Manage Enhanced Inventory Receiving

by Intuit•2• Updated 9 months ago

Learn about Enhanced Inventory Receiving (EIR) and how to manage it in QuickBooks Desktop Enterprise.

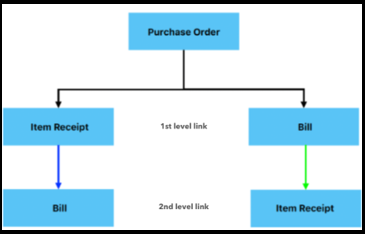

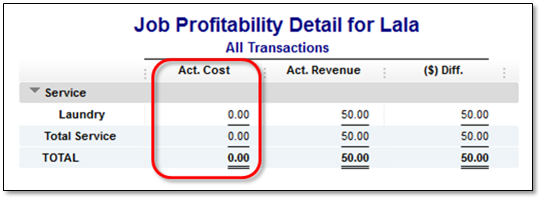

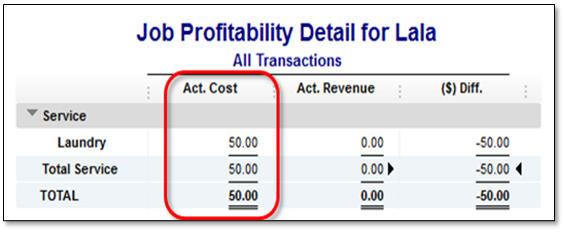

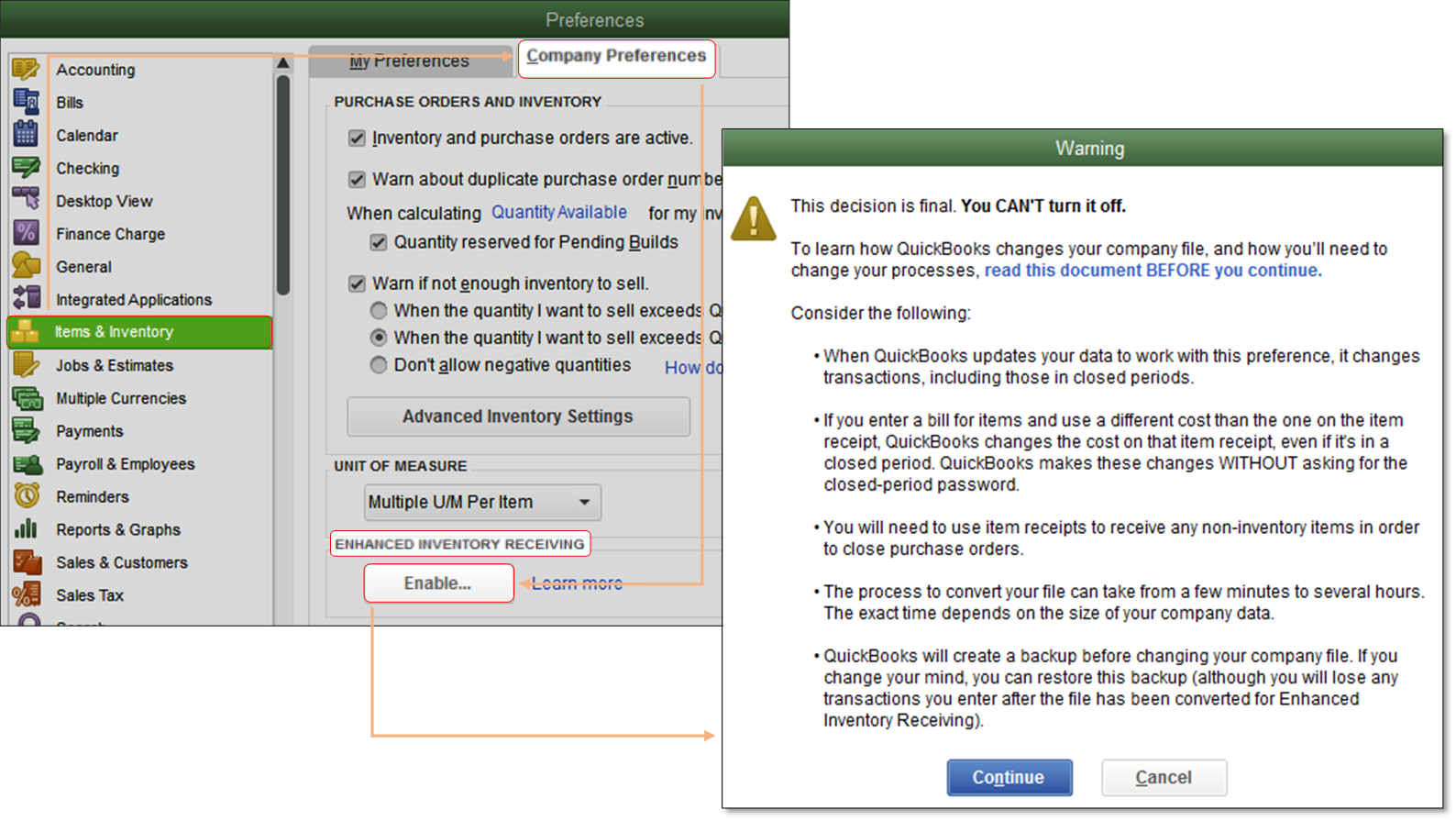

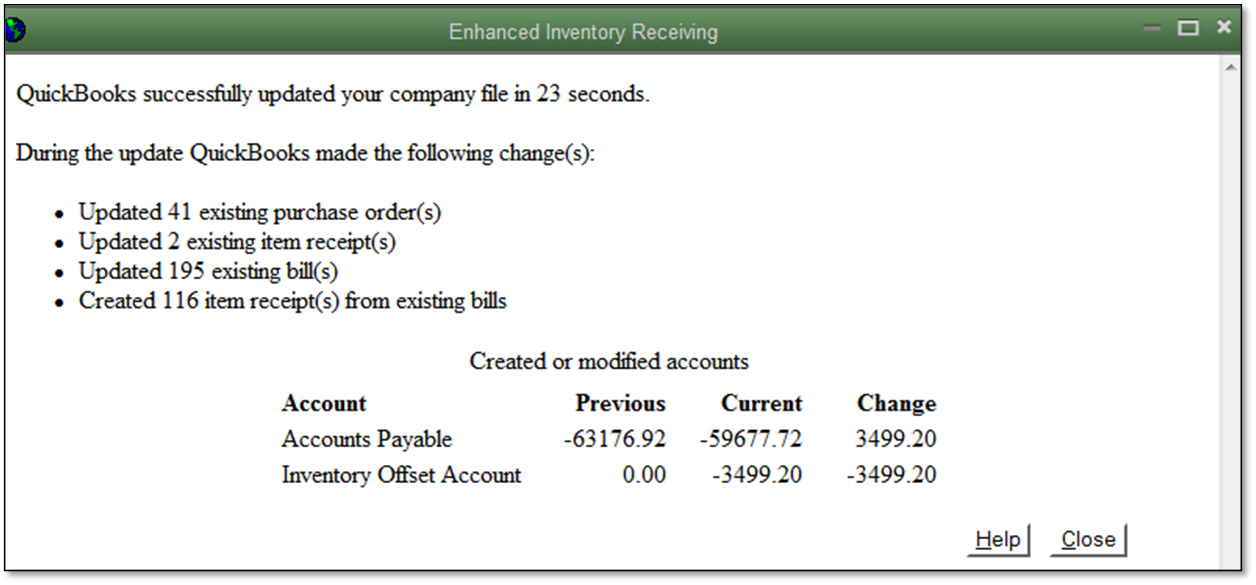

The EIR changes how you get and pay for items. It's only available in QuickBooks Desktop Enterprise. This version creates an inventory offset account, which is a liability account. It keeps item receipts separate from bills.

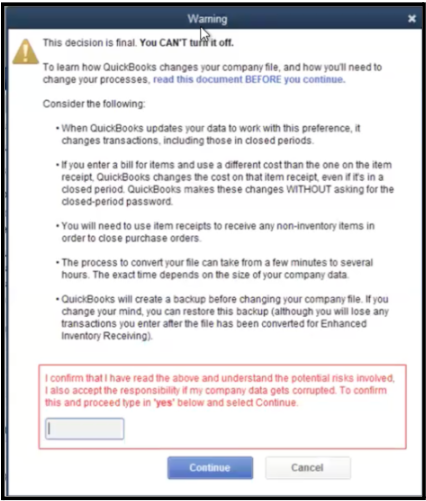

