Welcome to the Community space, @Chell. We can modify the report into a Cash basis, this way, it will only report the sales that were paid, and when it was paid. It will not record the payment, but it will report the invoice based on the payment date made to the invoice. Let me show you how to get through there:

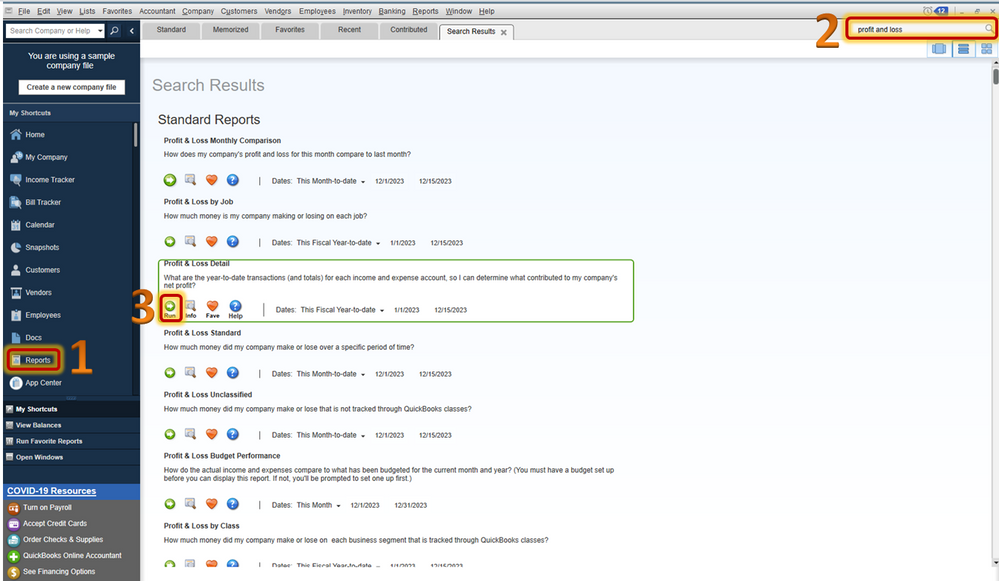

- Click the Reports.

- From the search bar, type Profit and Loss.

- Tap Run to view the report.

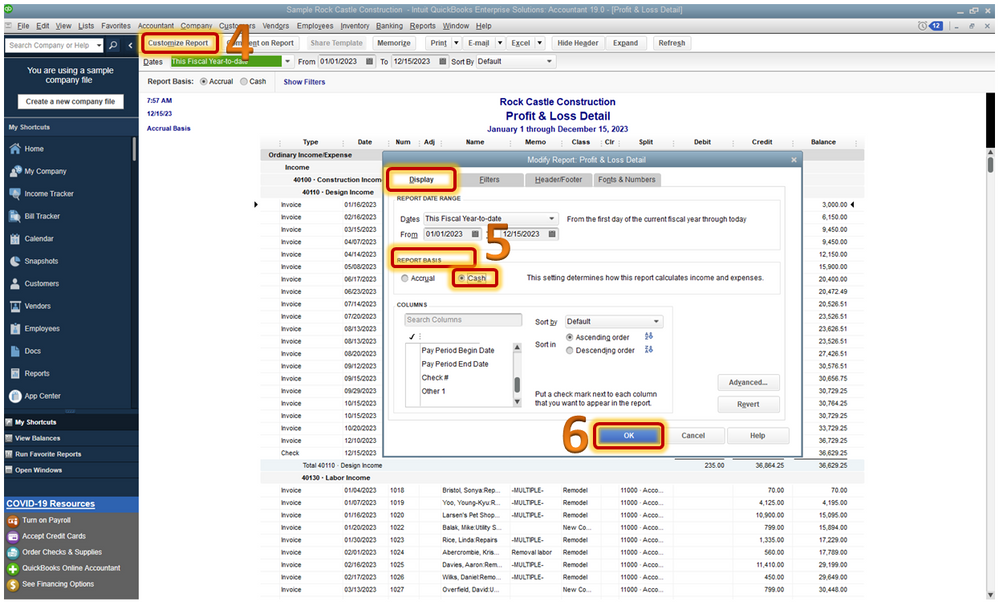

- Press Customize Report.

- Under Display, then Report Basis. Tap Cash.

- Hit OK.

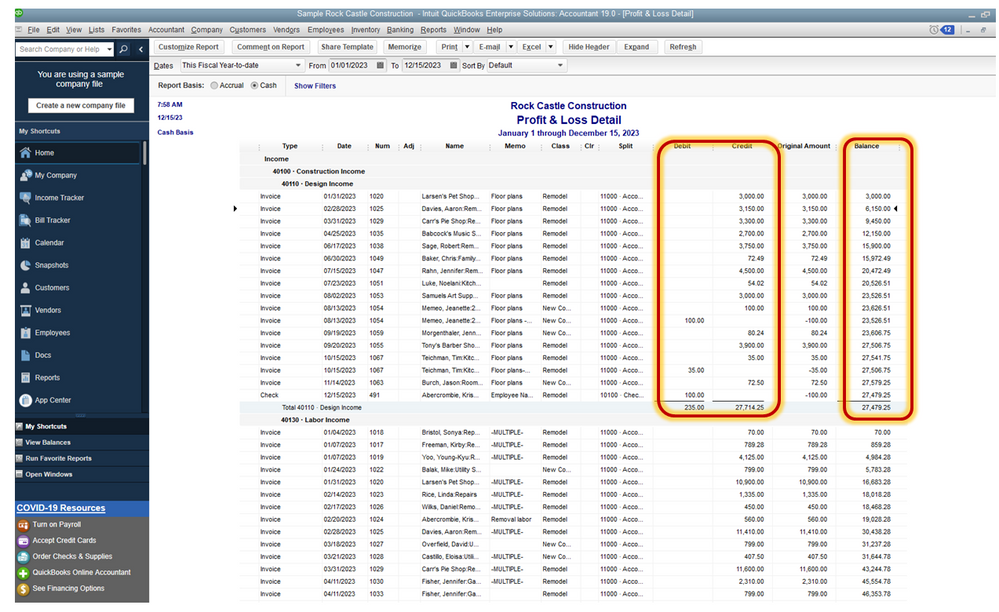

Then check the report if the total Income is accurate. Double-check as well the Debit, Credit, and Balance is correct.

I've added this article to guide you on how to modify the reports: Customize reports in QuickBooks Desktop.

Also, you can read about the difference between Cash and Accrual basis: Differentiate Cash and Accrual basis.

That's it. If you have any other questions, I'd be glad to help them. Thank you and take care.