Hi valeta,

I appreciate your effort in finding related posts and resources for paying bills with late fees or penalties. Let me walk you through recording your payment. However, I cannot suggest a category, but you can ask your accountant for that.

Yes, you'll want to create an account/category to track the late fees and penalties. If you don't have an accountant yet, you can find a certified ProAdvisor near you.

- Go to Settings ⚙ and select Chart of Accounts.

- Select New to create a new account.

- In the Account Type ▼ dropdown, choose an account type.

- In the Detail Type ▼ dropdown, select the detail type that best fits for penalties.

- Name the account. Example: Late fee, Vendor Penalties, etc.

- Click Save and close.

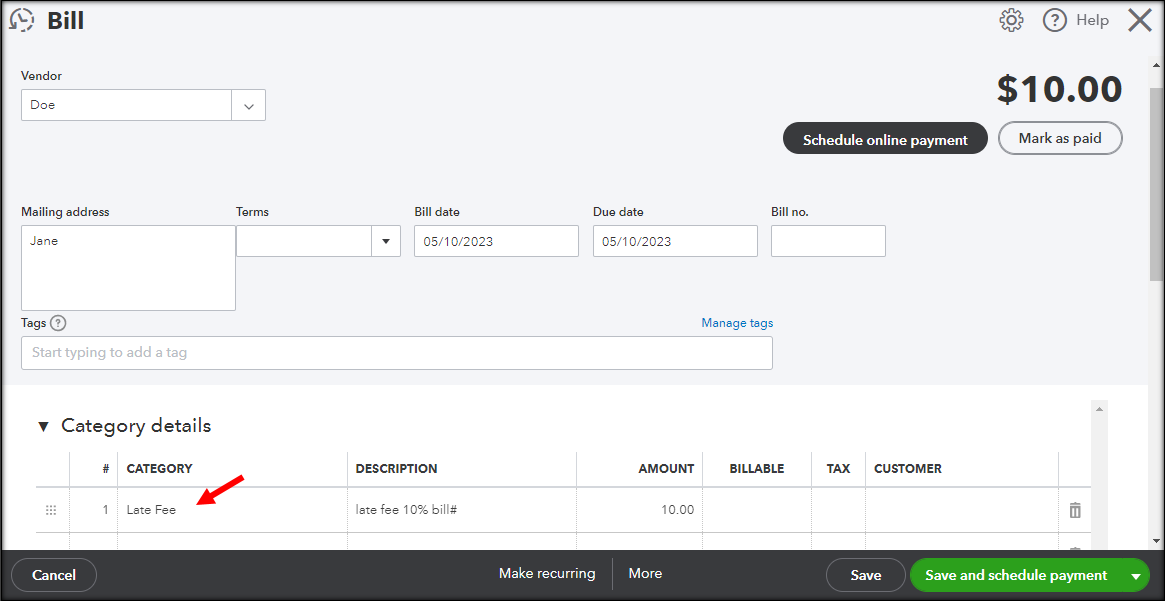

You can then record the late fee as a separate bill and use the created account in the Category details section. Then, pay the transaction together with the original vendor bill, so you'll only have one payment record like in real life.

Bill for the late fee:

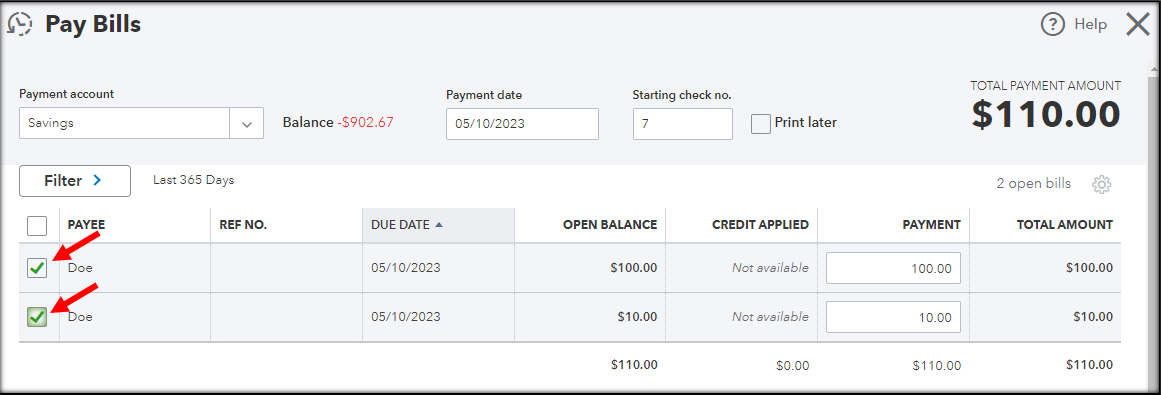

Paying the original bill and the late fee bill together:

- Click +New.

- Choose Pay bills.

- Select a Payment account and set the Payment date.

- Choose both bills, as shown below.

- Click Save and close.

You can then check your vendor's balance after recording all transactions.

If you need more help recording late fees or have other concerns about QuickBooks, just comment below. We're just here to guide you through your QuickBooks tasks.