Hi there, @LaurieL.

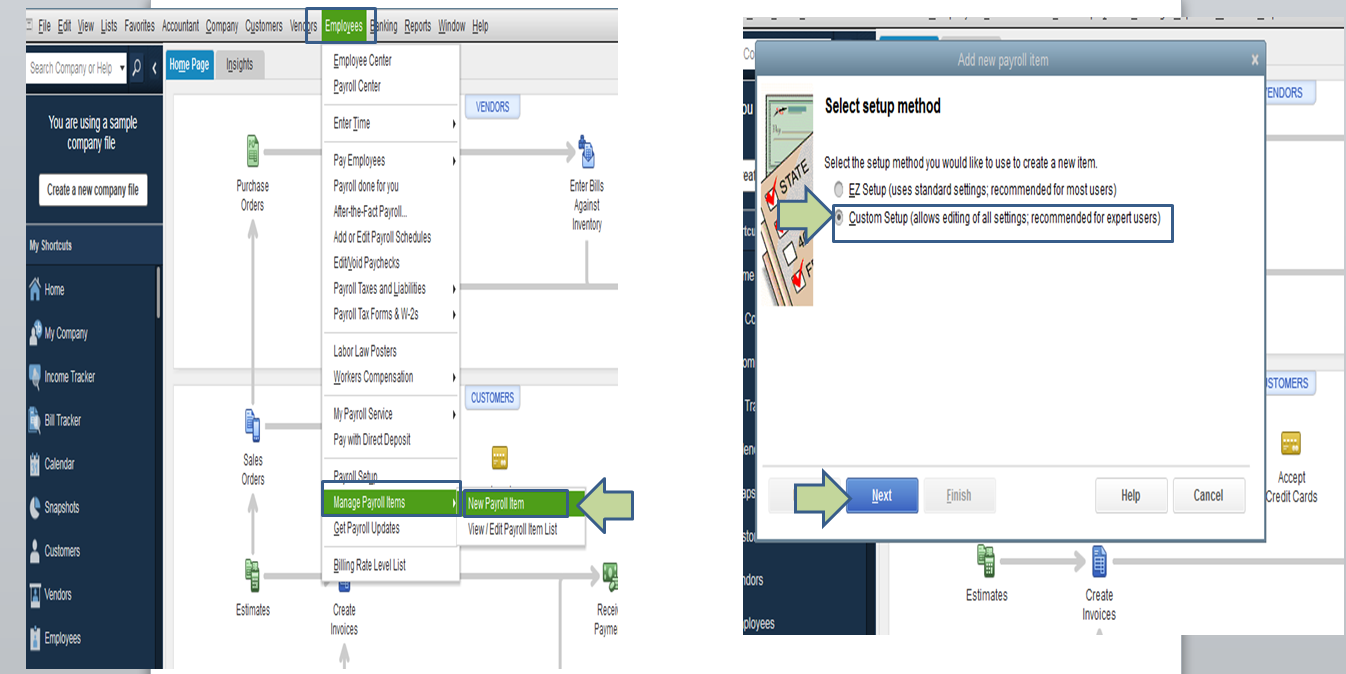

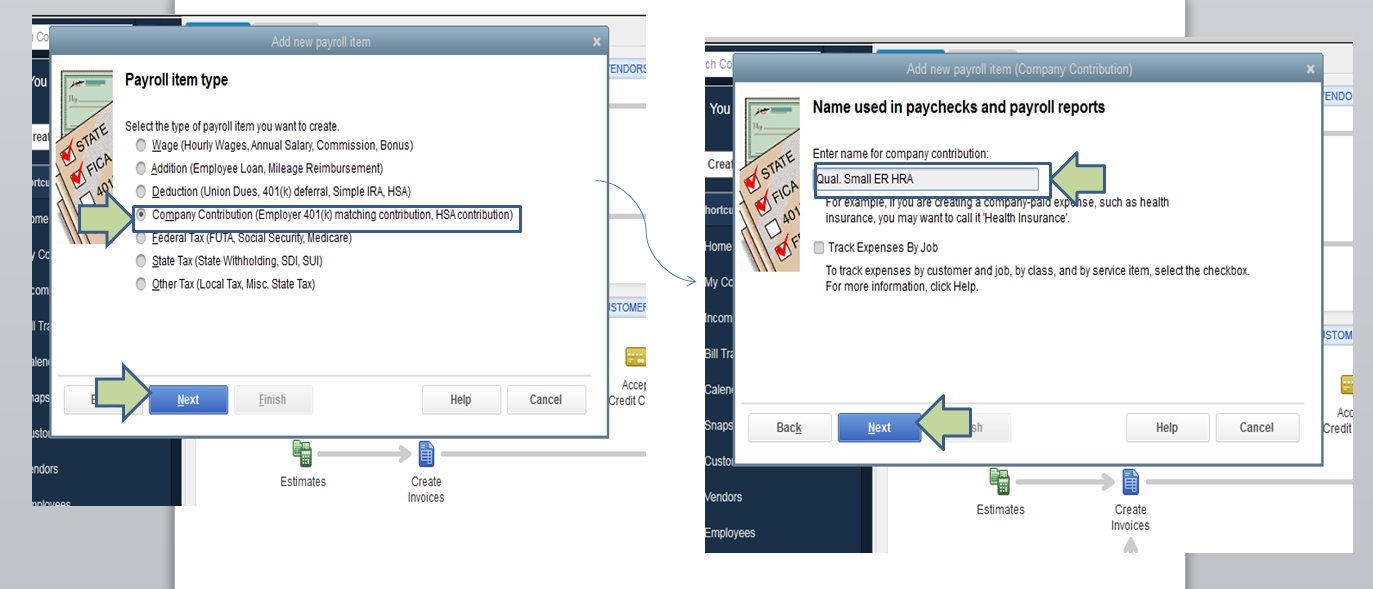

Let me help set your payroll item for the new QSEHRA.

When setting up the new tax tracking type for this item, you'll need to select the Qual. Small ER HRA. Any amounts tracked with the new tax-tracking type will be reported as required on Box 12 of Form W-2 code FF, beginning with tax tear 2017.

For more details on how to set up the QSEHRA in payroll, please click on this article link: Qualified Small Employer Health Reimbursement Arrangements.

I've attached some screenshots below for your reference.

As always, you can contact our Payroll Support if ever you need assistance in going through with the steps.

I'll be here to help if you have other questions about the new QSEHRA. Have a good one.