Hi there, @tolbertd.

Thank you for reaching out to the Community. I can help you check why the federal withholding taxes are not deducted into your employees' checks. We'll need to revisit the employees' profiles are set up correctly. QuickBooks calculates the federal withholding based on these factors:

- Taxable wages

- Number of allowances/dependents

- Pay frequency

- Filing status

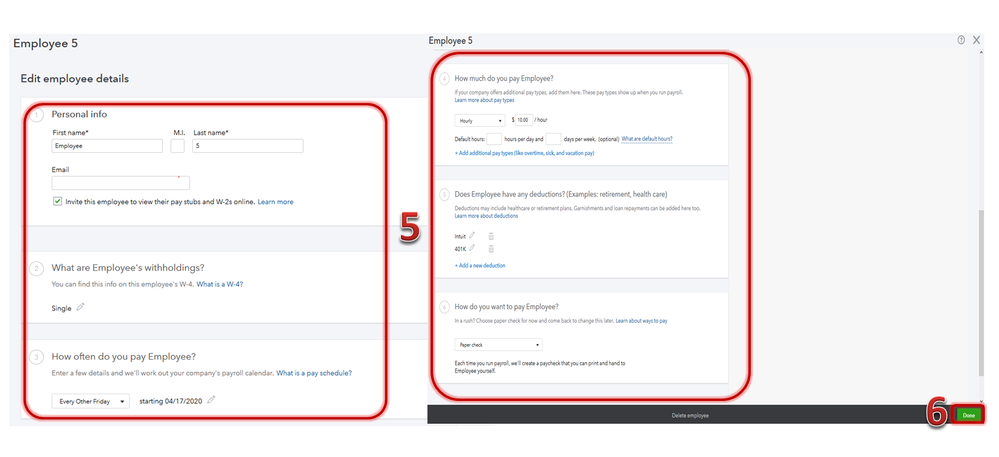

To review your employees’ payroll information, here’s how:

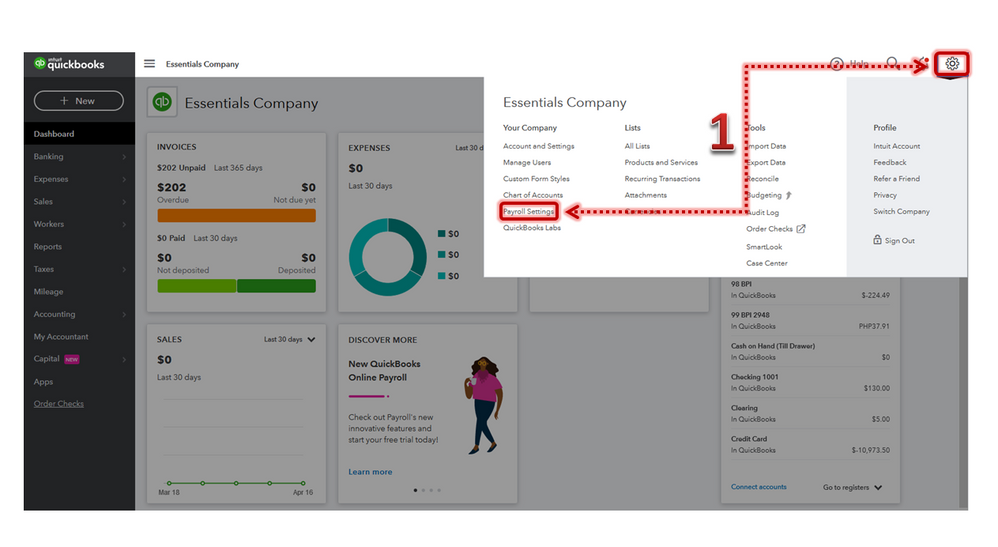

- Click the Gear icon, then choose Payroll Settings.

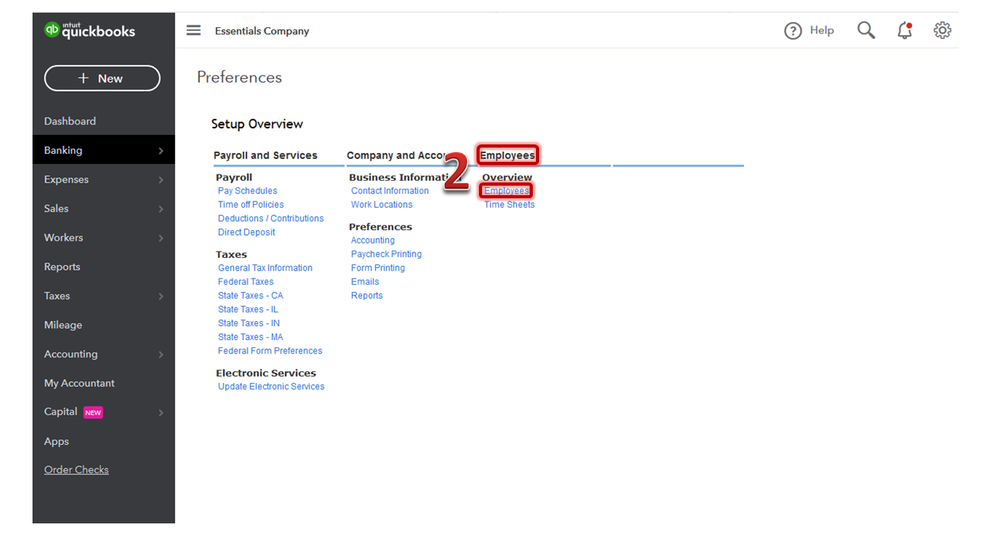

- Under the Employees tab, tap Employees.

