Understand QuickBooks Online customer financing options

by Intuit•303• Updated 6 days ago

Learn about the QuickBooks Online customer financing options.

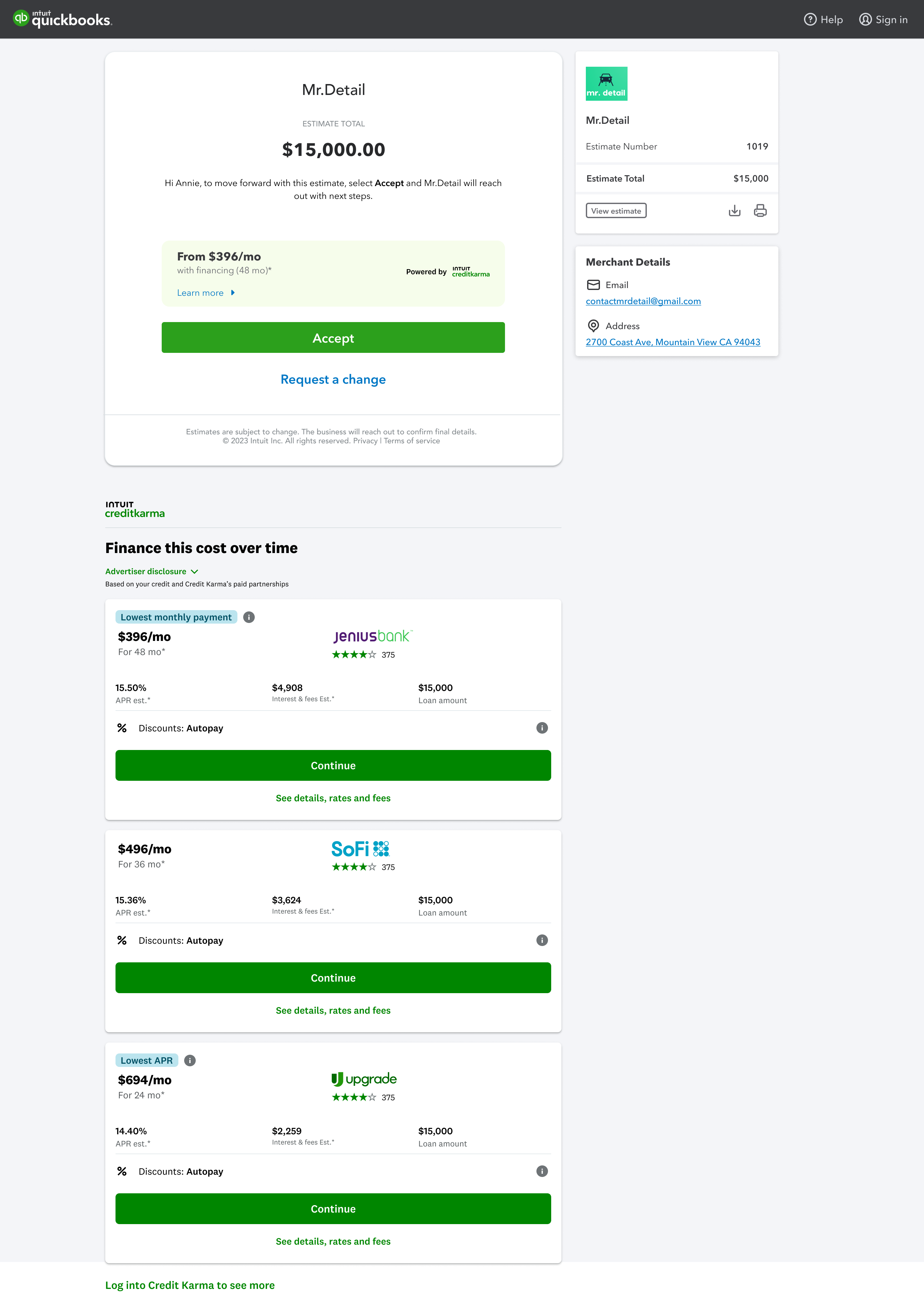

QuickBooks Online now offers customer financing options for consumers. You can now view custom financing options alongside the estimates you send.

Businesses that offer customer financing options allow customers to pay for the service over time. This increases the chance of turning an estimate into a job. There’s no cost to your business. Your customer pays a competitive Annual Percentage Rate (APR) to the lender they select. This is based on credit approval via Intuit Credit Karma’s marketplace.

Learn about customer financing options

- Customer financing options are only available to United States consumers via the Intuit Credit Karma Marketplace. We’re working to extend financing options to businesses in the future.

- Offering customer financing options is available at no additional cost to your business.

- QuickBooks has partnered with Credit Karma to offer flexible financing options to your customers. Credit Karma is a marketplace that brings together lenders to offer consumer financing. Your customers can apply for financing from these lenders.

- Your customer will receive funds from the lender, then they may use the funds received to pay for your service.

- Financing lets the customer pay for the service in regular monthly payments for a set time. These payments include interest and principal.

Enable customer financing option

Customer financing options are enabled by default for companies using QuickBooks Online. To manage the setting:

Note: Customer financing options aren't available for invoices today, as it can take several days for financing funds to be received by the customer / borrower.

- Go to Settings

, then select Account and settings.

- Select Sales.

- In the Financing section, select Edit ✎.

- Turn on the Customer financing switch.

Note: This turns on financing options for all estimates over $1,000 sent by your company. To opt-out, turn off the Customer financing switch. - Select Save, then select Done.

When creating an estimate, you’ll see a switch turned on when the estimate is greater than $1,000.

More like this

- Assess finance chargesby QuickBooks

- Understand customer surveysby QuickBooks

- What is QuickBooks Capitalby QuickBooks

- Use the Finance AI for financial insightsby QuickBooks