Turn on suggestions

Auto-suggest helps you quickly narrow down your search results by suggesting possible matches as you type.

Showing results for

Connect with and learn from others in the QuickBooks Community.

Join nowHi.

In my client's book of accounts, supplier bill was for $4.47 but they refunded $4.99. We have no clue what could be the reason for this overpayment. Could you please help me out about the accounting treatment for the additional amount.

Thank you.

Solved! Go to Solution.

Yes, you got it correct, Marufa.

I'd be delighted to walk you through the steps in how to account for your supplier refund in QuickBooks Online (QBO). Here's how:

Once done, use Pay bills to link the deposit to the vendor credit. You can utilize this link for more details about this process: Enter a refund from a vendor.

Then to account for the overpayment of $.52, you can record it as a credit and link it to your supplier's future bills. To be guided, feel free to check this article: Enter a credit from a vendor.

Furthermore, I'd suggest working with your account or visit our ProAdvisor page to prevent messing up your books. They can guide you on other ways to record this in QBO.

Once you're all set, you might want to read these resources for future reference. These contain details on how to pay your vendors online and match your account flawlessly:

In case you need more help supervising your vendor refund or with your payables, you're always welcome to tag me in your reply. I'll be here to back you up!

Hello there, @Marufa0013.

I'm here to help and provide ways on how you can handle the overpayment coming from the $4.99 refund amount in QuickBooks Online.

Since the supplier bill was for $4.47 and they refunded your client $4.99, the overpayment will serve as a credit to your client's supplier. They can apply the overpayment in the next transaction of their suppliers.

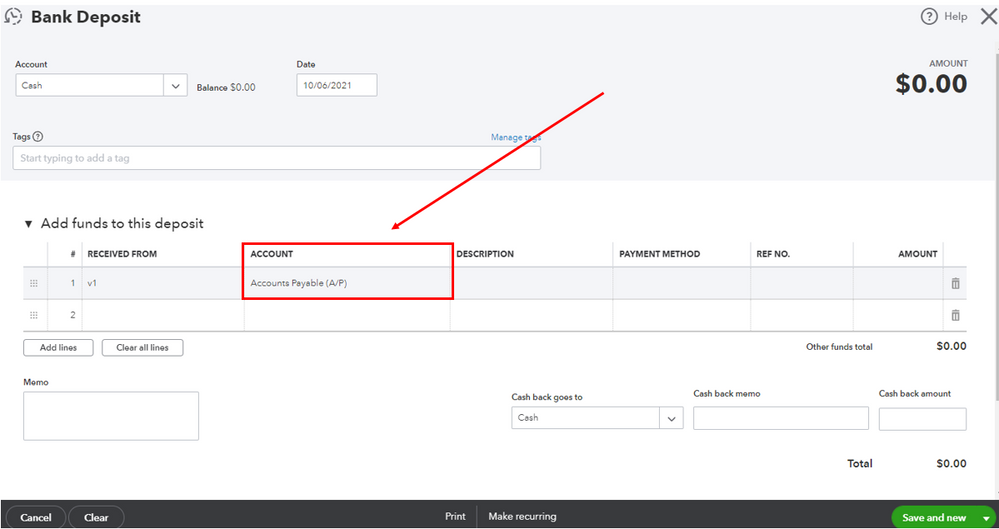

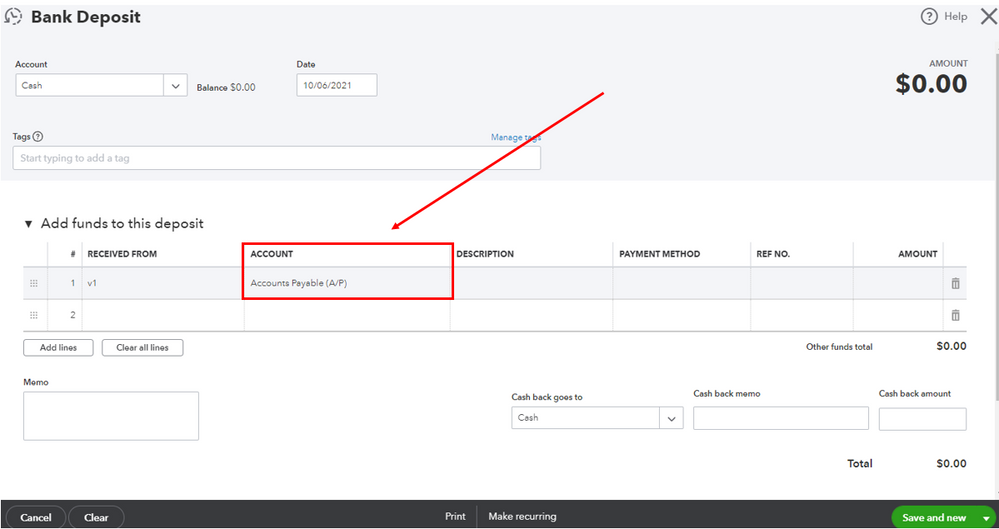

When recording a supplier's refund, you can link the vendor refund to a vendor credit. Then, enter vendor refund using a bank deposit. Then, you can proceed with linking it to the vendor credit. I've got some articles that you'll want to check for additional information about supplier refunds.

Please let me know if there's anything else I can do for you. The Community will always have your back. Take care and stay safe.

Thank you very much for the reply.

In that case, will I separate $4.47 as refund and tag it with the bill and rest of $.52 will be adjusted with other bills of the supplier.

Is it what I am supposed to do?

Yes, you got it correct, Marufa.

I'd be delighted to walk you through the steps in how to account for your supplier refund in QuickBooks Online (QBO). Here's how:

Once done, use Pay bills to link the deposit to the vendor credit. You can utilize this link for more details about this process: Enter a refund from a vendor.

Then to account for the overpayment of $.52, you can record it as a credit and link it to your supplier's future bills. To be guided, feel free to check this article: Enter a credit from a vendor.

Furthermore, I'd suggest working with your account or visit our ProAdvisor page to prevent messing up your books. They can guide you on other ways to record this in QBO.

Once you're all set, you might want to read these resources for future reference. These contain details on how to pay your vendors online and match your account flawlessly:

In case you need more help supervising your vendor refund or with your payables, you're always welcome to tag me in your reply. I'll be here to back you up!

You have clicked a link to a site outside of the QuickBooks or ProFile Communities. By clicking "Continue", you will leave the community and be taken to that site instead.