Thanks for reaching out to us here, @Leslie37.

I'll share the steps on how you can resolve your third-party sick pay withholdings. You'll want to make sure you're using the correct tax tracking type of your third-party sick pay payroll item.

Here's how to check:

- Go to Lists at the top.

- Select Payroll Item List.

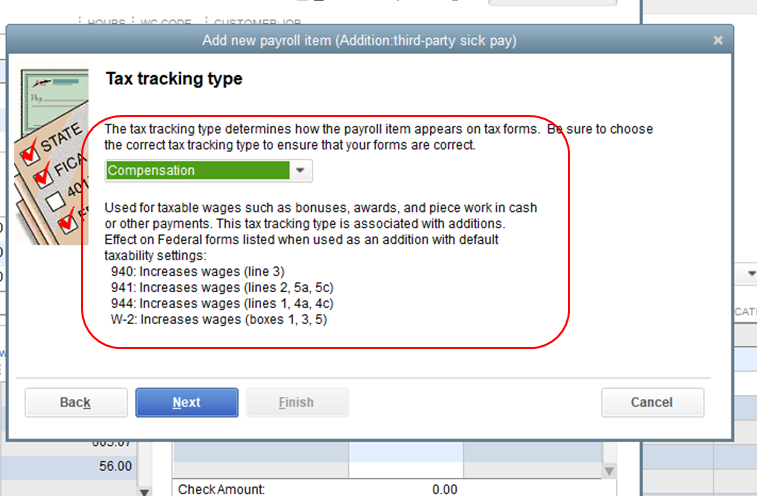

- Double-click your third-party sick pay addition item. Then, hit Next two times until you reach the Tax tracking type section.

- Make sure to choose Compensation on the drop-down. Tick Next until Finish.

Here's how it looks like:

After that, go back and check your form again. Please refer to this guide for the step-by-step instruction, just scroll over to Scenario 2: Third-party withholds, employer submits W2: Track and submit taxable third-party sick pay.

If you need help with other payroll tasks, you can browse for specific topics here and look for responses that fit your concern.

Keep me posted if you still have questions or concerns with payroll. I'm always here to help. Take care and have a lovely day ahead.