Turn on suggestions

Auto-suggest helps you quickly narrow down your search results by suggesting possible matches as you type.

Showing results for

Connect with and learn from others in the QuickBooks Community.

Join nowWe have a client that is a not-for-profit charity. We need to record a charitable contribution we made to them by credit card. When entering their name they come up as a "customer" and not sure if we should record the contribution to them this way or if we should modify their name and add as a new entry and if so add as "vendor" or "other name".

Any ideas?

Solved! Go to Solution.

Glad to have you back, @mac2it,

When making donations or charitable contributions, you may set up the Non-profit organization you're donating to as a vendor, just as you would do for any other company expenses.

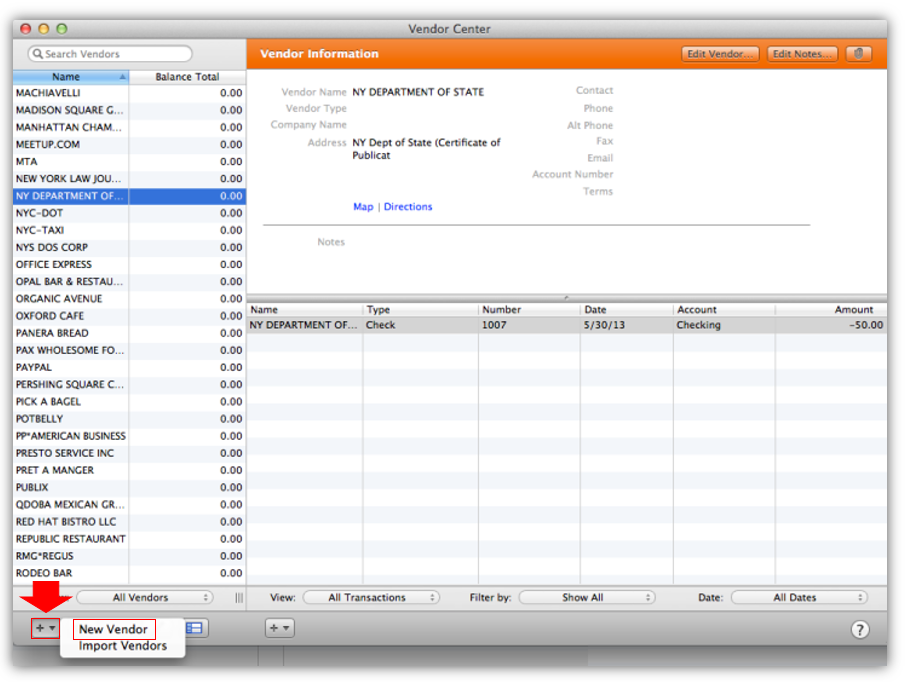

To add a Vendor in QuickBooks Mac:

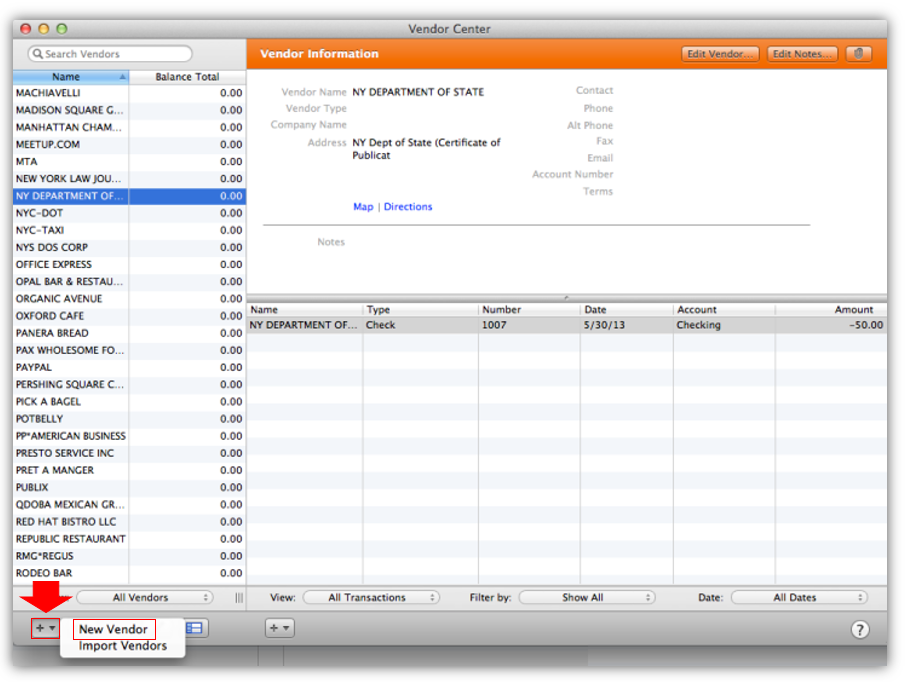

QuickBooks doesn't allow multiple names in the system. Since the organization is already listed as a customer, add a slightly different or modified name in the Vendor Center.

Once added, record the credit card contribution as Bill or Check then use Credit Card for the Payment Method. You may also utilize the Enter Credit Card Charges under the Banking tab.

