I know a way to record the payments and income transactions to QuickBooks @rustictreats12434.

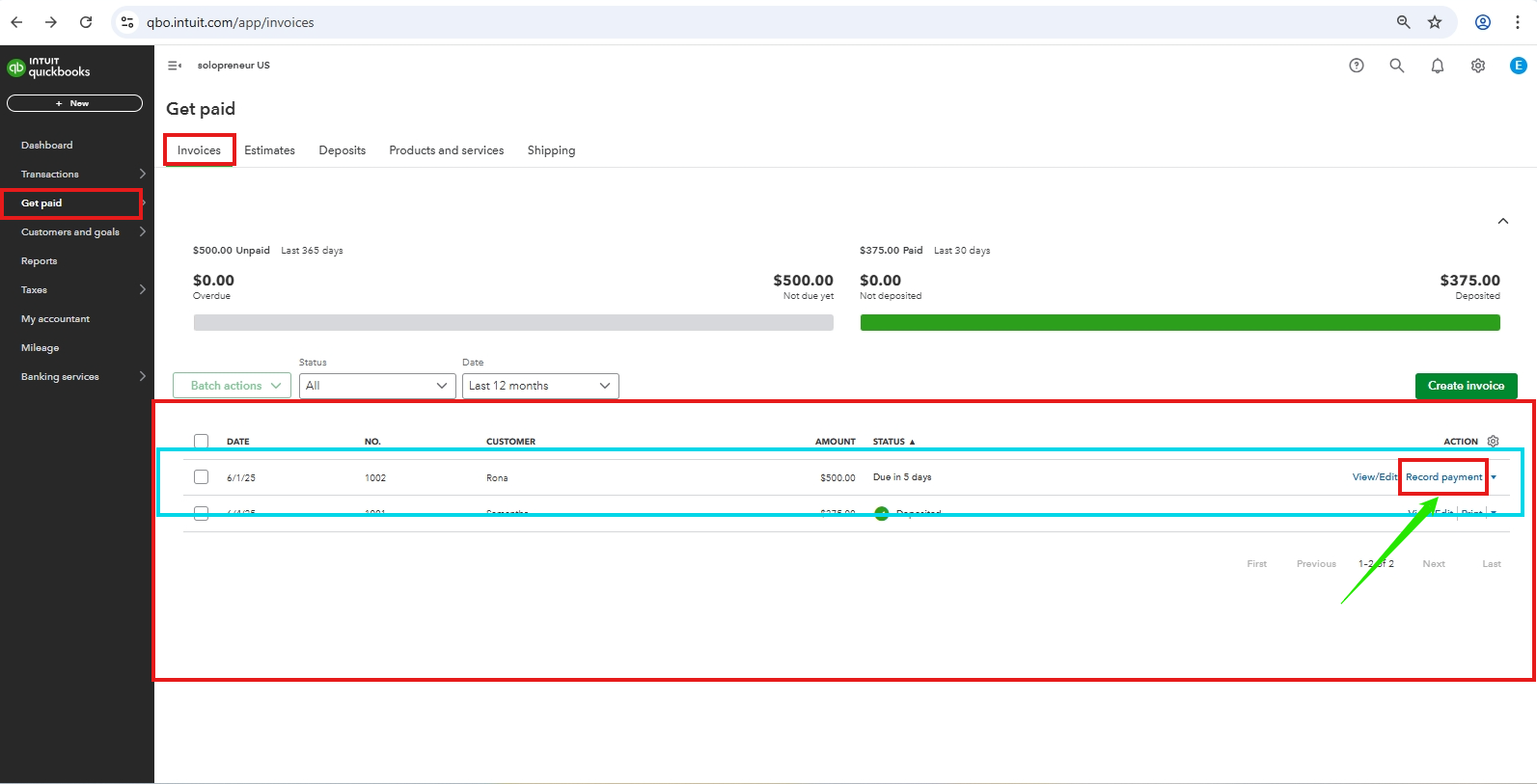

To record customer payments in QuickBooks, go to your Invoices and receive the payments. Here's a step-by-step process:

- In the Invoices window, find the invoice you want to record the payment for.

- Click the Record payment beside View/Edit.

- Select the account you want to record the payment.

- Check the Payment date, then Save.

There are two ways to record Income in QuickBooks Solopreneur, depending on whether income transactions are automatically imported from your connected bank account or manually entered.

