Turn on suggestions

Auto-suggest helps you quickly narrow down your search results by suggesting possible matches as you type.

Showing results for

Connect with and learn from others in the QuickBooks Community.

Join nowSolved! Go to Solution.

I know a way on how to add a tax rate on your bill, sh2295.

QuickBooks Online US versions only allow us to track sales tax on sales transactions. To track the tax on your bills, we'll have to perform the process manually. I'll guide you how.

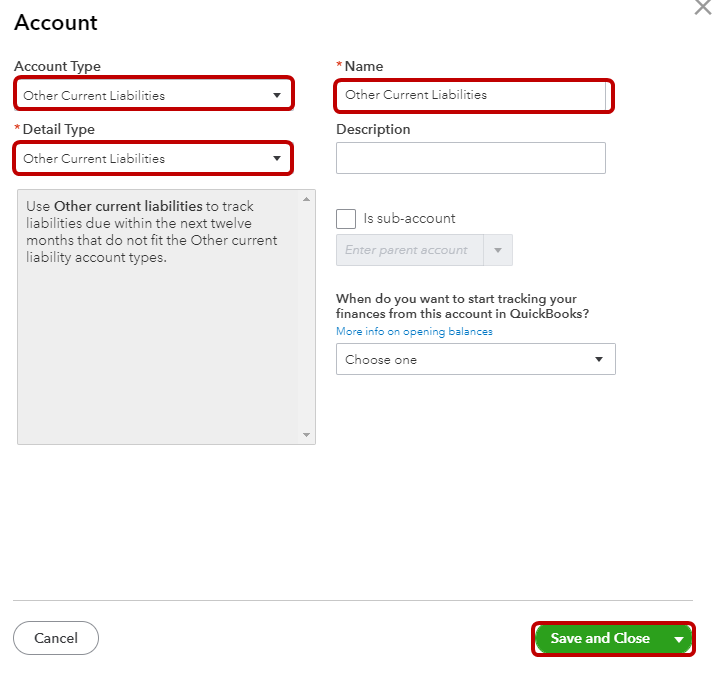

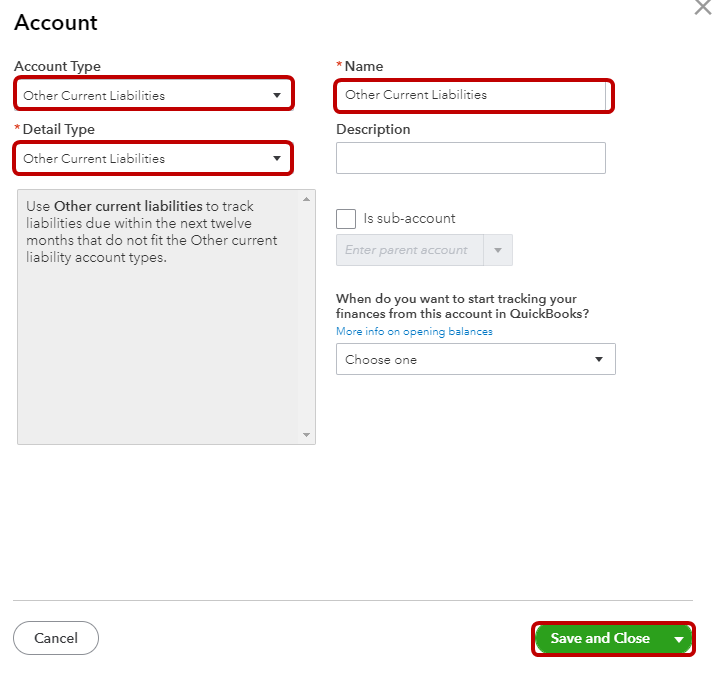

To begin, we'll have to create a current liability account to track the amount you owe in the tax agency. Here's how:

