Turn on suggestions

Auto-suggest helps you quickly narrow down your search results by suggesting possible matches as you type.

Showing results for

Connect with and learn from others in the QuickBooks Community.

Join nowHello,

Double check your employee setup. If their address are in those states then you may have been collecting taxes that need to be submitted to those states.

Welcome to the Community, Pinebeach.

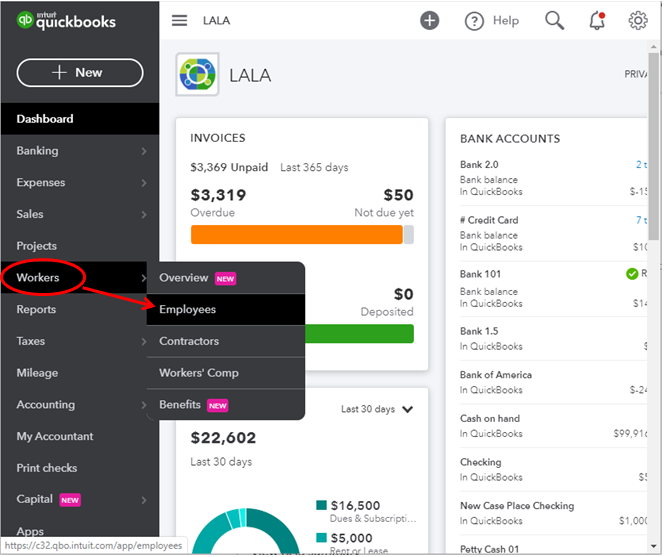

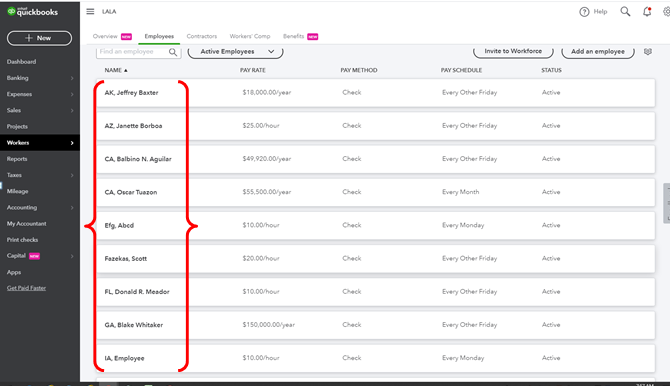

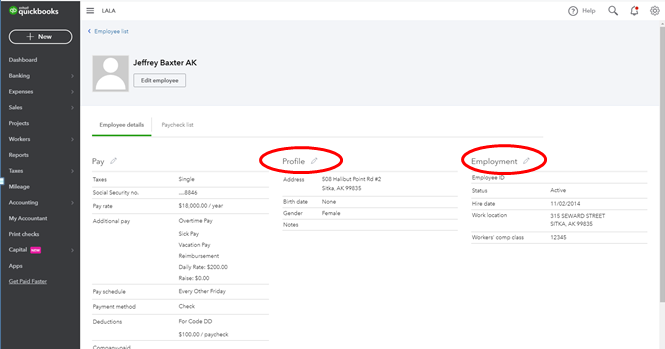

I'm here to share some insights about multistate situations in QuickBooks Online. QBO generates the forms and taxes based on the employees’ residence and work locations. It could be that these are included as forms you need to file since you have employees initially set up under these states. You'll want to check if this might be the case. Here's how:

You can learn more information about multistate employment payroll situations in this article.

If you have any other concerns, please add a comment below. You got me here to help you out.

Sounds like this is the solution. Thank you. However, is there any type of search function that would help me zero in on the Employee(s) that have out of state addresses as I have hundreds of employee records dating back 20 years.

Thank you again!

Glad to see you back, Pinebeach.

Yes there is a way to lessen the numbers of your employees on that state addresses. To do that, you can change the status to terminated. Here's how.

I added this screenshot on how the page looked like.

Also, I suggest to work with your accountant to verify the prompt of the Quarterly taxes from those states and review the help article provided by my colleague GlinetteC.

Count me in if you need anything else. I'll be a few clicks away. Stay safe.

You have clicked a link to a site outside of the QuickBooks or ProFile Communities. By clicking "Continue", you will leave the community and be taken to that site instead.