Turn on suggestions

Auto-suggest helps you quickly narrow down your search results by suggesting possible matches as you type.

Showing results for

Connect with and learn from others in the QuickBooks Community.

Join nowA client of mine invoiced a customer in QBO back in September for a job + sales tax. My client has since remitted the amount of this sales tax to the appropriate authority. This month (November) the customer paid the invoice MINUS sales tax, since they are exempt and my client did not know that. If my client deletes the sales tax amount from the invoice BEFORE accepting the payment, will the tax and taxable sales totals in the sales tax center of QBO be adjusted? If so, will it affect the current sales tax filing month or will it mess up previous months' amounts? My client's plan is to adjust the sales tax filing numbers for November by reducing the tax and taxable sales by the amount on the invoice since he never should have paid it in the first place - but he is worried that the QBO sales tax won't reflect the same numbers he filed with.

Question is, will simply deleting the tax from the invoice fix this, or is there another way?

Solved! Go to Solution.

Thanks for the detailed information about the issue you've encountered while recording your sales tax payment in QuickBooks Online (QBO), @SK3022.

I can see that you've already performed some of the troubleshooting steps to resolve the issue. However, there are times that the browser is full of frequent;y accessed pages, thus causing unusual responses of the system. You can also isolate this by logging into your QuickBooks Online (QBO) account using a private browser (incognito). Here's how:

Once signed in, go to the Sales Tax Center page and then record your tax payment. If it works, return to your default browser and clear its cache and cookies. This will refresh the system and remove older data that causes viewing and performance issues.

However, if the issue continues, I'd recommend contacting our Customer Care team. They can securely pull up your account, identify the cause of the issue, and guide you with a fix. To address your issue on time, you'll have to contact them from Monday to Friday, 6:00 AM to 6:00 PM PT. Then, 6:00 AM to 3:00 PM PT every Saturday.

In case you want to talk to one of our representatives, you can request a callback at the time of your convenience. Here's how:

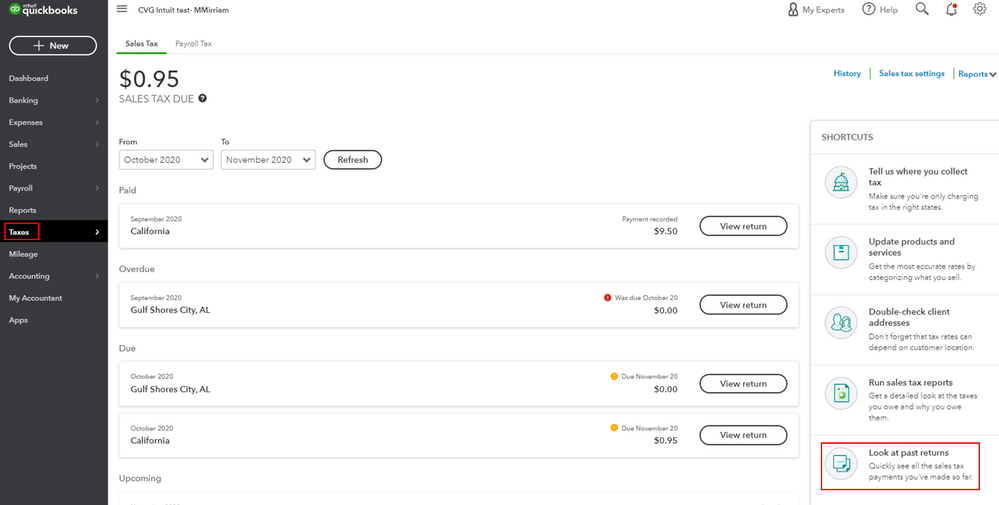

I've attached a screenshot below for your reference.

In the meantime, I'm adding this article to further guide you in effectively managing your sales tax payments in QBO: Sales tax in QuickBooks Online. It includes answers to the most frequently asked questions, as well as setting up, implementing, and paying your sales taxes.

Please know that you're always welcome to comment below if you have other concerns or follow-up inquiries about managing your sales tax payments in QBO. I'm just around to help. Take care always.

Resolving your sales tax issue is my priority, @SK3022.