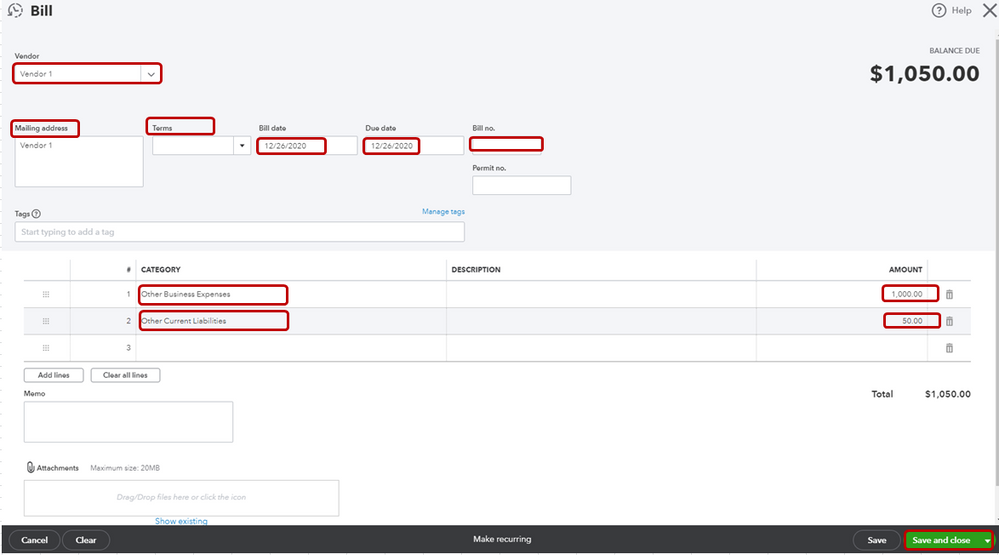

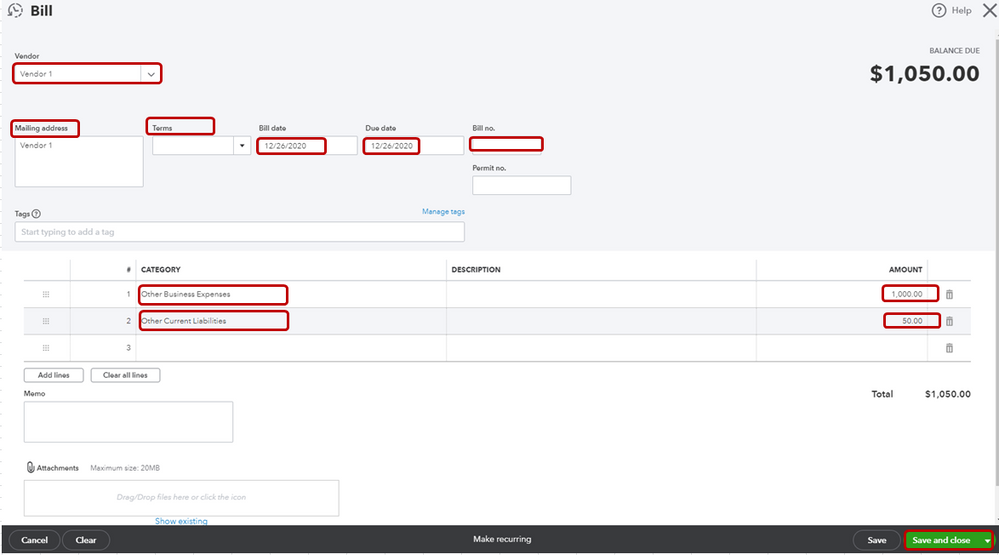

Once done, let's create a bill in which you'll be tracking sales tax.

When it's time to pay the sales tax, check the liability that has been accrued by going to the Chart of Accounts, locate the account, then click View Register. You can write a check to pay the amount.

Additionally, in case you'd like to set up, edit, and deactivate your sales tax rate and settings that you're using on your sales transactions, I suggest checking this article: Set up your Sales Tax.

It's my pleasure to help you with the process. Stay in touch with us if you have other concerns about taxes in QuickBooks. This way, we'll be able to help you out.

I know a way on how to add a tax rate on your bill, sh2295.

QuickBooks Online US versions only allow us to track sales tax on sales transactions. To track the tax on your bills, we'll have to perform the process manually. I'll guide you how.

To begin, we'll have to create a current liability account to track the amount you owe in the tax agency. Here's how:

Once done, let's create a bill in which you'll be tracking sales tax.

When it's time to pay the sales tax, check the liability that has been accrued by going to the Chart of Accounts, locate the account, then click View Register. You can write a check to pay the amount.

Additionally, in case you'd like to set up, edit, and deactivate your sales tax rate and settings that you're using on your sales transactions, I suggest checking this article: Set up your Sales Tax.

It's my pleasure to help you with the process. Stay in touch with us if you have other concerns about taxes in QuickBooks. This way, we'll be able to help you out.

You have clicked a link to a site outside of the QuickBooks or ProFile Communities. By clicking "Continue", you will leave the community and be taken to that site instead.