Turn on suggestions

Auto-suggest helps you quickly narrow down your search results by suggesting possible matches as you type.

Showing results for

Connect with and learn from others in the QuickBooks Community.

Join nowI have 1099 questions:

Two of my vendors/contractors were paid more than $600; however, when I attempt to do 1099s, they show up as below the threshold and all of my payments to them are excluded. I did pay both with credits cards. I One of them invoices through QB and the other one uses Square. On the other hand, I have two other vendors who I paid via credit card and none of their payments were excluded. One of those vendors was paid from my checking account through QB and the other person was paid via credit card via paypal. I can't find a pattern here that makes sense. Finally, I have yet another vendor. In this case, the invoices initially came through paypal; then, the vendor switched to a different processor. The money that was paid through the different processor was excluded, but none of the paypal payments were excluded.

My question is why are the payments excluded on the first two vendors, but not on the second two? Why the split on the last one? All of these vendors are set up as contractors.

I thank you for the complete details you've shared, @ihatetaxes1.

When preparing your vendor's 1099 form, you'd want to make sure that it meets all the necessary criteria.

Once you have reviewed your vendors information, you can try viewing your vendor or contractors 1099 list. Here's how:

Lastly, you can read through these articles to further assist you with managing your 1099-related transactions:

Leave a comment below if you have other questions or concerns. I'm always here if you need anything else.

Hi @ihatetaxes1,

Thank you for your prompt reply, as well as for sharing screenshots. I'm here to clear things up for you.

QuickBooks Online (QBO) automatically exempts vendor payments made through credit cards, debit cards, or third-party systems such as PayPal. In this situation, it's the financial institution that reports these payments, so you won't have to.

To confirm if all other vendor payments should be tagged as excluded, you can run the Excluded Payments by Vendor report.

Here's how:

Open this article for more information: What payments are excluded from a 1099-NEC and 1099-MISC?

Feel free to post a reply below if you have other questions about your 1099 form in QBO. I'll get back to you as soon as I can.

Thanks, but there's still an inconsistency. In this image, the person in the red invoices through QB, but none of those payments were excluded. Why not? Also, if a vendor invoices through paypal, why aren't they excluded? The yellow vendor and most of blue vendor's payments were invoiced through paypal.

I'm not giving up on this issue, and I've got some further troubleshooting to help you @ihatetaxes1.

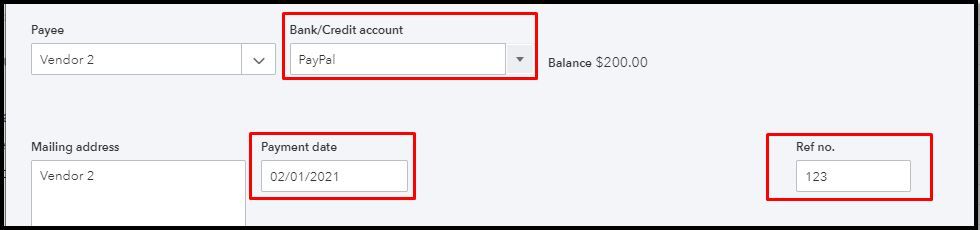

Thank you for the screenshot you've provided and for following the steps outlined by my colleagues. To exclude the payment made through PayPal, let's open the transaction and edit the payment and have it list under PayPal.

Once done, process 1099 again.

Also, I encourage you to visit our 1099 tutorial page. This will help you earn more QuickBooks knowledge that can help you with your 1099 tasks.

If you have further questions about creating and filing 1099 in QuickBooks, feel free to post here again. I'm always around to help. Have a good one.

You have clicked a link to a site outside of the QuickBooks or ProFile Communities. By clicking "Continue", you will leave the community and be taken to that site instead.