Hello, Allen. You can easily turn sales tax off within the invoice by adjusting the checkbox for each product or service. Let me guide you through the steps.

By adjusting the tax settings for each item in the invoice, you can ensure that sales tax is not applied. Here’s how to do it:

- Go to the Sales menu and select Invoices.

- Either create a new invoice or open an existing one that you want to edit.

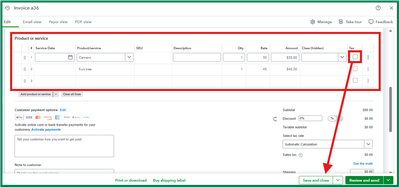

- In the Product/Service section, add the items you’re invoicing for.

- There will be a checkbox in the Tax column next to each product or service.

- Uncheck the box next to each item to ensure sales tax is not calculated for this invoice.

- Select Save and close once done.

If non-profits regularly receive invoices from you and do not pay sales tax, you might want to consider setting up a non-taxable customer profile to streamline future invoicing. Refer to this article for future reference: Understand and set up sales tax-exemptions in QuickBooks Online.

Furthermore, I'm also pleased to inform you that you can elevate your financial management with the help of our QuickBooks Live Expert Assisted team. They specialize in helping you transform your financial management and provide personalized advice for your business's specific demands.

If you have any other questions or need further assistance with your invoices, please feel free to reach out. The Community is here to actively support you in the thread.