You're getting there, becky222.

You can record and track billable expenses in QuickBooks Online (QBO), so your co-worker can reimburse you when she receives the invoice. I'll guide you how.

Let's make sure to enable the billable expense feature beforehand:

- Go to the Gear icon and then select Account and Settings.

- Go to the Expenses tab.

- From the Bills and expenses section, select Edit ✎.

- Mark to select the following:

• Show Items table on expense and purchase forms

• Track expenses and items by customer

• Make expenses and items billable

- Click on Save and then Done.

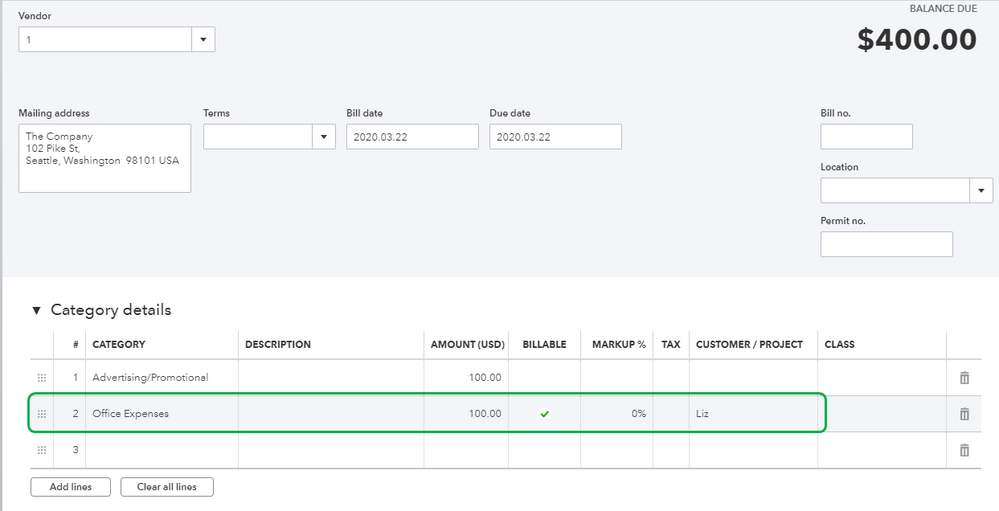

To create a billable expense:

- Click on the + New button and choose Bill.

- Select the vendor's name.

- Choose the account for the shared expenses under Category details.

- You can either make any other accounts billable to your co-worker.

- Click on Save and close once done.

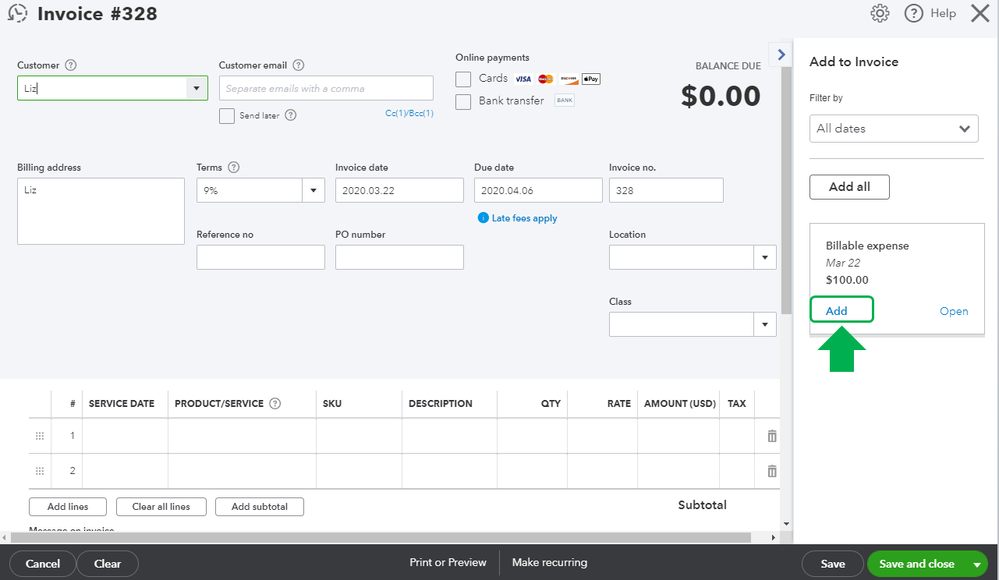

Then, create your co-worker's invoice:

- Click on the + New button and choose Invoice.

- Select your co-worker's name in the Customer drop-down arrow.

- The Add to invoice section will show up, click on Add within the Billable expense transaction.

- Click on Save and close.

From there, you can record your co-worker's payment and pay the bill to the vendor.

Here's more information about entering billable expenses in QBO. This link provides detailed steps in recording the expense transaction billable to customers.

If you want to learn more "How do I" steps in QBO, visit our Help Articles page for reference.

You can leave a comment below if you have further questions. We're always here to help. Have a great day.