How to use the Accountant's Copy

by Intuit•4• Updated 1 year ago

Learn how to use the Accountant's Copy in QuickBooks Desktop.

An Accountant's Copy is the way to go if you need your accountant to review your books, You can continue to work on your company file at the same time. With the Accountant's Copy file transfer service, the file is saved on an Intuit server, where you can exchange data securely with your accountant.

You’ll need to make sure your accountant’s QuickBooks version matches your QuickBooks Desktop or Enterprise version. For example, if you have QuickBooks Desktop Premier 2022, your accountant needs QuickBooks Desktop Accountant 2022 to open your Accountant's Copy.

Note: QuickBooks Desktop and Enterprise 2024 offer best-in-class data security, which is higher than in QuickBooks Desktop or Enterprise 2023 and older. Accountants can’t update client company files into QuickBooks Desktop 2024. You’ll either need to use the older version of QuickBooks Desktop Accountant or have your client update their file to QuickBooks Desktop 2024, then send a new accountant’s copy.

The Accountant's Copy workflow

There are two workflows you can follow.

- Manual workflow -

- You and your accountant can exchange Accountant's Copy file via:

- a USB drive

- email attachment

- or shared through a cloud service like Box.

- You can send back the updated version in the same way. Check out on how to create an Accountant's Copy for specific details.

- You and your accountant can exchange Accountant's Copy file via:

- Accountant's Copy file transfer (ACFT) workflow -

- The ACFT service lets you and your accountant exchange Accountant's Copy files through Intuit's secure server.

Check out how to create an Accountant's Copy for more info on how to create and share an Accountant’s Copy.

Accountant's Copy limitations

Here's what you can and can't do with an Accountant's Copy.

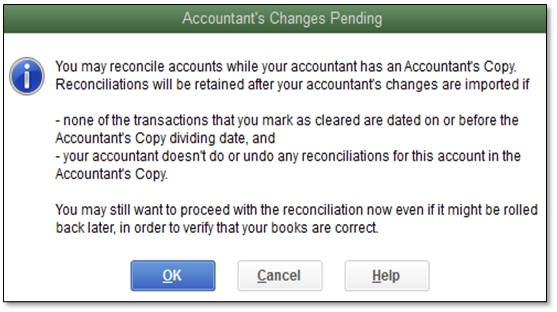

Limitations for clients

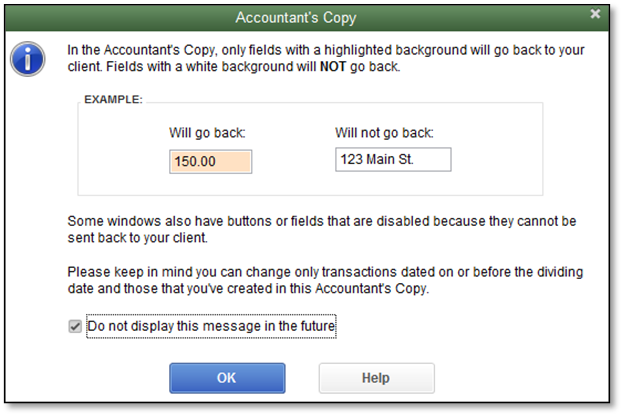

Limitations for accountants

The Essential Accountant's Copy Guide

This article is part of a series about Accountant's Copy in QuickBooks. To learn more, check out the following articles:

More like this