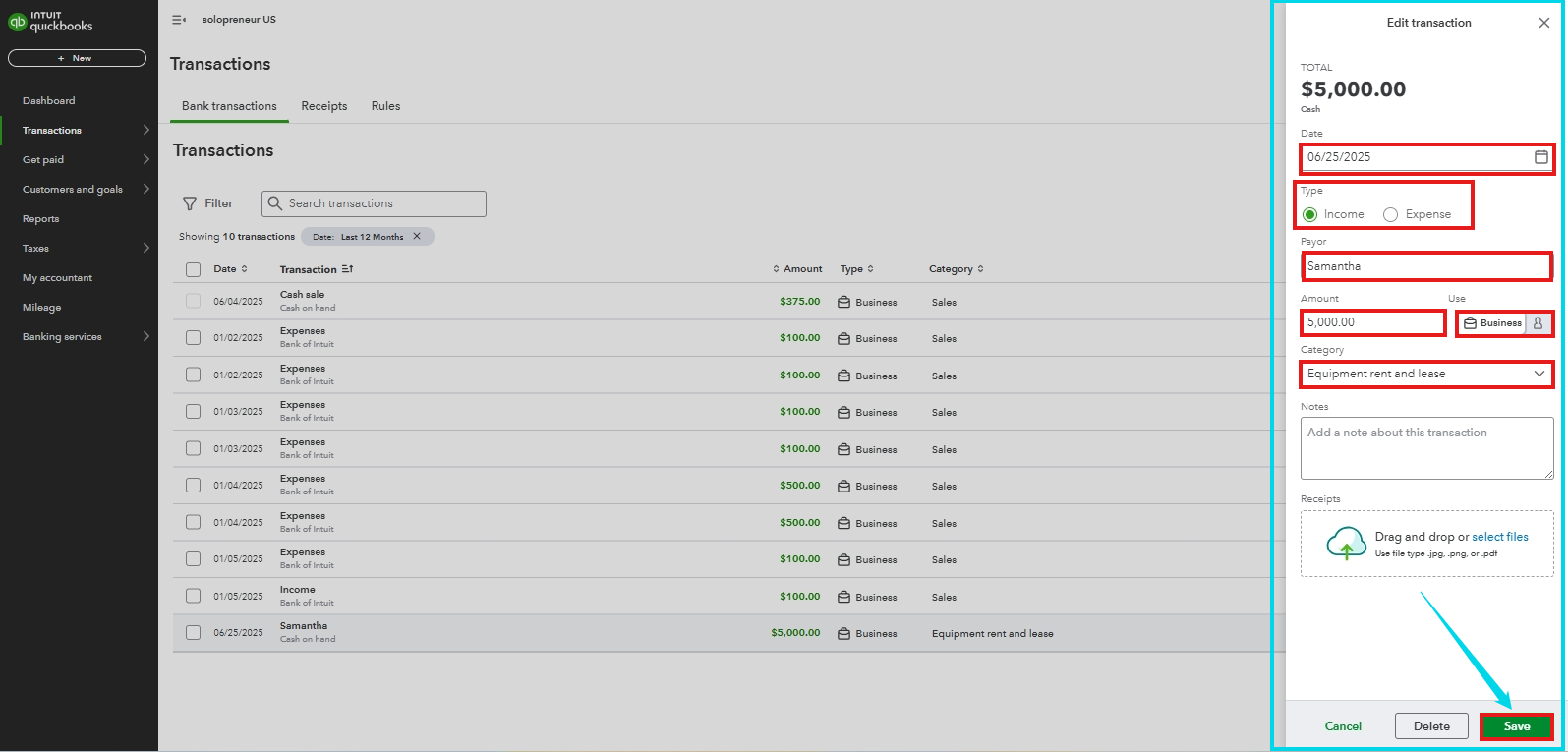

If you link your bank account to QuickBooks, income transactions are imported automatically. You can categorize your downloaded transactions in the Transaction list. Here's how:

- In the Transactions list, locate the transaction you want to record.

- Click the Pencil icon on the right corner to open the details.

- In the Payor section, choose your customer.

- Select Business Income or Personal Income.

- In the Category dropdown, select the appropriate income category.

- Click Save to finalize the categorization.

