Turn on suggestions

Auto-suggest helps you quickly narrow down your search results by suggesting possible matches as you type.

Showing results for

Connect with and learn from others in the QuickBooks Community.

Join nowI have a client who received a working capital loan through Paypal. I am unable to link to that loan account in QBO. The loan was not deposited into the bank account or Paypal account so I am not sure how to account for.

I know that when you set up a liability you have to choose bank the funds were deposited into but I don't have this option.

What is another way can I account for this loan?

Thank you!

You can set up a Liability Account without connecting to a Bank. Select Manual when you're setting it up and call it whatever you want. (Same as a loan from an individual, etc. would be set up.)

I'm just curious though.... You say they received a Capital Loan through PayPal, but the deposit was not made into their PayPal account or transferred into their bank account. Where did the money go? Is this a Construction Loan where the bank paid the contractors?

Sorry for the confusion. The working capital loan is in Paypal but I am not able to connect to it because it is its own account within Paypal. Not sure if this makes sense.

I guess where I am getting confused is that it says to choose a bank to deposit the funds into after creating the liability account in the chart of accounts.

So do I just create a bank and then name it Paypal Working Capital?

Thanks for reaching out back to us and clarifying things out, @lizsamaniego.

Allow me to step in for a moment and share some more insights about tracking loan and its payment in QuickBooks Online (QBO).

The option to enroll both a parent account and its sub-accounts in online banking is currently not possible. That's why you're unable to connect the working capital loan in Paypal. For in-depth information, you can check this link: About bank or credit card subaccount setup.

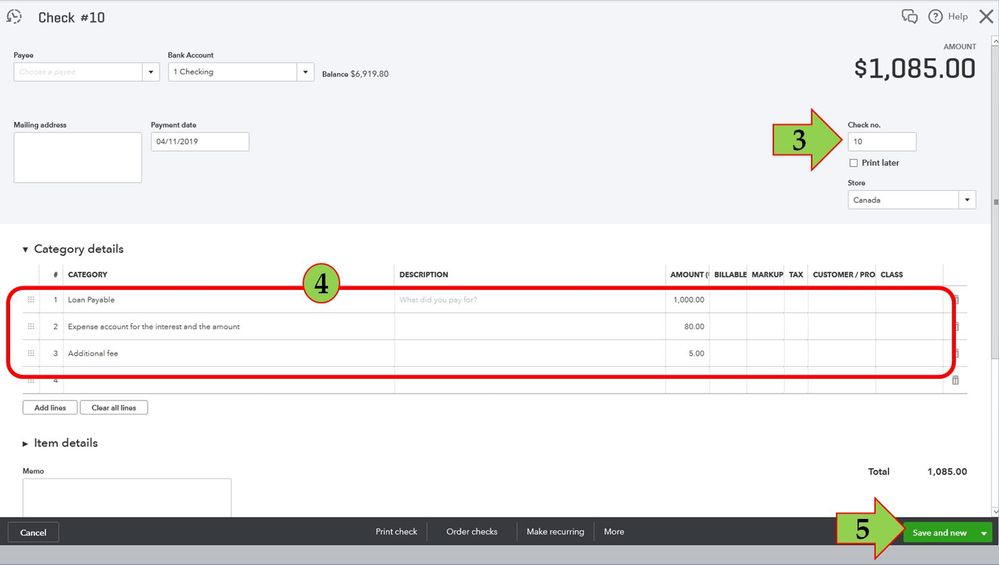

Yes, you're correct. You will have to create and set up a different bank where you'll deposit the loan funds. After that, you're all set to record the loan payments in QBO:

For additional reference, you can check this article: Record a loan and its payment.

Let me know how it goes or if you have any follow-up questions about setting up loan. I'll be here if you need further assistance. Have a wonderful day ahead!

@lizsamaniego wrote:

The loan was not deposited into the bank account or Paypal account

Where was it deposited?

Thank you very much for this step by step. I really appreciate it!!

I do have one more question. When I am setting up the bank I am not sure what detail type to choose since this is not a checking, savings, cash on hand...etc.

Does it matter which I choose as long as I name it Working Capital?

Thanks for getting back to us, @lizsamaniego.

I'll share some information about the detail types when setting up your bank account.

A detail type is a predetermined sub-category on your account. Here are the detail types associated with your bank:

Please see the screenshot below to serve as your visual guide.

Yes, you're right in choosing Working Capital as the account's name. Currently, there isn't an option to edit the detail types since these are predefined. If you can't locate the exact type you're looking for, you can choose the detail type that is the nearest match.

I'd also suggest consulting your accountant if you want to make sure the correct detail type is selected. This way, your books will be accurate.

For more information, please see this helpful article: View Account Detail Types.

This will help get the information you need for today, @lizsamaniego

I'll be here to help if you have other concerns. Have a nice day.

You have clicked a link to a site outside of the QuickBooks or ProFile Communities. By clicking "Continue", you will leave the community and be taken to that site instead.