Turn on suggestions

Auto-suggest helps you quickly narrow down your search results by suggesting possible matches as you type.

Showing results for

Connect with and learn from others in the QuickBooks Community.

Join nowI have to manually enter the balance sheet of an existing company to QuickBooks Desktop, starting January 1, 2021. When I do the bank reconciliation, checks written in the prior month will clear in January. Since I don't have that prior month's info loaded onto QuickBooks, how do I balance the bank reconciliation?

You've come to the right place, @Beebo. I've got all the steps you'll need to make sure your account matches your bank statement.

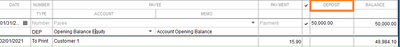

If it's your first time reconciling an account, make sure to review the opening balance. You'll have to enter the opening balance in January 1 the same as the ending balance from the last bank statement. This way, everything matches your bank records from the start and so you won't have to worry about the uncleared checks written in the prior month. You can edit your Opening Balance entry from your bank register.

Here's how:

Then, make sure there are no missing transactions. If so, import them into your bank feeds, categorize and add them to the account register to be reconciled.

Once done, you can start reconciling your accounts for January. Then, go month by month until you reach the most recent statement.

Here's to start reconciling:

Once done, compare the list of transactions on your bank statement with what's in QuickBooks. For the detailed steps, refer to this article and proceed to Step 4: Reconcile an account in QuickBooks Desktop.

Let me know if this helps you balance out your reconciliation. I'm determined to ensure your success.

Generally, when you set up a bank account that has current activity (not brand new), enter all of the outstanding transactions - all transactions that haven't cleared. Use their real dates.

Then, make the opening balance the same as the ending balance from the last bank statement (the one before the first one you'll reconcile in QuickBooks for that account.)

Then when you reconcile, everything that might appear on any future bank statement will exist in the account, ready to be marked cleared.

I'm a little confused. It sounds like you said to enter the prior month's ending balance from the bank statement when I first set up the bank account. Do I then start the reconciliation but before finishing it, do I go back to the chart of accounts and change the opening bank balance to what the check register shows? Would I then go back to the bank reconciliation to finish it if in balance? I hope you understand my question. My confusion is that there would be unreconciled transactions that were dated in the prior month. Since those transactions are not in the new software, they won't show up when reconciling January. Thank you

Thanks for coming back to our forum, @Beebo,

Joining the thread to share some insights about this reconciliation problem you'e getting. Ideally, the previous month's balance becomes the beginning balance of the next reconciliation period.

If you haven't reconciled, enter that balance in QuickBooks to ensure the ending balance after transactions matches with the bank statement. Also, you only need to select the entries that cleared the bank for the month you are reconciling. Do not include the ones that are not part of the bank statement.

Regarding the entries from previous months that are outstanding, you can try uploading the bank entries for reconciliation. If you try to reconcile an account with incomplete entries, it would not reflect the actual financial activities, throwing off the balances.

Here's an article about the complete process of reconciling an account in QBDT: Reconcile an account in QuickBooks Desktop

I'd like to know how you get on after trying the steps, as I want to ensure this is resolved for you. Feel free to message me back. Have a great day!

This answer was confusing because it said for the first time reconciling, use the ending balance from the prior bank statement, then I won't have to worry about uncleared checks from the previous month. Then I can edit the opening balance in the check register. Why wouldn't I start with the ending balance of the prior month from the check register? Shouldn't it have the same effect?

The attached article says to use the real-life bank balance from the beginning of when I start the reconciliation. That's what I did. Other comments said to use the prior month's ending bank statement balance and don't worry about uncleared checks from the prior month. Then I could change the opening balance in the check register. I found that confusing. I reconciled using the real-time bank balance. Thank you for the information.

You have clicked a link to a site outside of the QuickBooks or ProFile Communities. By clicking "Continue", you will leave the community and be taken to that site instead.