Turn on suggestions

Auto-suggest helps you quickly narrow down your search results by suggesting possible matches as you type.

Showing results for

SALE EXTENDED 70% OFF QuickBooks for 3 months* Ends 12/8

Buy nowWe have not filed Quarter 1 Form 941 or state payroll reports, but none of them are showing in Action Needed.

Hello, Chris.

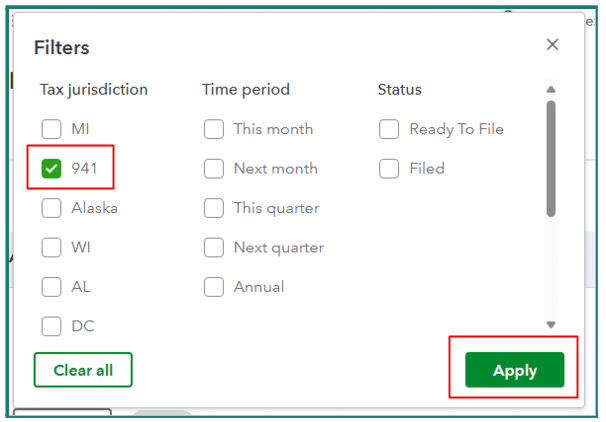

We can start by checking the filter settings in the Payroll Tax Center to ensure the 941 form is visible. Let me provide the steps on how this works.

Additionally, we can verify if the filing frequency is correctly set up to ensure that the forms are scheduled to appear at the right times. Here are the steps to check and ensure the filing frequency is properly configured:

For more detailed information about checking the Payroll Tax Center and verifying the filing frequency, you can refer to these articles:

Moreover, you can run a payroll summary report, which gives you the total payroll wages, taxes, deductions, and contributions.

After filing the 941 form, you can either download it or print it for your records. If you need further assistance, feel free to click the Reply button, and we'll respond to you as soon as possible.

941 is not showing up under tax jurisdiction in the filters. All it shows is WA. I have checked all of our settings and everything looks correct. I think last quarter I clicked something saying to have Quickbooks file it for me, but I don't see that option, nor do I see where it may have been filed for me this quarter.

Thanks for bringing this to our attention, Krenray. It sounds like this might require a closer look. Our phone support team is equipped to handle these types of situations. They can screen-share with you and investigate in real-time.

We recognize the importance of your Form 941. To help you further with your concern, I recommend contacting our QuickBooks Live Support team. They are fully equipped to assist you with any immediate questions or concerns to ensure they are addressed promptly and efficiently.

Here's how to connect with them: Your concern will be addressed promptly and efficiently.

Here's the best time to contact:

QuickBooks Online Payroll (Core, Premium, Elite)

Furthermore, you can create payroll reports, allowing for a detailed review of employee compensation and contributions, which is crucial for accurate tax preparations.

Moreover, this article is designed to simplify your payroll procedures and improve your user experience with the QuickBooks platform: Set up and manage payroll schedules.

Being your QuickBooks support partner, we are committed to helping you with any questions or assistance needed with your Form 941. I will keep an eye on this thread for any future communications.

You have clicked a link to a site outside of the QuickBooks or ProFile Communities. By clicking "Continue", you will leave the community and be taken to that site instead.

For more information visit our Security Center or to report suspicious websites you can contact us here