I have a client with about 250 1099s and now I will need to manually adjust all the amounts after looking at each individual vendor to make sure no paypal payments have been pulled in. Given the nature of this bug and the IRS deadline, I'm disappointed that no one from customer service ever got back to me about fixing this.

I wish I could make it, even more, better, serahrose.

Our Customer Care Support may sometimes unable to initiate a callback as scheduled due to the volume of calls within the day. With this, I'd also recommend getting back to them if you still didn't receive the promised call within a day or two. Rest assured, we're all doing the best we can to cater to all your needs.

For your reference, you can read this article so you'll be guided with the IRS requirement for Merchant Processing.

Feel free to let us know if you have any other concerns. We're always here to help you anytime.

I ran into this same issue for my 2021 1099's and none of the above "solutions" worked for me. Through some last ditch efforts I finally found the solution... ENTER THE WORD "PAYPAL" IN THE REF. FIELD and voila...the payment is now excluded from 1099.

If we had the reference field in the bank feed, this fix would be great. But it isn't there and then requires going into the transaction itself to enter. So it causes double entry. Ugh. This is a known issue that QB should have been doing a fix for LONG ago.

Hi, @CDWhite.

Thanks for sharing your thoughts. Having a reference field in the bank feed would be helpful. This would help save data time entry as you won't have to go to the transaction itself and enter "PayPal" in the reference field to exclude it from 1099. Rest assured that I'll relay this message to our team in concern here on my end and add your vote for this one

You can also share your thoughts and ideas through your account. Our product development team reviews all the feedback we receive to ensure we’re meeting the needs of our customers.

Here's how:

For your reference, check out this link: How to Submit Feedback.

Additionally, here are some resources that will help you in managing your bank feeds:

I'll be sure to keep a lookout for any updates on this. Please let me know if there's anything you need help with. We're always here to assist. Take care always, @CDWhite!

You have clicked a link to a site outside of the QuickBooks or ProFile Communities. By clicking "Continue", you will leave the community and be taken to that site instead.