Let me know if you have other questions or need clarification about this topic, mention me or add a new comment below. I'm more than glad to share additional insights about QuickBooks and help any time. Have a wonderful day!

Hi @mac2it,

You can re-enter your customer as a vendor, with a slightly modified name since QuickBooks will notify you that these entries have the same name.

As for the process of recording the donation, you can follow these steps:

For the expense account dedicated to tracking your donations, I'd suggest you ask your accountant on how it's best to record it in your books.

In case you're using QuickBooks Nonprofit, view this article: Process a credit card donation in QuickBooks Desktop.

Let me know if you have other questions, I'll be sure to get back to you.

Thank for the reply. It doesn't seem this will work as a sales receipt records income and on QB Mac Desktop the sales receipt just records money received from a customer. To be clear we are a business not a charity. We have a customer that is a charity and we made a donation to them and are trying to figure out if we need to just add a new name for the client who is also now a vendor.

Do we just go to Banking>Enter Credit Card Charges, then enter their name in the "Purchased From" section and add them as a vendor?

Is there a recommended practice so that it's not confusing if you see the same name as both customer and vendor?

Thanks for getting back, @mac2it.

For this scenario, you can write a check to the customer/vendor to show that you donated.

To write a check:

The customer name should be slightly different from the vendor name. QuickBooks will automatically prompt if the name is already in use regardless of the type.

Here's what I can recommend:

Please reach out to me if you have further questions. I'm more than happy to help. Take care!

Hi, we are doing this for a CC not a check but we tried both ways and notice that QB MAC Desktop does NOT prompt us to enter a new name it actually fills in payable line with the existing customer name. I take it we should NOT accept that and create a new name since it's a vendor, right? That's really our whole question, maybe we didn't explain it correctly.

Glad to have you back, @mac2it,

When making donations or charitable contributions, you may set up the Non-profit organization you're donating to as a vendor, just as you would do for any other company expenses.

To add a Vendor in QuickBooks Mac:

QuickBooks doesn't allow multiple names in the system. Since the organization is already listed as a customer, add a slightly different or modified name in the Vendor Center.

Once added, record the credit card contribution as Bill or Check then use Credit Card for the Payment Method. You may also utilize the Enter Credit Card Charges under the Banking tab.

Let me know if you have other questions or need clarification about this topic, mention me or add a new comment below. I'm more than glad to share additional insights about QuickBooks and help any time. Have a wonderful day!

Hi, thanks for the reply. We actually know how to create vendors and customers and other names. The question is if we need to create a new one for a customer that is also a vendor. If we type in their name when entering the CC charge it comes right up because they exist already as a customer. Our guess is we need to create a separate entry as a vendor or "other name" but then should we modify the name so it's clear one is a vendor and one is a customer?

Thank you for coming back, @mac2it.

I’m happy to further help you figure out if you need to create a new one for a customer that is also a vendor. Yes, you can make them both a customer and a vendor.

Let me show you how:

When a customer is also your vendor the transactions between the two parties are called Barter Transactions. You can record your exchanges correctly by creating a Barter Account.

Here’s how:

Below is an article about how to Record a barter transaction:

Should you have other questions, feel free to leave a comment.

I don't believe that is correct at all. A barter transaction as indicated on the page you linked to is for "when you and your vendor exchange goods and services".

We are not exchanging and goods or services. They pay us in money and we are donating to them as they are a not-for-profit charity.

I'm here to help you record this type of donation, @mac2it.

Let's start by creating an invoice for your customer or organization since you are receiving payments from them. Once you've received the payment, make sure to select your bank as the account to deposit the payment from your customer.

On that same page, you can now enter a refund to your customer since the payment you received from them is also a donation. To do so:

I've got you this article to learn more about how you can create a refund for your customer: Record a credit memo or refund in QuickBooks Desktop for Mac.

Lastly, I'd still suggest contacting your accountant because he/she has also the other ways of recording this type of payment and donations and guide you as well.

Let me know in the comment section down below if you have any other questions. I'm always around happy to help.

Sorry that's 100% incorrect.

Sorry but this won't work. This is not a refund, it's a charitable donation to a charity that is also a customer. If we follow your instructions there will be no way to properly record the charitable and tax deductible donation.

Why a check, this was a cc transaction.

I've got your back, @mac2it.

You can enter credit card charges for the donation to a charity and create a sales receipt for the tax-deductible donation. Let walk you through the process.

When you're donating to a charity, you'll have to write a check if paid through cash or enter credit card charges if via CC transactions, then select the vendor name. Here's how:

Also, for the donation that you've received from them, you can create a sales receipt and select the customer name.

Here's an article you can read for more details: Process a credit card donation in QuickBooks Desktop.

You might also want to check this pdf article to learn how to record donations properly in your QuickBooks Desktop for Mac: QuickBooks Desktop for Mac 2019 User’s Guide.

Please touch base with me here for all of your QuickBooks needs, I'm always happy to help. Have a great day.

You have clicked a link to a site outside of the QuickBooks or ProFile Communities. By clicking "Continue", you will leave the community and be taken to that site instead.