Resolve accounts receivable and accounts payable balances on a cash basis balance sheet

by Intuit•1• Updated 1 month ago

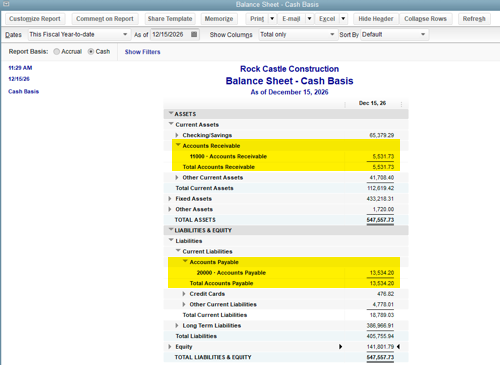

Learn how to resolve A/R and A/P balances on a cash basis balance sheet report in QuickBooks Desktop.

A balance sheet report in cash basis shouldn’t show A/R or A/P balances because these accounts track open (unpaid) invoices and unpaid bills. If they show up, here’s how to fix the issue.

More like this

- Resolve accounts receivable or accounts payable balances on a cash basis balance sheet in QuickBooks Onlineby QuickBooks

- Resolve AR or AP on the cash basis Balance Sheet with journal entriesby QuickBooks

- What transactions are not supported by Balance Sheet by Class in QuickBooks Desktop?by QuickBooks

- Fix a Balance Sheet that's out of balanceby QuickBooks