Turn on suggestions

Auto-suggest helps you quickly narrow down your search results by suggesting possible matches as you type.

Showing results for

Connect with and learn from others in the QuickBooks Community.

Join nowThere are different time-off policies, mandy24.

You can set up how many hours they can accrue for the whole year, per hour, or per pay period. There's also an option to enter maximum hours.

If you set up your employee to have unlimited hours, you can enter how many hours your employee will get paid for their PTO every time you run payroll. Meaning, they don't accrue those hours.

To change the policy, here's how:

Let me know if you have other questions. I'll be glad to answer them for you.

I went into the employee's overview, I changed their PTO to reflect what they should have with what they might have had as a carry over from 2020. When I printed their 1/14/21 paystub, it only shows their carry over from 2020.

Some employees receive their PTO all on 1/1/21 and some receive bi weekly pay periods.

Thank you

Thanks for sharing the details you’ve done to fix your issue, @Pat F.

Let me direct you to the right support available so this gets taken care of. I recommend contacting our Support team. They have the tools to securely check your account and investigate the reason why your employee’s pay-stub is showing incorrect data when printing.

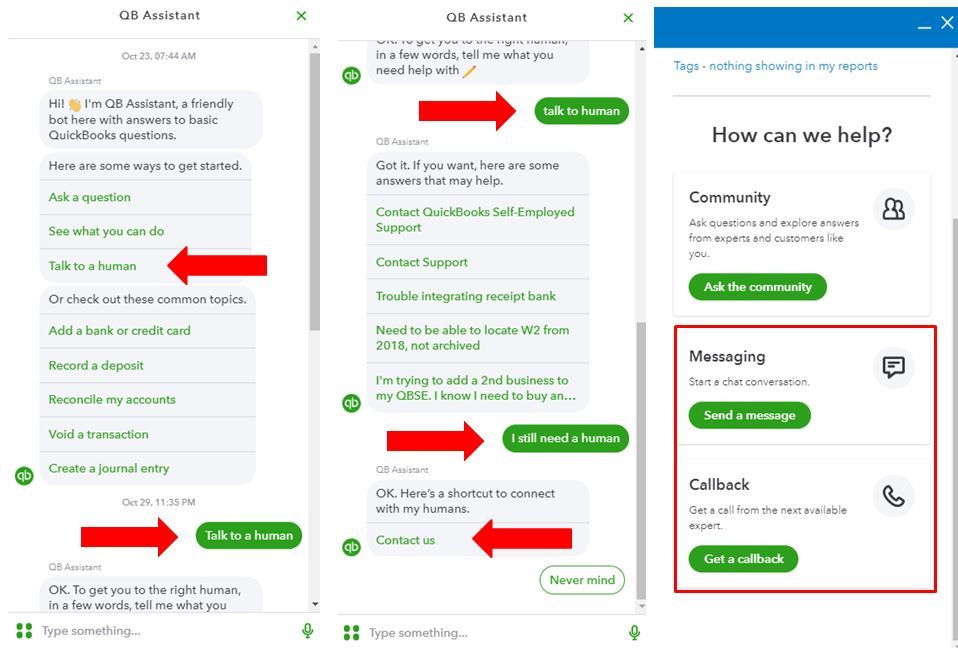

To reach out to them, you can follow these steps below:

Ensure to review their support hours to know when agents are available through this link: QuickBooks Online Support.

You might also want to invite your employees to view their paycheck online This way, you won’t have to print their pay-stubs manually. You can refer to this article for the complete guidelines: Invite your employees to QuickBooks Workforce to see pay stubs, W-2s and more.

Let me know if there’s anything else you need help in managing your employee's paystubs or with your account. Keeping you in working order is my top priority. Keep safe and keep well.

You have clicked a link to a site outside of the QuickBooks or ProFile Communities. By clicking "Continue", you will leave the community and be taken to that site instead.