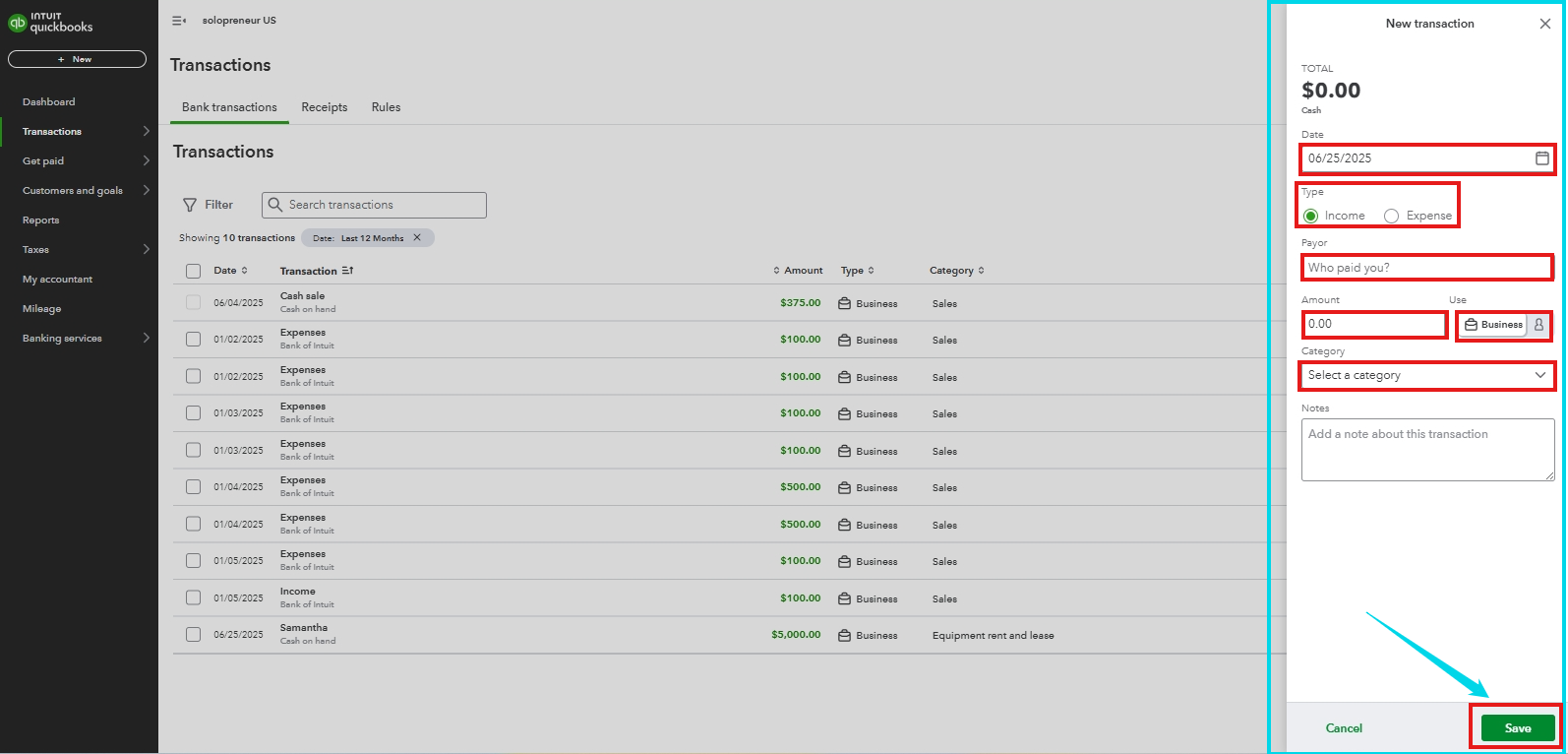

On the other hand, if you are recording an income that is not from your connected bank account, you can manually add it in QuickBooks. Here's How:

- In the Bank transactions window, click the New transaction beside the Refresh button.

- Set the Date and select Income in the Type section.

- In the Payor section, choose your customer.

- Enter the Amount, and select the transaction type (Business or Personal).

- Choose a category in the Select a category dropdown.

- Then click Save to record the Income.

When you categorize a transaction in QuickBooks Solopreneur, it aligns with a line on your Schedule C. For details on Schedule C categories and how they appear in your financial reports, refer to this article: Schedule C and expense categories in QuickBooks Solopreneur and QuickBooks Self-Employed.

Check this article for guidance on how to use rules to categorize the transactions you download from your bank in QuickBooks Solopreneur: Use rules to categorize bank transactions in QuickBooks Solopreneur.

If you have any further questions or need additional assistance with managing your Income in QuickBooks, please feel free to reach out. We are here to help!