Refund sales tax

by Intuit•39• Updated 2 weeks ago

Learn how to refund sales tax collected from customers who are exempt from paying tax.

When conducting a sale there are times when you can accidentally charge sales tax to a customer who is tax exempt. In these situations, the correction will depend on whether the bill has been paid or not.

- If the invoice has not been paid yet: You can edit the invoice or sales receipt.

- If the invoice has been paid already: You have to refund the customer for the sales tax they were charged.

In this article we'll show you how to issue a refund to a customer who has already paid their invoice.

For a better experience, open this article in QuickBooks Online. Launch side-by-side view

Issue a refund

If the invoice has already been paid, you'll need to issue a refund.

- Select + Create.

- Select Refund Receipt.

- Select the same customer that needs to be refunded, then the bank account from which the refund will come from.

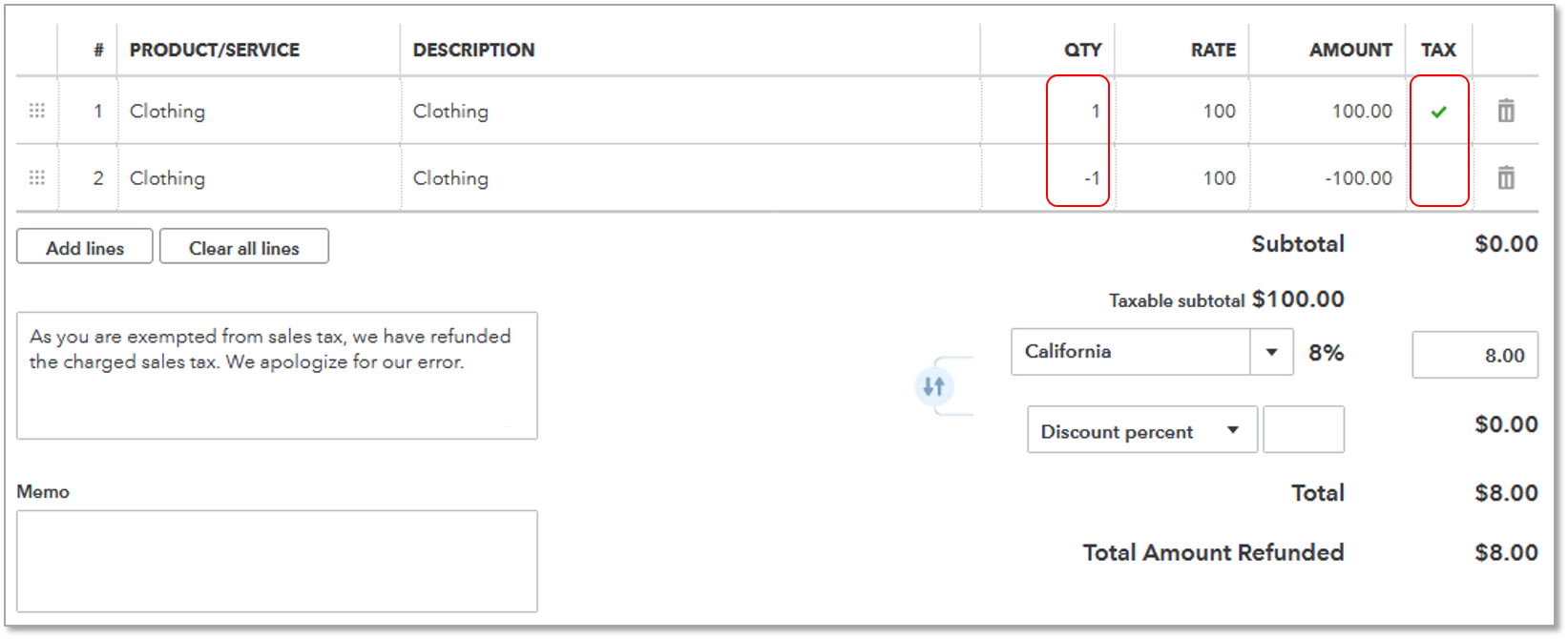

- Select the same taxed Product/Service item as the original invoice or sales receipt.

- Enter the same information on the next line but this time, enter a negative amount/quantity and uncheck the Tax box.

Things to know:

- When entering a negative line item equal to the taxable item, it results in the Total Amount Refunded being equal to the amount of Sales tax previously charged.

- The income account should now reflect the correct amount of income that was received. The Sales Tax Center should also show the correct taxable amounts and correct amount of sales tax due.

More like this

- Refund sales tax collected from tax exempt customersby QuickBooks

- Request sales tax exemption and refundby QuickBooks

- File and pay sales tax in QuickBooks Onlineby QuickBooks

- Collect sales taxby QuickBooks