You've come to the right place, @user59778.

In QuickBooks Online Payroll, we can only use one bank account when paying employees. If you need to track cash tips in the petty cash account, you can transfer the funds from petty cash to the actual bank that you use to pay your payroll expenses.

Here's how:

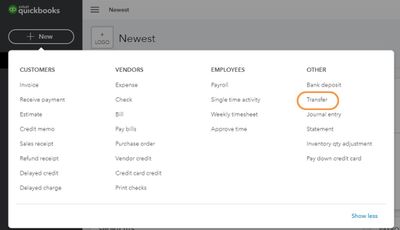

- Go to the +New menu.

- Select Transfer.

- In the Transfer Funds From drop-down, select the petty cash account.

- Select the bank account you use to pay your expenses in the Transfer Funds To drop-down.

- Enter the transfer amount.

- You can enter other details in the Memo field.

- Select Save and close.

I've added some articles that I'm sure you'll find helpful regarding cash and paycheck tips:

Should you need further assistance recording cash tips in QuickBooks, please don't hesitate to comment below. I'm always here to help.