Happy to help out here, @root69.

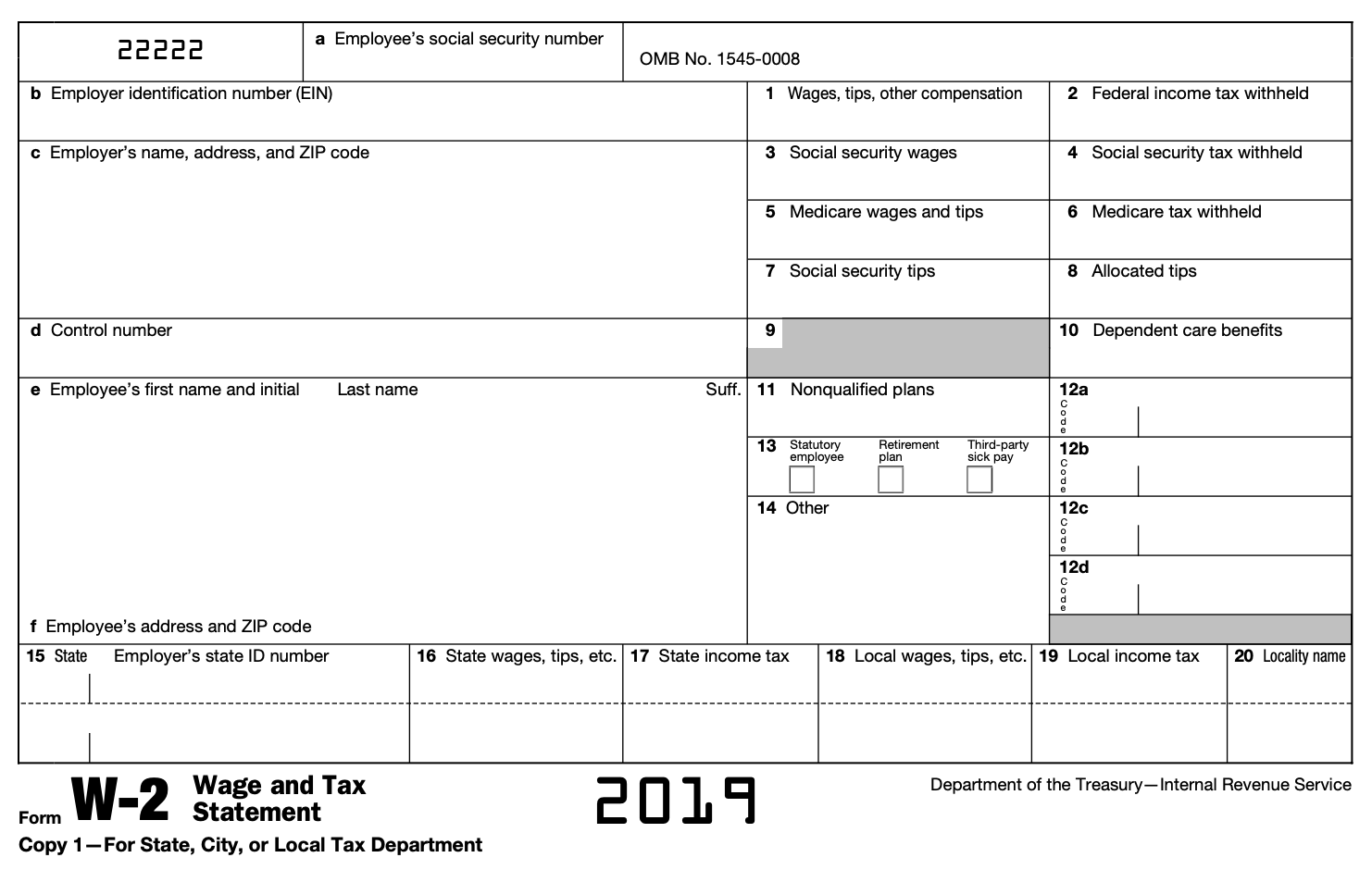

The IRS requires employers to report wage and salary information for employees on Form W-2. Your W-2 also reports the amount of federal, state and other taxes withheld from your paycheck. As an employee, the information on your W-2 is extremely important when preparing your tax return. To insure you have it in time, the IRS requires your employer to send you a W-2 no later than January 31 following the close of the tax year, which is usually December 31.

You should only receive a W-2 if you are an employee. If you are an independent contractor or self-employed, the work you do may be the same as an employee, but you will receive an earnings statement on a Form 1099 rather than a W-2.

I recommend checking out this page from the IRS for more information.

Let me know if you have any other questions. I'm happy to help out. Have a good one!