I can share some information about adding deductions in your QuickBooks Online (QBO) account, @SLNP.

Once you’ve added the deduction to your employee’s profile, QBO automatically calculates it when running payroll for that employee.

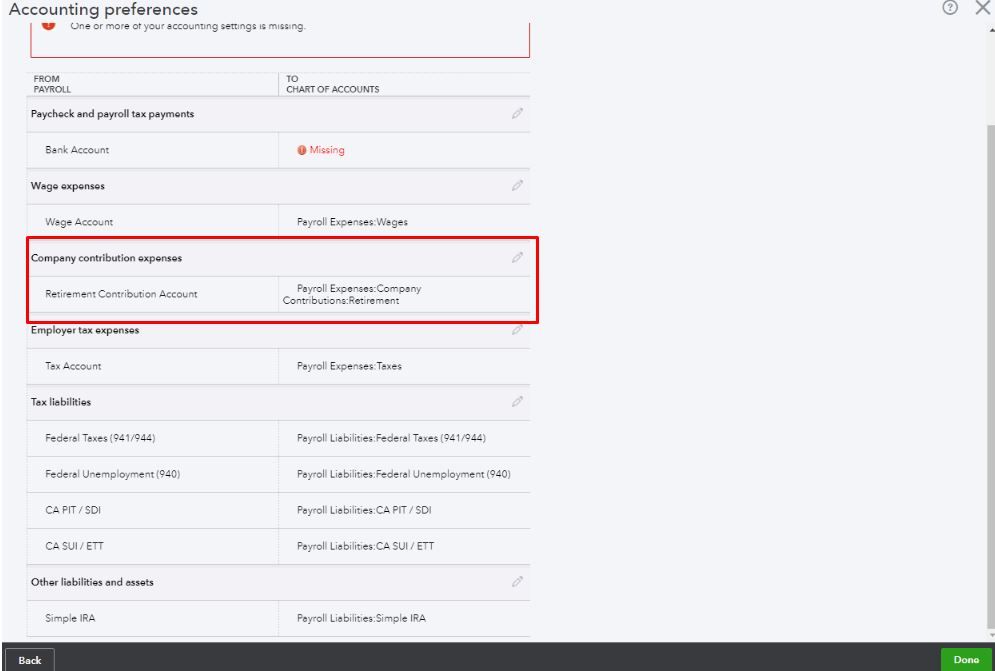

The amount will also be shown on the account you choose on where the payroll transactions will be posted. Let me show where to check it in your QBO account:

- Go to the Gear icon.

- Select Payroll settings.

- From the Accounting section, you’ll see which account your payroll transactions will be posted.

If you wish to change the account:

- Click the Edit (pencil) icon.

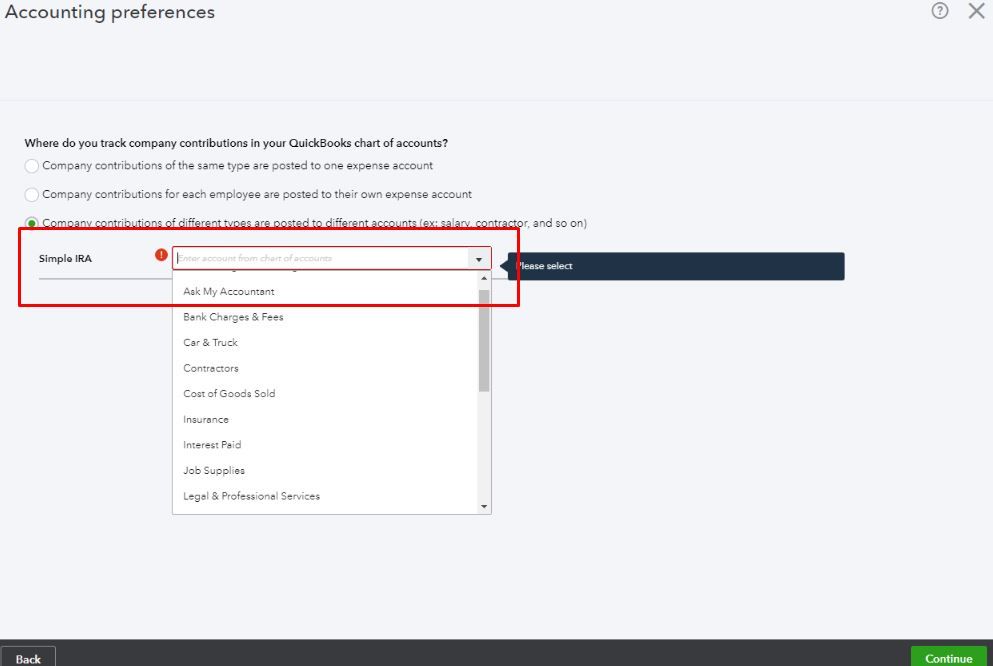

- From the Company contribution expenses, click the Edit (pencil) icon.

- Select the account you preferred. If you’re unsure what account to choose, you can refer to your accountant for guidance.

- Click Continue and then Done.

You might also want to check this link to learn more about setting up Simple IRA in QBO: Set up a payroll

item for retirement benefits (401(K), Simple IRA, etc.).

Let me know if you need further assistance running payrolls in your QBO account. I’ll be glad to lend a hand. Keep safe and always stay healthy!