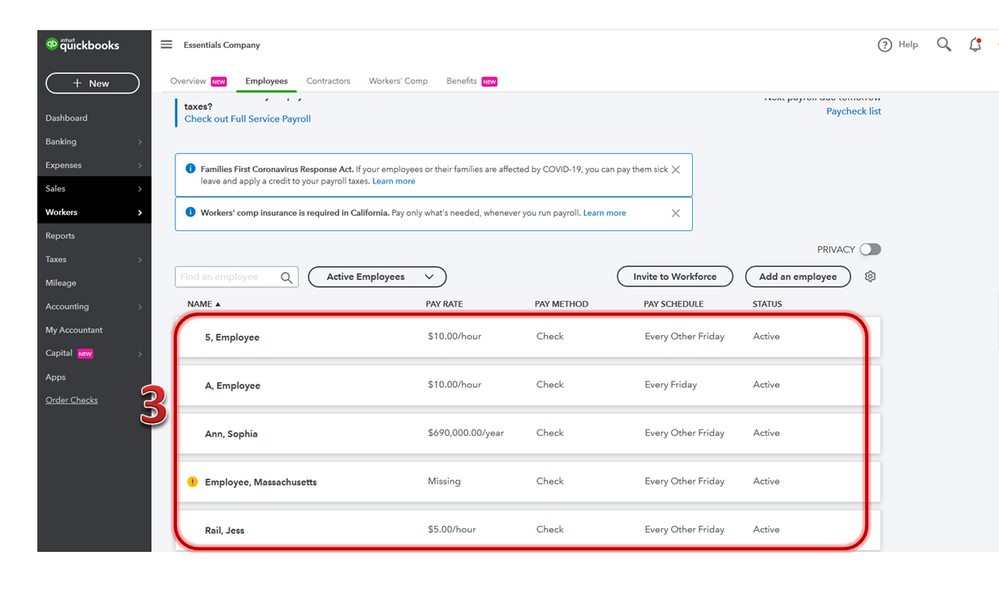

- Press the Employee's name.

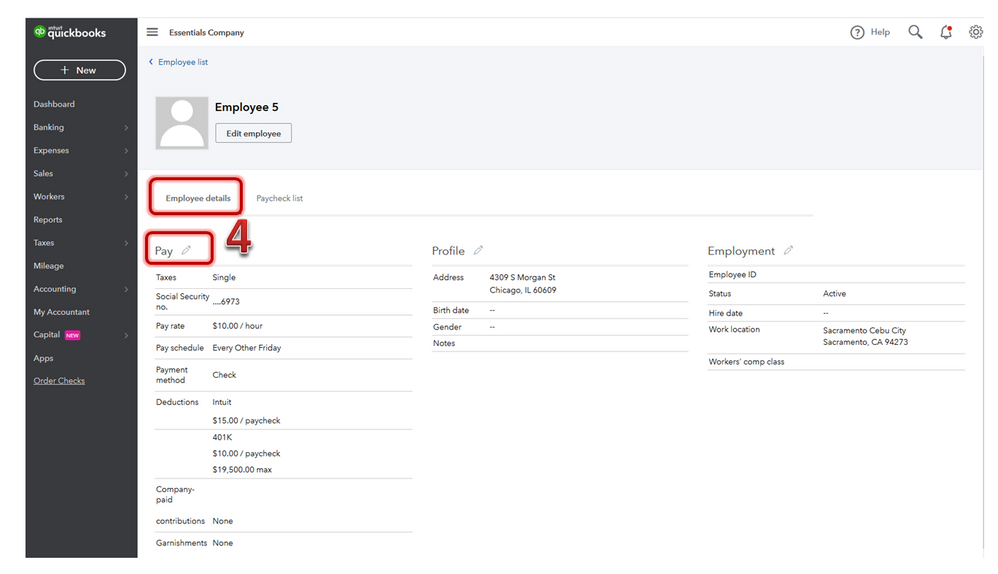

- From the Employee details tab, hit the pencil icon under Pay.

- Please make sure that all information is correct.

- Click Done once finished.

That's it. To help you figure out about withholding amount calculation, you can go through the IRS 2020 Publication 15.

Feel free to click the Reply button if you have other questions about federal withholding in your employee’s paycheck. I’m always here to lend a hand. Have a great day!