Important: Once you turn on the EIR, you can’t turn it off. The Purchase Order Management Worksheet will no longer be available. Here’s what we suggest.

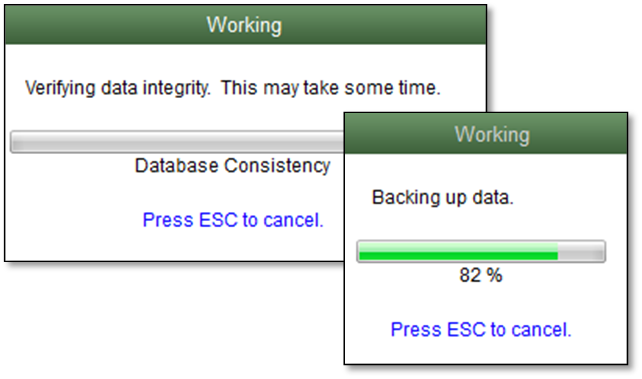

- Back up your company file before you turn on the EIR.

- Test the EIR in a sample file first to check if it fits your business needs.

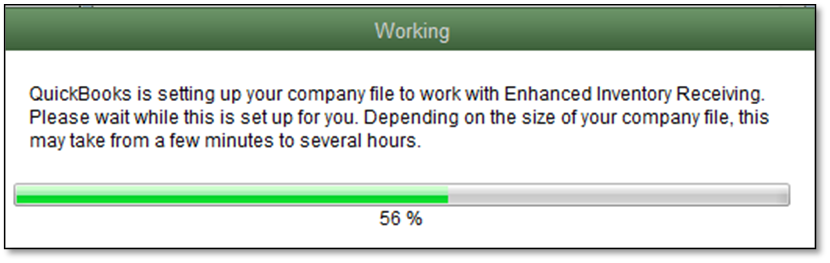

- Once you decide, update your main company file. If it’s large, condense it.

More like this

- Use the purchase order management worksheetby QuickBooks

- The Inventory Offset balance is too high or too lowby QuickBooks

- Receive inventoryby QuickBooks

- Use the Inventory Stock Status by Lot Number report in QuickBooks Enterprise 24.0by QuickBooks