Find out how to use the Review List Changes tool in QuickBooks Desktop Accountant and Enterprise.

The Review List Changes tool shows you all the changes in your lists such as Chart of Accounts, Item List, Payroll Items, and Fixed Asset Items. This way you can keep track of all the changes you’ve made in your lists. We’ll show you how to access it and how it works.

What you can review

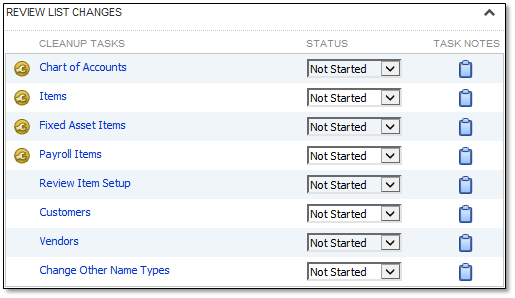

Here are the lists that you can review.

Chart of Accounts, Items, Fixed Asset Items, and Payroll Items

These lists let you see and review the changes you’ve made in your items. Once you open one of these, you’ll see the added, changed, deleted, and merged items.

Review Item Setup, Customers, Vendors, and Change Other Name Types

These lists directly open the existing QuickBooks features. It lets you check the items you need to change or those you already changed.

How to access the tool

Let’s now start reviewing your lists. Here’s how.

- From the Accountant menu, select Client Data Review.

- Select Client Data Review.

- In the Review List Changes section, select the list you need to review.

Note: You can change the status of each list for your checklist.- Not Started

- In Progress

- Completed

- Not Applicable

- Review the added, changed, deleted, and merged items.

- Select Mark All as Reviewed after you finish reviewing all of the items.

Note: Once you mark all items as Reviewed, you can’t change their status to unreviewed. To see all items, you can select the Include Reviewed Items checkbox.

What changes are tracked

Chart of Accounts

- Account type, name, and number

- Tax line mapping

- Active or inactive status

- Account or subaccount changes

Items

- Item type

- Cost of good sold, income, expense, and asset account

- Sales Tax code

- Unit of Measure

- Sales Tax Rate or Agency (for Sales Tax Items only)

- Active or inactive status

- Item or sub-item changes

Fixed Asset Items

- Account type, name, and number

- Tax line mapping

- Purchase date and cost

- Sales date and cost

- Sale expense amount

- Active or inactive status

- Account or sub-account changes

Payroll Items

- Agency

- Accounts assigned to the rate of the item (e.g., Federal unemployment tax rate)

- Limit

- Tax tracking type

- Payment frequency

- Payroll schedule

- Status