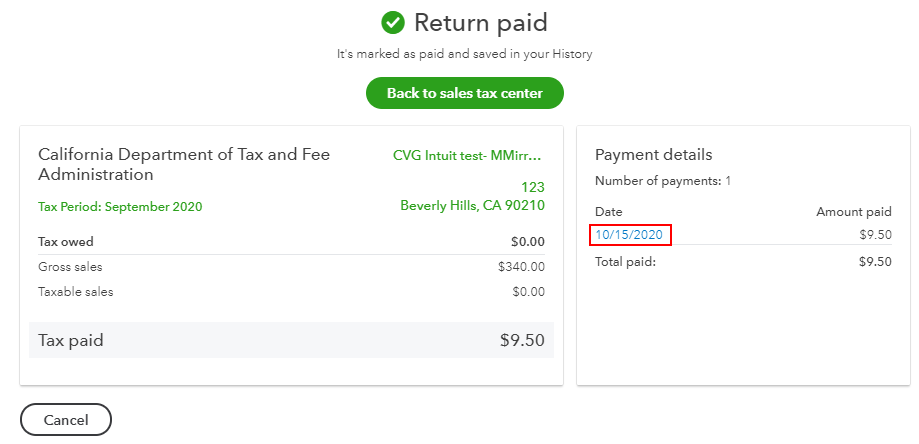

Yes. The taxable sales will be affected once you make any changes to the invoice transaction. To get this fixed, you'll want to let your client delete the sales tax payment, then recreate a new one with the correct amount.

Here's how:

Once done, you can now remove the sales tax from the invoice and process the sales tax payment with the correct amount. For more guidance, feel free to check out this article: File your sales tax return and record tax payment in QuickBooks Online.

You might also want to read this article to learn more about sales tax: Sales tax in QuickBooks Online.

Keep in touch if you need more help with your sales tax, or if there's anything else I can do for you. Of course, I am always here ready to help you whenever you reach out. Have a great day!

Thank you so much for your reply! However when i go into this particular client's sales tax center page, those shortcut options are not on the right hand side... There is a section at the bottom of the page that says "Recent sales tax payments" and i deleted the payment from there. Now there seems to be a glitch or something on this page, and i am unable to add a new sales tax payment. Right after i deleted the first payment, the sales tax page and ONLY the sales tax page has this spinning circle in the center like it is loading and my cursor is also a spinning loading circle, though the page appears to be loaded. I've refreshed, i've tried to use a different browser, i've restarted my computer, and the spinning circles won't go away. It seems like that is the reason i can't add a new sales tax payment, since when i go to add one the drop down to choose a bank account won't work (because of my cursor?) so i can't add a payment without a bank account. I tried this yesterday and the same issue is happening this morning. Do you have any idea what is happening?

Thanks for the detailed information about the issue you've encountered while recording your sales tax payment in QuickBooks Online (QBO), @SK3022.

I can see that you've already performed some of the troubleshooting steps to resolve the issue. However, there are times that the browser is full of frequent;y accessed pages, thus causing unusual responses of the system. You can also isolate this by logging into your QuickBooks Online (QBO) account using a private browser (incognito). Here's how:

Once signed in, go to the Sales Tax Center page and then record your tax payment. If it works, return to your default browser and clear its cache and cookies. This will refresh the system and remove older data that causes viewing and performance issues.

However, if the issue continues, I'd recommend contacting our Customer Care team. They can securely pull up your account, identify the cause of the issue, and guide you with a fix. To address your issue on time, you'll have to contact them from Monday to Friday, 6:00 AM to 6:00 PM PT. Then, 6:00 AM to 3:00 PM PT every Saturday.

In case you want to talk to one of our representatives, you can request a callback at the time of your convenience. Here's how:

I've attached a screenshot below for your reference.

In the meantime, I'm adding this article to further guide you in effectively managing your sales tax payments in QBO: Sales tax in QuickBooks Online. It includes answers to the most frequently asked questions, as well as setting up, implementing, and paying your sales taxes.

Please know that you're always welcome to comment below if you have other concerns or follow-up inquiries about managing your sales tax payments in QBO. I'm just around to help. Take care always.

this worked! thank you so much!!

Hello there, @SK3022.

I'm glad you're now able to record your sales tax payment in QuickBooks Online (QBO).

Please don't hesitate to post again if you have other concerns in managing your sales taxes and the growth of your business using QBO. I'm always ready to help. Take care.

You have clicked a link to a site outside of the QuickBooks or ProFile Communities. By clicking "Continue", you will leave the community and be taken to that site instead.