Turn on suggestions

Auto-suggest helps you quickly narrow down your search results by suggesting possible matches as you type.

Showing results for

Connect with and learn from others in the QuickBooks Community.

Join nowThanks for checking this with us, @kathrynhollis195,

You will get the message "This form will be available soon. Please check back later." if a form is temporarily blocked. At the moment, our engineers are validating the accuracy of our forms which is why some of them are unavailable for filing and paying.

Rest assured, the 941 return for Quarter 2 will be available after the maintenance. For more information about this, please see the following link: Unavailable forms for QuickBooks Online.

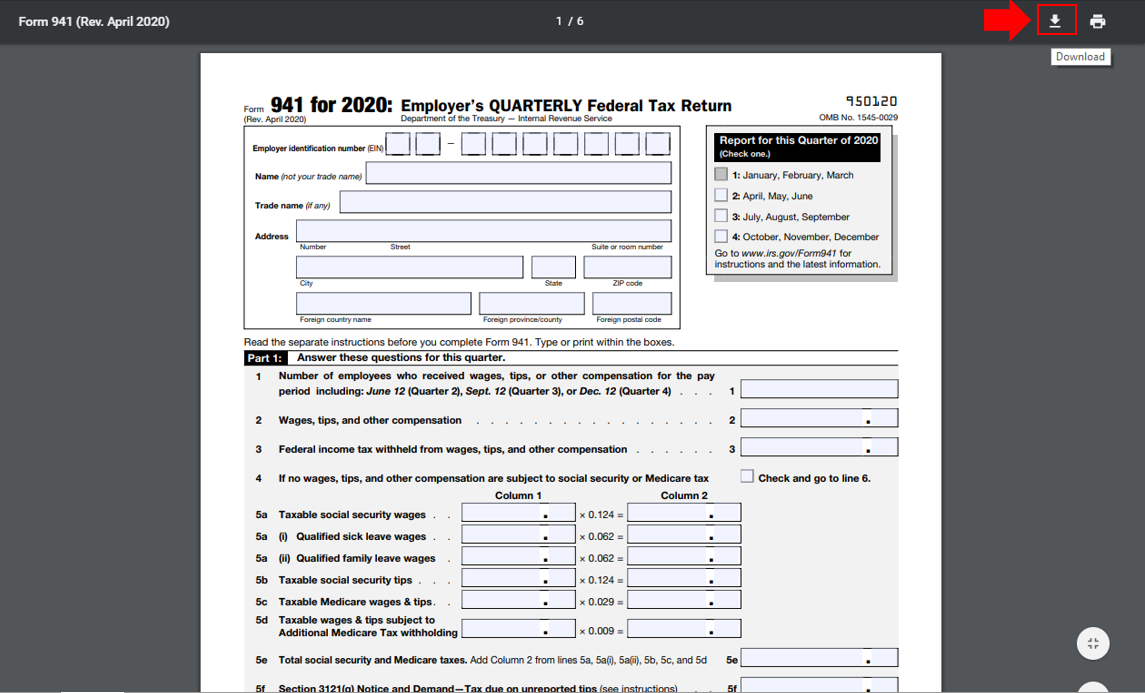

As a workaround, you can go to the IRS website and manually fill out a 941 return. This way you can print or download the form then mail it to the Federal Agency. Follow the steps below:

Let me know if there's anything else I can help you with. I'll be right here to help. Have a safe week ahead!

Your answer to this is to do it manually? What's the problem. The form has been available since April. The Quickbooks Desktop programmers got it ready. What's up with IOP? It's 7/820. Everyone has a lot of these returns to file & you suggest that instead of IOP providing the forms we should do them manually. That's pathetic.

I understand the importance of being able to file the form seamlessly, @davistax.

QuickBooks and our engineers are now diligently working to provide the form as quickly as possible so customers can file it through QuickBooks. While they're finding a fix, you can follow the steps suggested by Jen_D above to download the form and mail it to the agency. I also encourage reaching out to our Support Team and have them attach your case to INV-45584 so they can add your account information to the notification list.

To contact support, tap on Contact us from the Help menu.

For additional reference about filing quarterly forms, feel free to read this article.

Please extend your patience while we're working on the fix of the issue. As always, leave a comment below if you have any other questions. I'm a few clicks away to help. Have a good day!

Perhaps, the engineers should have been working on it diligently before this as the QB desktop engineers apparently did.

Your suggestion to manually do the 100+ 941's that we have to prepare is evasive & condescending, a typical response that you get from Intuit on a continual basis.

Poor support, and just sad, by a company with such resources.

Now I try to go back in the desktop version and I get a mesage to download and file by hand. What is up with the 941 QB.

Welcome to the thread, @meyertax.

The error you've encountered happens if the 941 has 0 wages or no employees. Since QuickBooks doesn't allow it for e filing and needs to file manually.

However, if you have reported wages for the quarter, you'll want to start updating QuickBooks Desktop to its latest release. Here's what you'll need to do:

Once done, proceed by downloading the latest tax table update:

You can consider checking out these articles for more detailed steps:

After that, try to file 941 again. Check to see if everything is now working fine.

Leave a comment below if you have other payroll questions. I'm here to answer it for you. Have a great day!

**Say "Thanks" by clicking the thumb icon in a post.

**Mark the post that answers your question by clicking on "Accept as solution".

I HATE not being allowed to talk to a human!!!!!! I am unable to print my 941 for the 2nd quarter. It still says form available soon. Does the IRS know we can't file? Are they willing to wait? Can't e-file my CA DE 9 or DE 9C either. Are they aware of this issue? Will Quick Books be paying our penalties for being late? Give us a phone number! This is ridiculous!

Thanks for taking the time to post here and letting us know what's going on.

Let me share some information on why you're unable to file the 941 form for Quarter 2. At the moment, we're still unable to release the return because it hasn't been finalized by the Internal Revenue Service (IRS).

The IRS has released changes on the 941 for quarter 2, 2021. Hence, the cause why you're unable to file it online at the moment. Here are some updates being worked on:

To learn more about the changes, see this IRS publication link: https://www.irs.gov/pub/irs-dft/i941--dft.pdf

You can also check out this article to see what has been added or updated on the form 941.

We understand the urgency of getting your forms filed on time. Rest assured, once the updates are official, the system will automatically roll it to all payroll accounts. By then, you can submit it without any issues or alerts.

If you want to get updated on this issue, you can request our agents to add your account to the notification list. Here's how to contact us:

To ensure we address your concern on time, check out our support hours.

This thread will remain open for additional questions and updates. If you have any further questions about filing payroll forms in QuickBooks, please tag me anytime. I'm always right here to help you.

You have clicked a link to a site outside of the QuickBooks or ProFile Communities. By clicking "Continue", you will leave the community and be taken to that site instead.