Hi rusan1,

I'll help you with your Chart of Accounts and Profit and Loss report. Let's talk about P&L first.

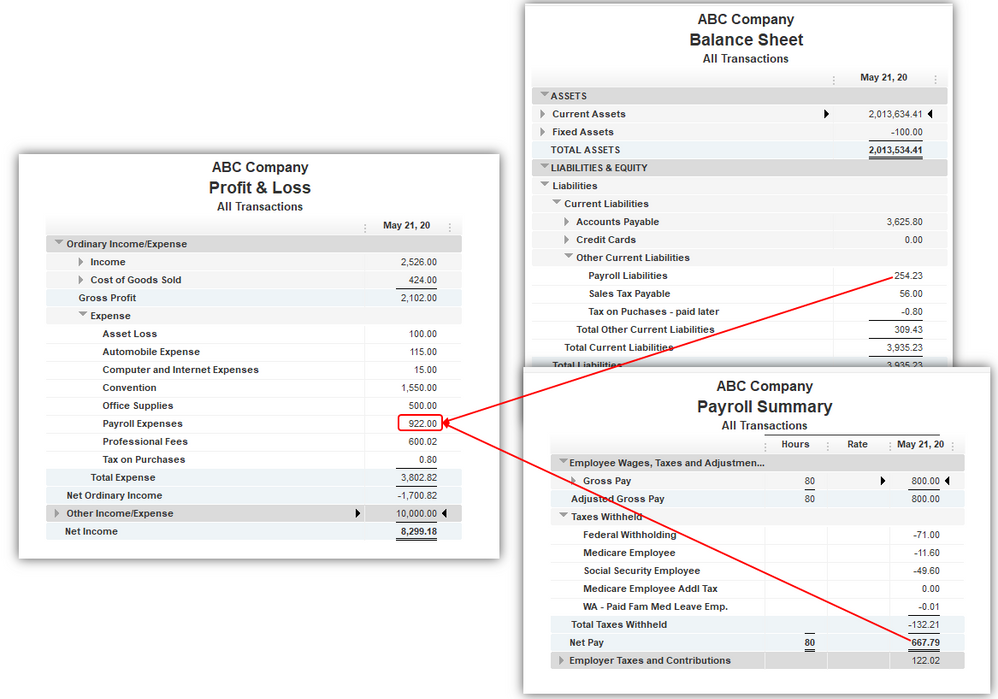

The company's share of Social Security and Medicare taxes is declared in the Payroll Expense in the P&L report. In fact, it is composed of the employee's tax, net pay, and employer taxes and contributions. Or, everything you spend on payroll. You'll want to be sure to set the correct period on your report as well to get the right amount.

With regard to sub-accounts, I would like to ask for more details on this concern. Are you able to delete (inactive) the duplicates by right-clicking on them and selecting Delete Account? What are you trying to achieve that caused duplicates instead?

You can be as detailed as you like. This will help us understand this part of the concern better, and we will be able to give you the right steps to resolve this.

Lastly, I know you need to spend time taking care of your business. As such, we are available 24/7 in the Community, so feel free to reply anytime. The next available agent will pick it up and will continue to help you.