Turn on suggestions

Auto-suggest helps you quickly narrow down your search results by suggesting possible matches as you type.

Showing results for

Connect with and learn from others in the QuickBooks Community.

Join nowI purchased QB2019 desktop pro to track I/E for both business and personal. I am employed and have rental properties. I went through set up interview after installation and the rental is presently a sole prop. How do I set this up to separate out items based on whether the item is rental or employment as some of it crosses over (i.e. vehicle expenses, capital improvements, ...)

When looking for guidance online, I am now confused as how to structure within QB.

1) set up as 2+ companies to track (personal and each rental unit); 2) set up 1 company file with classes and projects for rentals and personal (as I have read in online searches on rental structure); or 3) do I just set up subcategories within the Chart of accounts?

I presently track all income and expenses with XL workbook for each year that categorizes things. I am not sure it translates well as I track all of my gross income and any expenses (income taxes withheld, real estate taxes, insurance, contributions to employer and personal retirement accounts)

Any suggestions are appreciated?

Hello there, @dtrudell_2000.

In QuickBooks Desktop, it's recommended to create two companies for setting up your property management company. The first company is used to track the income and expenses for your client's properties. At the same time, the second company is for your own company with its income from management fees and overhead expenses.

For additional reference, please refer to the following article about how to categorize tenants by type, naming properties, record transactions, and complete other tasks: Create a property management company.

You can also consult your accountant with the process and to ensure your books are accurate. I've attached a link below for tips, training, and related articles you need to know about the product: Get QuickBooks Desktop user guides.

Please know that you're always welcome to post if you have any other questions. I'll be happy to help you out.

Hello,

I have a similar question, but using QB Online. I have three part time small business plus my personal expenses that I would like to track using QB online. They all use my my personal credit cards and checking accounts. I just signed up for QB and was doing this on Quicken for many years until January.

How do i correctly set up the chart of accounts to track all these expenses in their respective business units. I don't have an accounting background, so I need to get some step by step instructions.

Bryan

Thank you for reaching out to the Community. I'm here to help you sort this out, @bryanbrown4638.

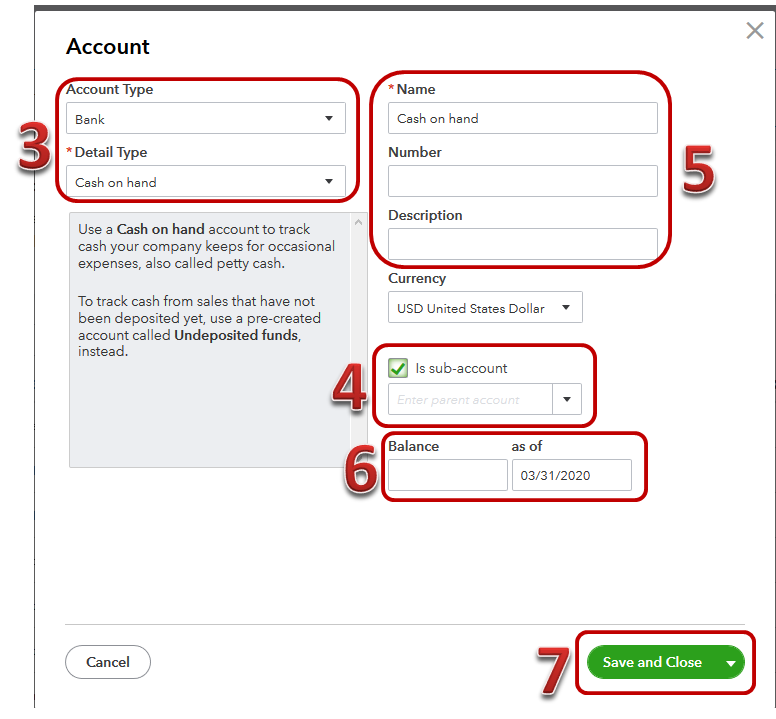

We can create a sub-account for each business unit to track the expenses. (Example for Business Unit I - Parent, Sub-account expense 1, Sub-account expense 2) and the same on the other business units as well.

However, for the three part-time business, if they are a different company or different EIN, then you need to create an account for each company. If they are all the same EIN, we can use the sub-account. Let me show you how to create a sub-account.

Though, you can also create a new parent account first if you need to. Creating subaccount to break down your expenses. income, and more into greater details. It will divide your utilities account into subaccount, so you can track different types of utility payments. like telephone, water, gas and so on.

You can also consult your accountant with the process and to ensure your books are accurate.

I've added this article for more understanding about the flow of chart of account in QuickBooks: Understand the chart of accounts in QuickBooks.

Please let me know how it go, I want to ensure you'll be able to track down your expenses. Have a great day!

Dear AileneA,

My accounting background is very weak, so please allow me to ask the question in a different format (I did review the resources you sent and my question is in response to your answers).

I would like to organize my finances/accounting in the following manner.

Quickbooks

I'm using 3 personal credit cards for both business and personal charges and when I download from the bank I need to be able to allocate the charges to the proper category.

I would like to be able to print out a report for each unit show income and expense.

Does the answer in your response allow for this type of categorization and reporting?

Bryan

Hello, @bryanbrown4638.

You can organize your account the same way with your response by simply following the steps above given by my colleague AileneA. You just need to make sure that you put a checkmark on the sub-account box. Please refer to the screenshot below.

You can refer to this article for additional information: Create subaccounts in your chart of accounts in QuickBooks Online.

Fill me in if you have further concerns. Have a nice day!

You have clicked a link to a site outside of the QuickBooks or ProFile Communities. By clicking "Continue", you will leave the community and be taken to that site instead.